Key Bookkeeping Skills To Consider Mastering for Bookkeepers

Bookkeeping is a key task for any business to run well. All companies, big or small, must keep clear and correct records. Mistakes in bookkeeping can cause big problems and poor decisions. Learning basic bookkeeping skills is needed for anyone who wants to handle accounts well. These skills help keep records right, reports ready, and money matters safe.

A bookkeeper does more than just write down daily transactions. They check accounts, match statements, and make clear reports for owners. Skilled bookkeepers keep work smooth and help the business stay stable. Companies rely on them to track cash flow, watch spending, and follow tax rules. Good bookkeeping skills form the base for growth, success, and long-term health.

What Are Basic Bookkeeping Skills?

Basic bookkeeping skills are the key skills needed to keep financial records right. They form the base of good accounting, making basic bookkeeping skills essential for every bookkeeper. Every bookkeeper should know these skills:

Record All Transactions

Write down all sales, purchases, and payments correctly. Right entries stop mistakes.

Keep Ledgers and Journals in Order

Keep all records neat and easy to read. Clean ledgers make reports simple.

Prepare Financial Statements

Make balance sheets, income sheets, and cash flow reports. Accuracy gives clear data for decisions.

Check Bank Accounts

Compare bank statements with company records often. This finds errors fast.

Manage Accounts Payable and Receivable

Track the money the company owes and the money owed to it. Proper handling keeps cash flow smooth.

These skills help businesses stay organized, follow rules, and grow. They stop mistakes and give clear information for decisions.

Why Bookkeeper Skills Are Important

A bookkeeper helps a business run its money well. Strong bookkeeping skills make work easier and safer.

Reduce Errors

Good bookkeeping stops mistakes in accounts and reports. Errors can cost time and money.

Save Time

Skilled bookkeepers prepare reports fast. This helps owners focus on other tasks.

Follow Rules

Bookkeepers ensure tax and legal rules are met. This avoids fines and trouble.

Support Decisions

Clear records help owners make smart choices and plan for growth.

Without these skills, money work can be slow, full of mistakes, and risky.

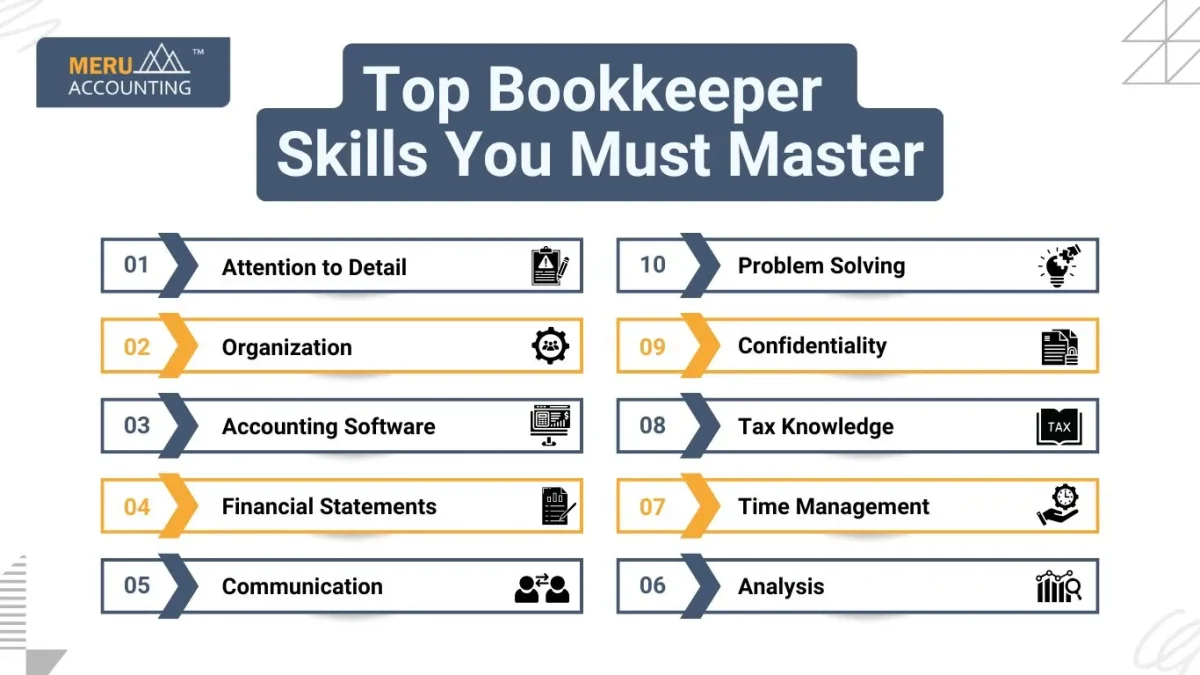

Top Bookkeeper Skills You Must Master

Attention to Detail

One of the most vital skills of a bookkeeper is to check each entry and avoid mistakes in all records.

