Managing accounts payable manually may seem simple, but it often leads to cash flow problems, late payments, and errors. An accounts payable outsourcing company can streamline the process, reduce mistakes, and keep your finances on track.

By outsourcing AP tasks to professionals, businesses gain better control over cash flow, improve accuracy, and free up time for strategic work.

In this blog, we will explain why manual AP leads to cash flow problems and how partnering with an accounts payable outsourcing company can solve them. We will also cover when and how to outsource accounting services for the best results.

What You Will Learn From This Blog

By the end of this blog, you will understand:

- The hidden risks of manual accounts payable processes

- Why cash flow problems happen with manual AP

- How an accounts payable outsourcing company streamlines invoice processing

- Benefits of choosing to outsource accounting services, including cost savings, accuracy, and scalability

- How AP outsourcing improves vendor relationships and reduces errors

- How to identify the right accounts payable outsourcing company for your business

How an Accounts Payable Outsourcing Company Fixes Cash Flow Issues Caused by Manual AP

Manual accounts payable involves a lot of human intervention, from data entry to approval routing.

Each step carries the risk of delays or mistakes, which an accounts payable outsourcing company can help prevent. Businesses that rely on manual AP often face:

- Lost or misplaced invoices

- Payment delays due to approval bottlenecks

- Missed early payment discounts

- Difficulty predicting cash flow

An accounts payable outsourcing company automates many of these tasks, making the process more accurate and faster. They handle invoice data entry, approval workflows, and payment processing.

With clear records and timely payments, your cash flow becomes more predictable, and you can make informed financial decisions.

The Hidden Cash Flow Risks of Managing Accounts Payable Manually

Many businesses don’t realize how manual AP impacts cash flow. Common risks include:

Duplicate payments

Without proper checks, the same invoice may be paid twice. This can unnecessarily drain your available cash and affect your budgeting.

Late fees and penalties

Delays in approvals often lead to extra costs. These fees can quickly add up and put pressure on your cash flow.

Poor cash flow forecasting

Without real-time reporting, businesses struggle to know their actual cash position. This makes it difficult to plan for upcoming expenses or investments.

Vendor dissatisfaction

Late payments can damage relationships and harm future negotiations. Unhappy vendors may delay shipments or reduce service quality.

Missed Early Payment Discounts

Paying invoices late can mean losing out on discounts that help save money. Over time, these missed opportunities can reduce overall profitability.

Increased Workload for Staff

Manual tracking and correcting errors take up valuable time that could be used for strategic tasks. This can also lead to staff burnout and lower productivity.

These issues may seem minor individually, but they add up over time, creating significant cash flow challenges.

Why Businesses Struggle With Payment Delays and Poor AP Visibility

Manual AP limits visibility into unpaid invoices, approvals, and upcoming payments. Common struggles include:

Time-consuming approvals

Managers manually check and approve invoices, causing delays. This often leads to a backlog of pending approvals, slowing down the entire payment process.

Inconsistent data

Spreadsheet errors or misplaced documents reduce reliability. Inaccurate or missing information can result in duplicate payments or overlooked invoices.

Difficulty tracking expenses

Without real-time insights, it’s hard to plan cash flow. This makes it challenging to identify spending trends and make informed financial decisions.

An accounts payable outsourcing company can solve these challenges by centralizing AP processes, providing accurate reporting, and improving visibility across all vendor payments.

Key Warning Signs It’s Time to Move Away From Manual AP Processes

You may need to consider outsourcing AP if you notice:

- Late payments or missed discounts

- Increasing errors in invoices

- Overworked accounting staff

- Difficulty forecasting cash flow

- Complaints from vendors about slow payments

Recognizing these signs early can prevent bigger cash flow issues and operational disruptions.

How an Accounts Payable Outsourcing Company Streamlines Invoice Processing

AP outsourcing companies manage the full lifecycle of invoices.

Invoice receipt and data capture

Manual data entry is replaced by automation or professional staff.

Verification and approval

Invoices are checked for accuracy before approval.

Payment scheduling

Payments are made on time, ensuring early payment discounts and avoiding penalties.

Record keeping

Detailed records improve reporting and compliance.

By streamlining these steps, an accounts payable outsourcing company reduces errors, saves time, and ensures better cash flow management.

