What makes Cash Flow very important for any business

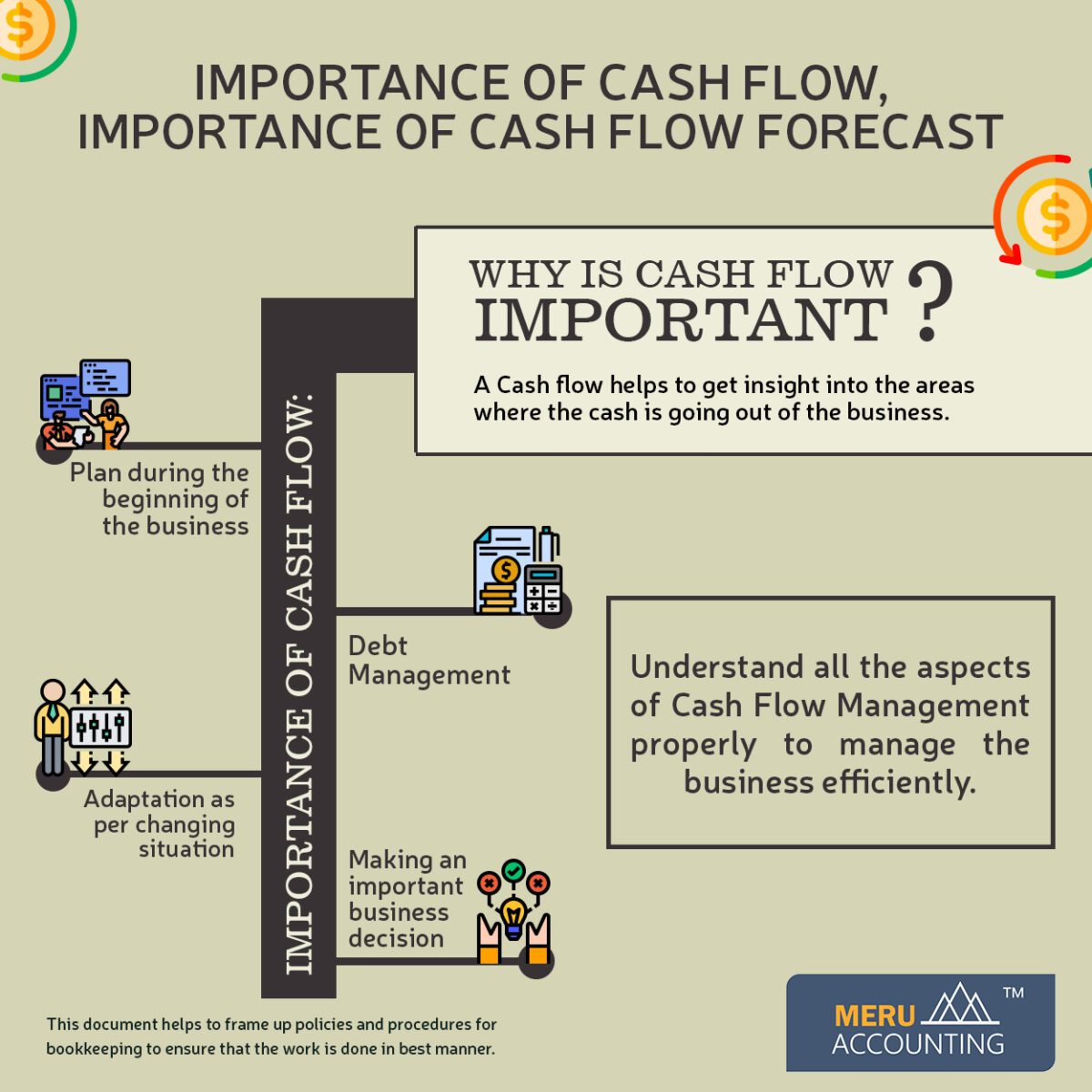

Meru Accounting is one of the well-known book-keeping service providers in India. We understand that Cash flow is a vital aspect for any business, so we strive to achieve accuracy in it. We use an effective, simple, and nice info-graphic image to explain the cash flow of the company properly.

Cash Flow helps to let you know the cash position of the company for a specific period. A positive cash flow is an indicator of more cash flowing in the company, while a negative cash flow shows that more cash is going out of the company.

Why is Cash Flow very important?

Business beginning

When starting a business, one might have several costs and cash would go out quickly. One would require other temporary cash sources for getting one going towards a situation that has a positive cash flow.

A seasonal business

During the starting phase of the business, several costs are estimated as well as un-estimated. However, if the costs are not utilized properly, then cash would go out quickly. So, one will need another temporary cash source that gets one going and making a positive impact leading to positive cash flow.

Debt

Whenever the cash is borrowed for purchasing essential business-related things like equipment, purchasing inventory, and buildings, then future cash flows are utilized for purchasing purposes. So positive cash flow is essential for paying the obligations of debt.

Growth

Along with debt management, a solid cash flow is essential for investing in growth and development. For example: upgrading the infrastructure, technological changes, exploring business in new regions, additional buying of inventories, training, and many more things.

Adaptability

Adaptability as per the situation is very important for any business to survive and grow. So, a proper cash flow helps to take necessary actions immediately. This may involve problem-solving, making important purchases necessary for the business, upgrading with the newer technology that is essential.

Provides the details of the money spent

There are different things where the cash flow occurs in the company which is not updated in the profit-and-loss statement. Many of the businesses have suffered losses due to uncontrolled cash flow in the business. While in the cash flow statement, it reflects the entire amount spent on the small and bigger things. It gives a very precise overview of the areas where the cash flow is made. A proper analysis of Cash flow can help to grow the business.

Surviving in difficult times

Every business goes some period with a slow-down, either occasionally at some period or sudden change in the situation. Proper Cash flow management will help to survive the business during this situation and also build up good cash reserves to take essential steps in a hassle-free way.

Take the important decision

For exploring new opportunities and going for a new project, a business needs to have a proper plan to deal with the cash flow. Here, an accurate cash flow management that will help the business owners to make important decisions with proper calculations.

These are some benefits of Cash flow management. Get a proper insight into the cash flow by contacting experts at Meru Accounting.