Look closely at numbers to keep accounts correct and safe.

Organization

Keep all files neat and easy to find quickly.

Arrange papers clearly to make work fast and simple.

Accounting Software

Learn QuickBooks, Zoho Books, or Xero to save time.

Use software often to reduce mistakes and work faster.

Financial Statements

Prepare balance sheets, income reports, and cash flow statements.

Check all numbers to make reports accurate and reliable.

Communication

Explain numbers clearly to managers and business owners.

Write simple reports so everyone can easily understand them.

Analysis

Look for trends, errors, or unusual activity in accounts.

Use this data to make smart business decisions quickly.

Time Management

Finish all tasks each day to keep records current.

Plan your work to meet deadlines and avoid delays.

Tax Knowledge

Understand tax rules to avoid penalties or fines.

Keep knowledge updated to file taxes correctly on time.

Confidentiality

Keep all financial information private to protect the business.

Share details only with people who have proper access.

Problem Solving

Fix errors quickly to keep records accurate and safe.

Act fast to stop small mistakes from growing bigger.

Additional Bookkeeping Skills to Excel

Data Entry Skills

Enter information accurately and consistently. Fast, precise entry saves time and reduces errors.

Payroll Management

Among the important skills of a bookkeeper is to handle employee payments and deductions properly. Updated payroll ensures correct taxes and benefits.

Accounts Receivable & Payable

Track money owed by clients and owed to vendors. Timely management improves cash flow.

Bank Reconciliation

Compare bank statements to internal records regularly. Detect missing transactions and errors early.

Report Generation

Create clear, timely, and accurate reports. Useful reports guide better business decisions.

How to Improve Your Bookkeeper Skills

To improve your bookkeeping skills, follow these steps:

Take Classes

Join online or in-person bookkeeping courses.

Use Software

Practice accounting programs to work faster and make fewer errors.

Learn the Rules

Keep up with tax and financial laws.

Check Your Work

Always review entries to keep records correct.

Join a Group

Talk with other bookkeepers to get tips and help.

Keep practicing every day. This will make your skills strong and your work easier.

Benefits of Mastering Bookkeeping Skills

Learning bookkeeping helps keep your business records clear. It makes work simple and saves time every day.

Reduce Errors

Good bookkeeping stops mistakes in reports and accounts. It also prevents fines and lost money.

Save Time

Bookkeeping helps plan tasks and organize your work. You can focus on what matters most.

Understand Your Finances

Bookkeepers can check numbers and make smart choices. This helps control costs and plan for growth.

Grow Your Career

Strong skills of a bookkeeper give more job opportunities. They help get promotions and higher pay.

Build Confidence

Knowing bookkeeping makes handling money easy. You can solve problems and manage accounts quickly.

Follow Rules

Accurate books help you meet tax rules. Audits are simple, and the risks of fines drop.

Plan for Growth

Bookkeeping shows cash flow and spending clearly. It helps plan budgets, forecasts, and goals.

Fix Problems Fast

Bookkeepers find mistakes and correct them quickly. This improves thinking and decision-making skills.

Common Mistakes to Avoid in Bookkeeping

Bookkeeping is vital for all businesses. Yet, even trained bookkeepers can slip. These errors hurt cash flow, raise stress, and break rules. To keep records clear and safe, avoid the mistakes below:

1. Mixing Personal and Business Finances

Mixing both makes records messy and hard to check. Always keep business and personal accounts apart. This makes tracking simple and audits smooth.

2. Ignoring Small Errors That Grow Over Time

A small error may seem fine at first. But if left, it grows into a big issue. Fix errors as soon as you spot them.

