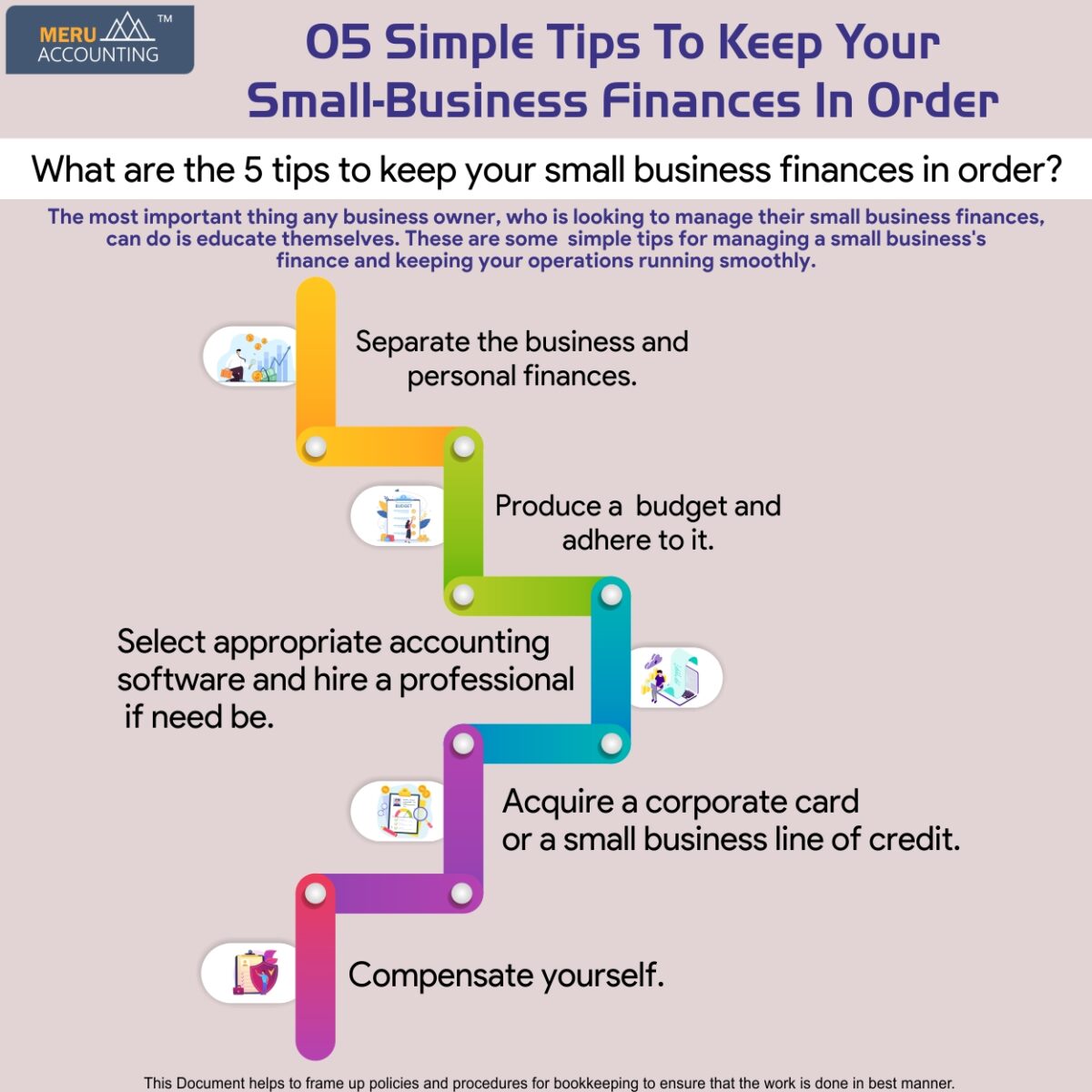

5 Simple Tips To Keep Your Small-Business Finances In Order

Managing your small business finances is crucial for keeping it operating smoothly and making sound decisions.

It allows you to forecast where your company is headed.

Once you know precisely how the expenses and revenues are stacking up, it becomes easy to start making more informed business decisions.

Following are some tips for managing a small business in a smooth manner.

1. Separate the business and personal finances.

Putting personal and business finances together will inevitably lead to confusion. Separate personal and business accounts are required for effective money management.

This practice will not only help you track where your funds are going, but it will also help you when it comes time to file your tax returns at the end of the term.

Because they lack awareness, experience, and accounting knowledge, small businesses frequently find themselves decapitated in sorting between private and business finances and find it difficult to manage business finances.

2. Produce a budget and adhere to it.

Creating a budget can dramatically alter how you manage small business finances but can also help achieve revenue targets sooner than you might expect.

A budget can aid you in accurately forecasting your company’s revenues and perhaps even identify extra or unnecessary expenses.

It’s a framework that can help you make sound decisions, whether it’s cutting new expansion costs to keep the profits on track or it’s increasing your marketing budget.

3. Select appropriate accounting software and hire a professional if need be.

Accounting software such as QuickBooks can assist in streamlining business financials and make monitoring expenses and income much easier.

Working with an accountant can help you manage small business finances more effectively.

They can assist in the creation of a business plan, the management of accounts payable, the selection of a business entity type, and the application for business loans.

Not only will this assist you in resolving financial issues, but it will also help in saving a significant amount of money in the long run.

4. Acquire a corporate card or a small business line of credit.

Corporate credit cards are designed to alleviate the hassles associated with digital expenditure for businesses.

They increase the company’s purchasing power while enhancing the cash conversion process by providing free short-term credit.

Obtaining short-term financing called a line of credit is yet another tool that can assist you to manage business finances and ultimately expand your company.

It can assist you in meeting a variety of short-term funding needs, such as inventory maintenance, salary payments, or responding to new orders.

5. Compensate yourself.

It can be tempting for owners of small businesses to put all of their money into daily operations.

You must, however, pay yourself in order for your personal and business finances to remain in good shape.

Remember that you are a part of the business, thus, you must compensate yourself in the same way that you compensate others.

The most important thing any business owner, who is looking to manage their small business finances, can do is educate themselves.

Conclusion

These are some simple tips for managing a small business’s finance and keeping your operations running smoothly.

Meru Accounting has a team of competent financial advisors who will ensure that you are running your small business smoothly and your finances are being managed adequately.