Running a business is not just about selling products or services. It is also about keeping your finances accurate, clean, and compliant with the law. Commercial and legal accounting services help businesses stay organized, reduce risk, and grow smoothly.

When a business uses these services, it gets expert support in financial planning, legal compliance, and tax management. This helps business owners focus on growth and daily operations without worrying about financial mistakes.

With the right accounting support, businesses can make better decisions based on clear financial data. It also helps build trust with banks, investors, and stakeholders. In short, these services are a strong foundation for long-term success.

What You Will Learn From This Blog

In this blog, you will learn:

- What commercial and legal accounting services mean

- How these services help businesses grow

- Key responsibilities of a commercial accountant

- How to stay legally safe and audit-ready

- Tax planning and strategy

- How a commercial accountant supports business decisions

- Industry-specific benefits

- Why Meru Accounting is the best partner for these services

What Are Commercial and Legal Accounting Services?

Commercial and legal accounting services combine business accounting with legal compliance. These services help businesses manage finances, follow laws, and stay prepared for audits. Businesses that use these services gain accurate financial reporting, tax compliance, and legal protection.

Commercial accounting focuses on tracking income, expenses, profit, and cash flow. Legal accounting focuses on compliance with tax laws, regulatory rules, and legal reporting standards. When both are combined, your business becomes stronger and more secure.

A financial accountant plays a key role in managing all financial records and legal compliance. The accountant ensures that financial statements are accurate, taxes are filed correctly, and the business follows all rules. This is especially important for businesses that are growing fast or expanding to new markets.

How Commercial and Legal Accounting Services Help Businesses Grow

Businesses that use commercial and legal accounting services gain several benefits:

1. Clear Financial Visibility

A commercial accountant provides accurate financial reports that show where the business stands financially. This helps business owners understand which areas are profitable and which areas need improvement.

2. Better Decision Making

With accurate financial data, business owners can make smart decisions about pricing, expansion, hiring, and investments. An accountant provides the numbers needed to plan the future.

3. Risk Reduction

Legal compliance reduces the risk of fines, penalties, and legal problems. A financial accountant helps ensure your business follows rules and stays protected.

4. Efficient Tax Management

Tax laws are complex and often change. Commercial and legal accounting services help businesses plan taxes, avoid mistakes, and save money legally.

5. Strong Business Planning

With accurate financial data and legal guidance, businesses can plan growth strategies more confidently. This includes budgeting, forecasting, and risk management.