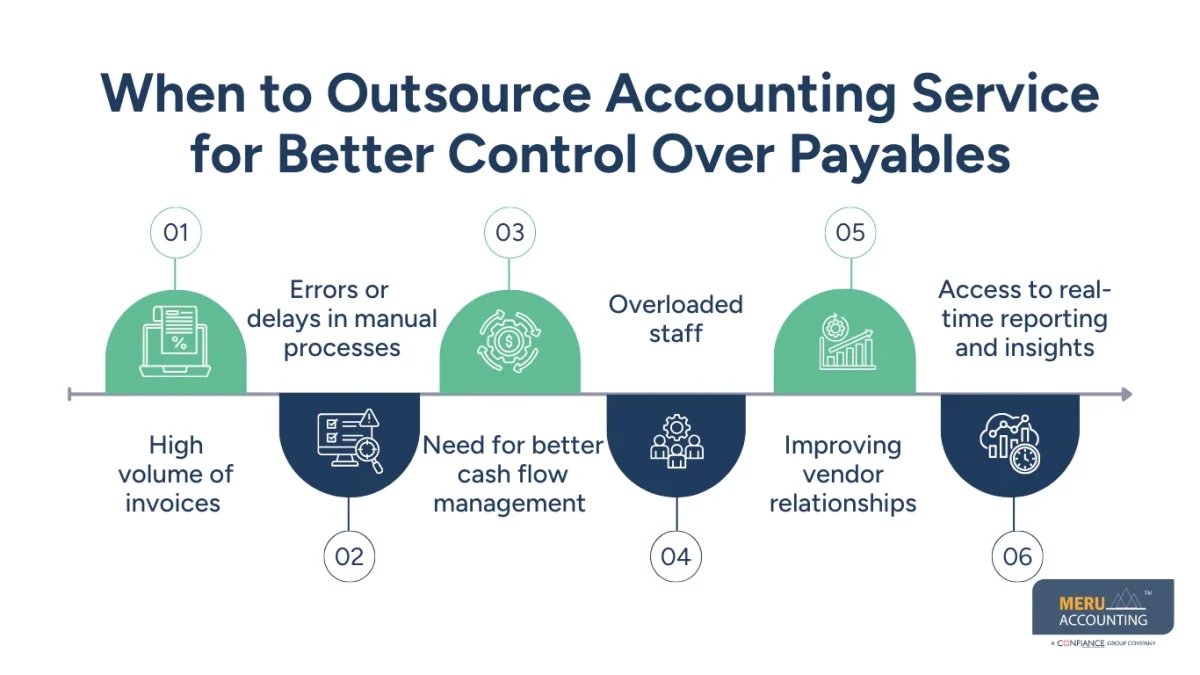

When to Outsource Accounting Service for Better Control Over Payables

Businesses should consider a financial outsource accounting service in the following situations.

High volume of invoices

When your business processes a large number of invoices, manual handling can become overwhelming and lead to delays.

Errors or delays in manual processes

If your current AP system frequently causes mistakes or late payments, outsourcing can ensure accuracy and timeliness.

Need for better cash flow management

Businesses that struggle to track outgoing payments and forecast cash flow can benefit from professional AP management.

Overloaded staff

When your accounting team spends too much time on routine tasks, outsourcing allows them to focus on strategic work that supports business growth.

Improving vendor relationships

Timely and accurate payments help maintain strong relationships with vendors and can open opportunities for better payment terms.

Access to real-time reporting and insights

Outsourcing provides detailed reports and dashboards that give a clear view of payables, upcoming payments, and cash flow trends.

Outsourcing AP enables your business to gain better control over payables while ensuring efficiency, accuracy, and financial clarity.

Cost, Accuracy, and Scalability Benefits When You Outsource Accounting Services

Partnering with an accounts payable outsourcing company offers several advantages.

Cost savings

Outsourcing reduces the need for additional in-house staff and avoids errors that lead to penalties. It also helps businesses save on training, software, and infrastructure costs.

Accuracy

Professionals ensure correct invoice entry, approvals, and timely payments. This minimizes the risk of duplicate payments, missed discounts, and financial discrepancies.

Scalability

AP processes can grow with your business without adding more internal staff. As your invoice volume increases, outsourcing allows you to handle growth efficiently without overburdening your team.

A reliable accounts payable outsourcing company delivers these benefits, helping businesses manage finances more effectively and plan for growth.

Improving Vendor Relationships While Optimizing Payment Schedules

Timely payments and accurate communication strengthen vendor relationships. When you outsource AP:

- Vendors receive payments on schedule, building trust and reducing delays in receiving goods or services.

- Payment disputes are resolved faster, as invoice discrepancies are quickly identified and addressed.

- Negotiation opportunities, like early payment discounts, are easier to manage with clear visibility of upcoming payments.