3. Failing to Reconcile Bank Accounts Regularly

When books and bank records do not match, trouble starts. Reconcile accounts each month. This keeps the balance right and the cash flow steady.

4. Missing Tax Filing Deadlines or Compliance Dates

Late filing brings fines and stress. Mark key dates in advance. Always file tax papers on time.

5. Not Keeping Backups of Important Financial Data

Losing data can halt work and cause delays. Keep backups on drives and in the cloud. This keeps records safe from loss.

6. Overlooking Proper Documentation of Expenses

Bills and receipts prove the cost of expenses. Without them, claims may not hold up. Store all documents in a safe place.

7. Neglecting to Track Accounts Receivable

Late payments block cash flow. Track receivables often. Send clients reminders when bills are due.

8. Avoiding the Use of Accounting Software

Manual work raises the chance of mistakes. Use smart accounting tools instead. They save time and boost accuracy.

Soft Skills That Support Bookkeeper Skills

Bookkeepers need more than technical skills. Soft skills help them manage work, build trust, and deal with daily tasks in a better way. They also make client relations stronger and work life easier.

Patience

Working with numbers takes focus and calm. Patience helps bookkeepers stay accurate even when the work is slow or deadlines are close.

Teamwork

Bookkeepers do not work alone. They share tasks with staff, managers, and accountants. Good teamwork keeps details clear and work on track.

Adaptability

Rules and tools often change. A bookkeeper who adapts fast can learn new methods and stay useful in any setup.

Critical Thinking

Bookkeepers must check and judge data before reports are made. This skill reduces errors and helps in making sound choices.

Soft skills add value to the main skills of a bookkeeper. Together, they make bookkeepers more reliable, improve results, and help in career growth.

Technology and Modern Bookkeeping Skills

Technology has changed bookkeeping in many ways. Bookkeepers now need skills that go beyond ledgers and papers. Modern tools save time, cut errors, and give better control of data.

Cloud Software

Cloud systems give access from any place at any time. They also make it easy to share records with teams and clients.

Automation

Automation handles routine work like data entry and reports. It reduces errors and lets bookkeepers focus on key tasks.

Data Security

Data safety is a must in the digital world. Strong systems keep records safe and help follow the law.

Online Payments

Online payment tools track income and costs with ease. They also improve cash flow and make the records clear.

Modern bookkeepers mix classic skills with digital tools. This blend builds trust, improves work, and ensures long-term success.

Career Opportunities With Strong Bookkeeping Skills

Strong bookkeeping skills open many career paths. Skilled bookkeepers enjoy both job security and flexible options. They can work alone, join large firms, or build their own business.

Freelance Work

Freelance bookkeepers serve small and mid-size firms. This gives flexible hours and more control over clients.

Corporate Roles

Big firms hire bookkeepers for accounts support. These jobs offer steady pay and room for career growth.

Specialized Services

Some bookkeepers focus on areas like payroll or tax. Special skills increase demand and raise income potential.

Business Ownership

Many bookkeepers start their own service firm. This path brings freedom, growth, and financial rewards.

Mastering bookkeeping skills builds both career growth and income. It creates a strong base for success in the long run.

Mastering the core skills of a bookkeeper is key for new bookkeepers. These skills keep financial records accurate and reports error-free. They also help businesses stay organized and follow tax rules.

At Meru Accounting, we offer expert bookkeeping services for all businesses. Our team manages accounts carefully using the latest accounting software. We provide precise reports on time and help businesses make smart decisions. Choosing Meru Accounting ensures reliable accounts and peace of mind.

Learning bookkeeping today builds a strong career for tomorrow. It also secures long-term financial stability for any business.

FAQs

- What are basic bookkeeping skills?

They include recording transactions, reconciling accounts, and preparing reports consistently. - Do I need a degree to be a bookkeeper?

No, but training and certificates improve skills and career opportunities. - Can bookkeeping skills be learned online?

Yes, many online courses and tutorials teach bookkeeping effectively. - Which software should I learn as a bookkeeper?

QuickBooks, Xero, and Zoho Books are widely used in businesses. - Are bookkeeper skills in demand?

Yes, businesses always need accurate financial management. - How long does it take to learn bookkeeping skills?

Basic skills can be learned in a few months of practice. - Is analytical skill important for bookkeepers?

Yes, it helps detect errors and track financial performance effectively.