What are the advantages of filing the Income Tax return online?

As a responsible citizen of the country, one of the primary duties of a person is to file an income tax return before the given date properly. If in case, you could not do it before the given period, it can add up unnecessary extra amount for the tax and your image in the banking sector may get degraded. Traditionally, income tax filing was a little tedious task which made it very difficult to know tax returns update.

However, with the growth of technology, it has become possible for the individual to file income tax returns online. If you are not aware of using the online platform, then you can take the tax returns help from the experts. It will be easier for you and your tax returns accountant to file tax returns online easily. Online tax return filing has got many advantages that can relieve you from many tax-related complications.

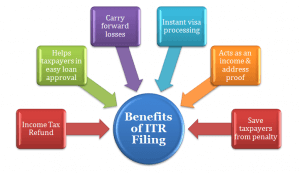

Advantages of filing the Income Tax return online:

You can purchase the tax return software, which can make the proper calculations of the taxes. You can choose the features in your software as per your requirement depending on your nature of the business. In certain cases, you can catch the blank lines and errors in the income, expenses, related taxes, etc. through software.

When you do tax return filing manually by taking tax returns for help from the expert, it will be comparatively cost you more fees. However, online tax filing can be done by yourself that can help save total fees. Also, any expert will charge comparatively lesser fees when the income tax filing is made online.

The biggest drawback of filing the income tax returns manually was that you need to go to a specific location of the accountant and arrange the necessary documents with hard copies. However, online tax filing has enabled you to file income tax returns through any location. Your tax returns accountant can manage it through their remote locations. It can be helpful in saving extra money and effort.

Earlier traditional tax return filings through manual way were having many errors, which sometimes made it difficult to meet the tax return last date. Online filing of the tax can help you do the tax liability calculations, tax deductions, and other aspects in a more accurate way.

Tax returns filing can be processed faster when they are done online. You can get the tax returns to update in a few minutes, providing you more insights about the tax-related aspects.

When you file the tax online, you will have the assurance of safer processing. After you file the tax returns, you will get confirmation about successful tax filing in a few days.

Tax refund used to be very long waiting during the manual tax filing days. However, with online tax filing, you can get the tax refunds more quickly wherever applicable.

Meru Accounting, a well-known accounting agency, is a pioneer in online tax return filing. They have excellent software along with the expert professional that can provide better accounting service.