- Vendors are more likely to prioritize your orders when an accounts payable outsourcing company ensures payments are consistent and reliable.

- Outsourcing AP improves communication, providing timely updates and reducing misunderstandings.

Healthy vendor relationships can lead to better terms, improved service, and long-term partnerships.

Reducing Errors, Fraud, and Compliance Risks Through AP Outsourcing

Manual AP is vulnerable to human errors, fraud, and compliance risks. Outsourcing offers:

Fraud prevention

Segregation of duties reduces fraud risk and ensures no single person has complete control over payments.

Regulatory compliance

Professionals follow legal and tax requirements, helping your business avoid penalties and maintain proper records.

Error reduction

Automated and verified processes minimize mistakes and ensure invoices are accurate before approval.

Audit readiness

Outsourced AP provides organized records, making audits faster, easier, and less stressful.

Reduced duplicate payments

Checks and automated workflows prevent duplicate invoice payments, saving costs and improving cash flow.

Partnering with an accounts payable outsourcing company ensures your AP function is safe, accurate, and compliant.

How AP Outsourcing Supports Business Growth Without Increasing Overheads

Using an outsource accounting service for AP allows businesses to grow without proportionally increasing staff or office space. Benefits include:

- Handling larger volumes of invoices without needing to hire extra staff, keeping processes efficient.

- Improving cash flow by ensuring timely payments and better tracking, which supports business expansion.

- Freeing internal teams to focus on strategic work instead of routine invoice processing.

- Quickly onboarding new vendors or projects without disrupting existing workflows.

- Scaling operations during peak periods without hiring temporary staff or adding overhead costs.

- Maintaining control over AP processes while the business grows, with the help of an accounts payable outsourcing company, ensures accuracy and reliability.

This means companies can scale efficiently while keeping AP processes under control.

What to Look for in a Reliable Accounts Payable Outsourcing Company

When choosing an accounts payable outsourcing company, consider:

Experience

Proven track record in managing AP efficiently. Our team has successfully handled complex accounts payable processes for businesses across multiple industries.

Technology

Ability to handle digital invoicing and reporting. We use modern tools to automate workflows, making processes faster and more accurate.

Accuracy

Processes to prevent errors and fraud. Each invoice is verified and approved systematically to ensure reliable and compliant payments.

Support

Responsive team to address queries and issues. We provide prompt assistance to resolve concerns and maintain smooth operations.

Customization

Services tailored to your business size and needs. Our solutions are flexible, allowing us to adapt to your specific requirements and growth plans.

Why Choose Meru Accounting for Your Accounts Payable Outsourcing Needs

When it comes to managing accounts payable efficiently, Meru Accounting is a reliable provider of professional accounting and bookkeeping services.

We deliver comprehensive AP outsourcing solutions that streamline your invoice processing, improve cash flow analysis, and reduce errors. By working with us, you receive:

Proven Expertise

Our team has years of experience in handling AP for diverse industries, ensuring accuracy and timely processing.

Customized Solutions

We tailor our services to fit your business needs, whether you want to fully outsource AP or need selective outsource accounting service support.

Advanced Technology

We use modern tools to automate invoice processing, approval workflows, and reporting, reducing manual work and errors.

Real-Time Reporting

Stay informed with dashboards and detailed reports that provide complete visibility into your payables and cash flow.

Cost-Effective Services

Reduce overhead costs by outsourcing AP to professionals while still maintaining high-quality, reliable service.

At Meru Accounting, we specialize in AP outsourcing and outsource accounting services for businesses of all sizes. Our team ensures accurate, timely, and reliable invoice processing while improving cash flow management.

Key Takeaways

- Manual AP often causes cash flow problems, late payments, and errors.

- An accounts payable outsourcing company can streamline invoice processing, improve cash flow visibility, and reduce risks.

- Outsourcing AP provides cost savings, scalability, and accurate reporting.

- Vendor relationships improve with timely payments and structured processes.

- Businesses can focus on growth without increasing overheads.

- Choosing the right outsourcing partner, like Meru Accounting, ensures smooth, reliable AP management.

FAQs

It is a company that manages your invoice processing, approvals, and payments for you. They help improve accuracy, save time, and prevent cash flow issues.

Outsourcing ensures invoices are processed and paid on time, avoids penalties, and helps forecast cash needs.

Yes, even small businesses can improve payment processes, reduce errors, and save time by using an accounts payable outsourcing company.

It is when a business hires an external company to handle accounting tasks, like AP, payroll, or bookkeeping.

Look for experience, accuracy, technology, support, and services that can be customized for your business.