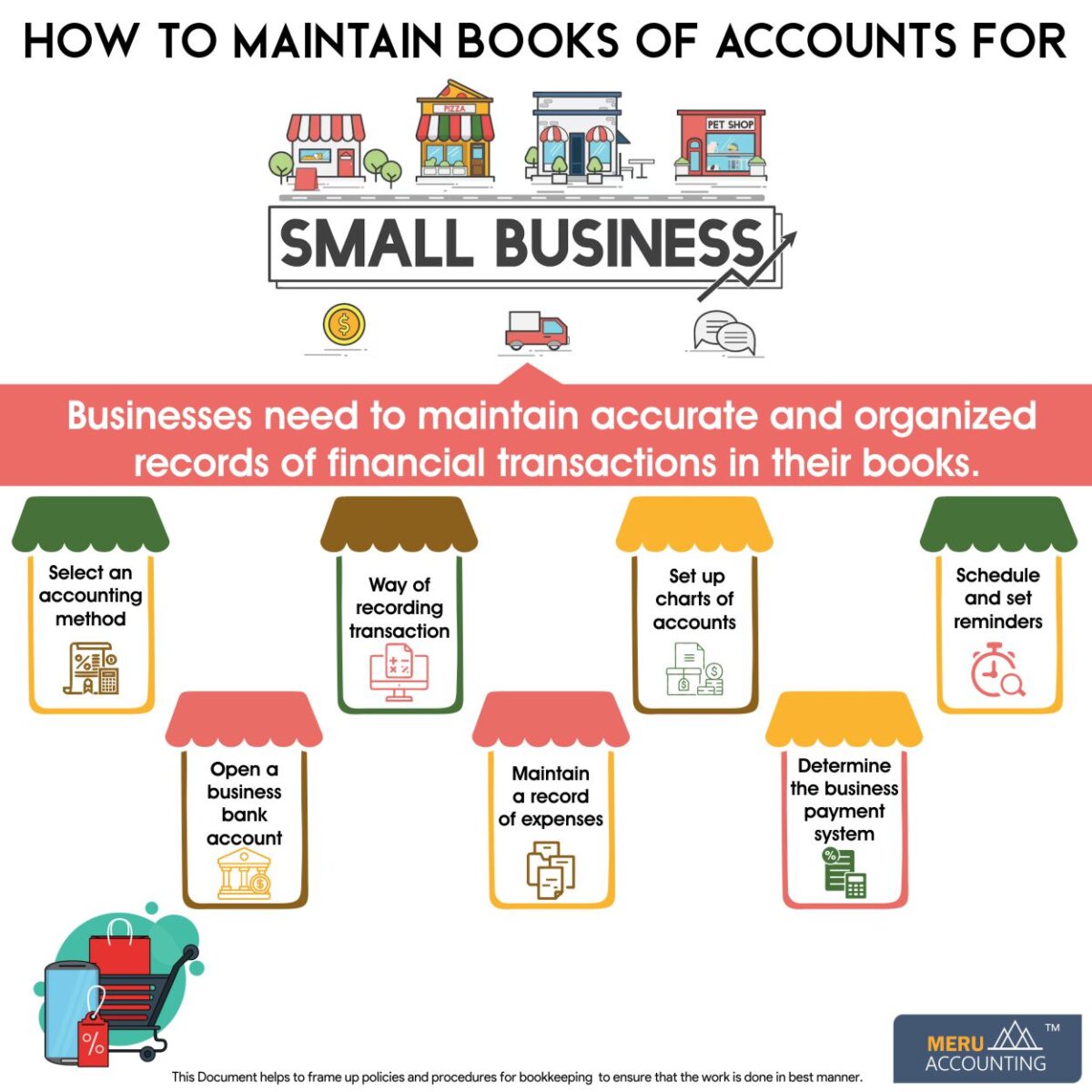

How to maintain books of accounts for small business?

How to maintain books of accounts for small businesses?

Businesses need to maintain accurate and organized records of financial transactions in their books. The accounting books help to review the business’s income and expenses and the financial standing of the business. Organized and up-to-date books enable better control over finances and informed business decisions. So, you need to learn how to set up Accounting For Small Businesses.

How to set up Accounting For Small Businesses?

Follow these seven steps to record and update the Small Business Accounting books.

1. Select an accounting methods

Before setting up your Small Business Accounting, choose an accounting method. Here are the accounting methods you can follow:

- Cash-basis accounting.

- Accrual basis accounting.

- Modified cash- basis.

Cash- basis accounting requires no extensive accounting knowledge. In this method, record a transaction only when money exchanges hands.

Accrual-basis accounting requires extensive accounting knowledge and is more time-consuming for small businesses. In this method, record a transaction as and when the transaction takes place with or without the transfer of money.

Modified cash-basis or hybrid accounting is a mix of accrual and cash-basis accounting.

2. Way of recording transaction

How are you planning to record the transaction in your books? You may be considering:

- Recording transactions in a spreadsheet manually.

- Hiring an accountant.

- Using accounting software.

Accounting software is the best solution as it automates manual tasks and saves time and money. Outsourcing your small business’s accounting is way more affordable than hiring an in-house accountant. You can choose to outsource Meru Accounting to a third-party provider.

3. Set up charts of accounts

The charts of accounts list all the accounts in the financial statement. It shows the inflows and outflows of money going into your business.

The COA or charts of accounts consist of five subheads

- Asset

- Liabilities

- Equity

- Revenue

- Expenses.

The account can be further broken down into sub-accounts (Product Sales, etc.) to organize transactions. You can add sub-accounts as your business grows.

4. Open a business bank account

Personal and business finances should be handled separately. Open a separate bank account to avoid accounting blunders, inaccurate tax fillings, and overspending.

5. Determine the business payment system

Your business cannot grow without money. You must set up an easy and clear customer payment policy to ensure payments from your customer.

Determine how you will accept payments from the customers. It can include:

Cash

Check

Credit cards

Mobile wallet payment.

6. Maintain a record of expenses

Tracking expenses is crucial for Small Business Accounting. You can review expenses at different intervals and help during tax time.

Ensure proper documentation of expenses in your records. You must keep the following to keep a record of expenses

- Receipt

- Banks and credit card statements.

- Invoices

- Bills

- Canceled checks

- Previous tax returns

- Proof of payments.

7. Schedule and set reminders

Streamline your bookkeeping tasks, and create and stick to a schedule or accounting cycle. Begin scheduling the opening account balance and the closing books period. Follow the standard process to record a transaction and set reminders for when you need to go through your cycle and update your books.