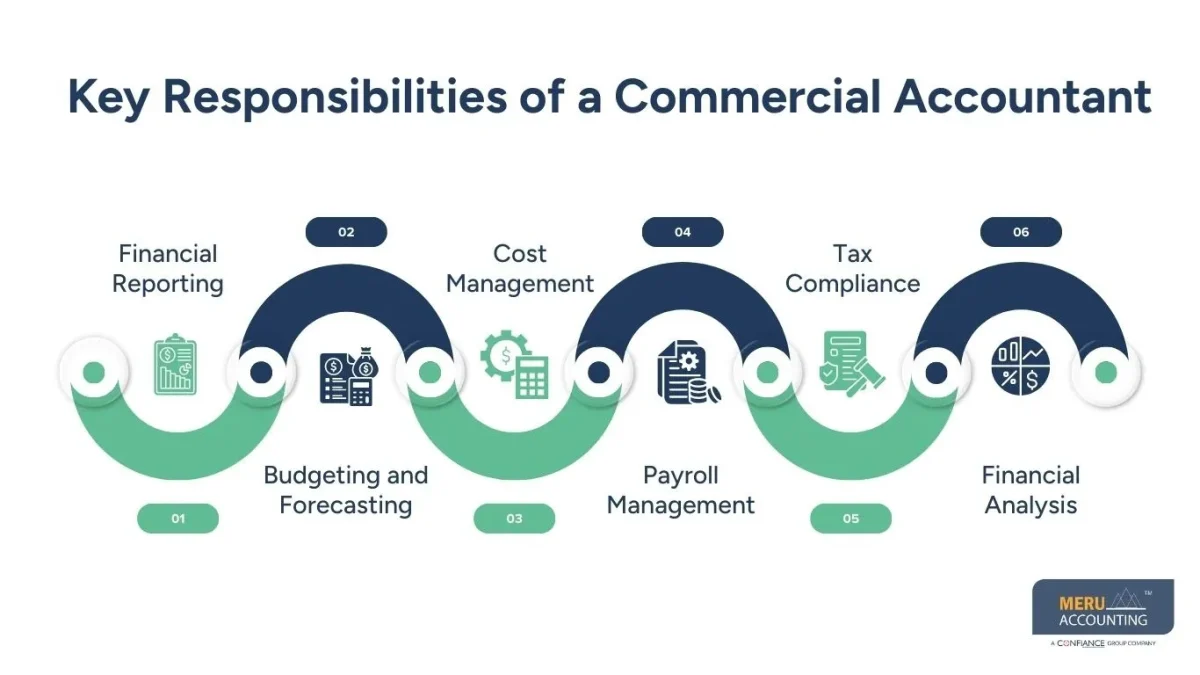

Key Responsibilities of a Commercial Accountant

A commercial accountant plays a vital role in managing business finances. Their responsibilities include:

1. Financial Reporting

Preparing balance sheets, profit and loss statements, and cash flow reports. These reports help business owners understand financial health.

2. Budgeting and Forecasting

Helping businesses plan budgets and predict future performance. This helps avoid cash shortages and improve profit planning.

3. Cost Management

Tracking expenses, reducing waste, and improving profitability. An accountant helps identify areas where money is being lost.

4. Payroll Management

Ensuring employees are paid accurately and on time. Payroll is a critical task and must be handled correctly to avoid legal issues.

5. Tax Compliance

Handling tax returns, planning, and legal compliance. A corporate accountant ensures the business follows tax rules and avoids penalties.

6. Financial Analysis

Reviewing financial performance and suggesting improvements. This helps businesses grow efficiently and avoid losses.

Financial Compliance: Staying Legally Safe and Audit-Ready

One of the biggest benefits of commercial and legal accounting services is compliance. Every business must follow financial laws, tax rules, and reporting standards. If not, it can face penalties, audits, or legal issues.

A commercial accountant helps businesses stay compliant by:

- Maintaining accurate financial records

- Preparing audit-ready financial statements

- Ensuring tax filings are accurate

- Following legal reporting standards

- Keeping financial records updated

Compliance is not just a legal requirement. It also builds trust with investors, banks, and partners. A business with clean financial records is more likely to receive loans and investment support.

Tax Planning & Strategy in Commercial and Legal Accounting Services

Tax planning is a major part of commercial and legal accounting services. A corporate accountant helps businesses reduce tax burden through legal and correct planning.

Key tax services include:

Tax Return Preparation

Ensuring accurate filing of all tax returns and meeting deadlines.

Tax Strategy Planning

Creating a long-term plan to reduce tax costs while staying compliant.

Identifying Tax-saving Opportunities

Finding legal ways to save money through deductions, exemptions, and credits.

Ensuring Compliance With Tax Laws

Making sure your business follows all tax rules and avoids mistakes.

Avoiding Penalties and Interest

Ensuring timely filing and correct calculations to prevent extra charges.

Reviewing Business Structure for Tax Efficiency

Suggesting the best structure (sole proprietorship, partnership, company, etc.) based on tax benefits.

Tax Planning for New Investments

Helping you understand the tax impact of buying assets, equipment, or property.

Managing Payroll Tax and Employee Benefits

Ensuring correct tax treatment for salaries, bonuses, and benefits.

Handling Tax Audits and Inquiries

Supporting the business during audits and responding to tax authority questions.

GST/VAT Compliance and Planning

Managing indirect taxes and ensuring correct filing and reporting.

A financial accountant ensures your business pays the right tax at the right time. This reduces stress and protects your business from legal trouble.

An accountant also helps in tax planning for future years. They help business owners understand how different decisions affect tax liabilities. This includes planning for business expansion, new investments, and hiring.

How a Commercial Accountant Supports Business Decisions

A financial accountant does more than just do bookkeeping. They help businesses make better decisions through financial insights. Here are some examples:

1. Pricing Strategy

A commercial accountant helps you set prices that cover costs and ensure profit. Pricing is important because if prices are too low, the business may lose money.

2. Cost Control

They analyze expenses and suggest areas where costs can be reduced. Cost control helps businesses increase profit.

3. Investment Decisions

They help evaluate whether an investment will bring profit or not. A corporate accountant can analyze expected returns and risks.

4. Cash Flow Management

They help manage cash flow to avoid shortages and ensure smooth operations. Cash flow is the lifeline of any business.

5. Business Growth

They provide financial guidance for expansion, new products, or new markets. An accountant helps plan the financial impact of growth.

Industry-Specific Benefits of Commercial and Legal Accounting Services

Every industry has different accounting needs. Commercial and legal accounting services can be customized to suit any industry. Here are some examples:

Retail Businesses

- Inventory tracking

- Profit margin analysis

- Sales tax compliance

Retail businesses require accurate tracking of inventory and sales. An accounting Consultant helps track inventory costs and profitability.

Manufacturing Businesses

- Cost of goods sold tracking

- Production cost analysis

- Budgeting for raw materials

Manufacturing businesses need to track production costs and raw materials. A corporate accountant helps analyze the cost per product and improve profit.

Service Businesses

- Project-based accounting

- Time tracking

- Client billing and invoicing

Service businesses need to track time and billing accurately. An accounting Consultant helps manage project costs and profit.

Healthcare Businesses

- Patient billing tracking

- Compliance with medical regulations

- Expense tracking for medical supplies

Healthcare businesses must follow strict regulations. A commercial accountant helps manage compliance and financial reporting.

Construction Businesses

- Job costing and project tracking

- Vendor payment tracking

- Compliance with labor laws

Construction businesses need job-based accounting. A corporate accountant helps track project costs and profits.

Why Choose Meru Accounting for Commercial and Legal Accounting Services?

At Meru Accounting, we understand that every business is unique. Our team offers customized commercial and legal accounting services to help your business grow safely and efficiently.

Here’s how Meru Accounting can help:

- Experienced commercial accountants

- Accurate financial reporting

- Complete legal compliance

- Tax planning and support

- Business growth guidance

- Audit-ready financial records

- Customized services for your industry

Meru Accounting is known for providing accurate financial services and strong compliance support. Our team helps businesses save time, reduce risks, and improve profitability.

Key Takeaways

- Commercial and legal accounting services help businesses stay compliant and grow.

- A commercial accountant supports business decisions, tax planning, and financial reporting.

- Compliance and accurate financial records reduce risk and build trust.

- Tax planning helps reduce costs and avoid penalties.

- Meru Accounting offers reliable and customized accounting services for businesses of all sizes.

FAQs

Commercial and legal accounting services are professional accounting services that combine financial management with legal compliance. They help businesses stay organized, follow tax rules, and remain audit-ready.

A financial accountant helps your business manage financial records, prepare reports, plan taxes, and stay compliant with laws. This reduces financial risk and supports business growth.

In legal accounting, a corporate accountant ensures your business follows laws and regulations, prepares audit-ready reports, and handles tax filings correctly.

These services ensure tax filings are accurate, deadlines are met, and all legal deductions are used correctly. This reduces the risk of penalties and tax audits.

Yes. With accurate financial data and compliance support, your business can make better decisions, manage costs, and plan expansion with confidence.