Outsource financial accounting services helps companies save time and effort. Experts manage accounts, records, and reports every month. This frees teams to focus on core business work.

Financial accounting management can become complex when teams grow large. Errors, delays, and missing reports can create stress daily. Outsourcing keeps books correct, reports clear, and decisions on time.

External professionals bring skill and tools to improve workflow. They use proven methods and simple steps to reduce errors. Outsourcing also lowers the costs of hiring full internal teams.

What You Will Learn From This Blog

- Key points about outsource financial accounting services.

- How financial accounting management works with outside experts.

- The main benefits of using outside accounting help.

- Possible risks to check before outsourcing work.

- The best ways to make outsourcing work smoothly.

- How outsourcing helps business growth and decisions.

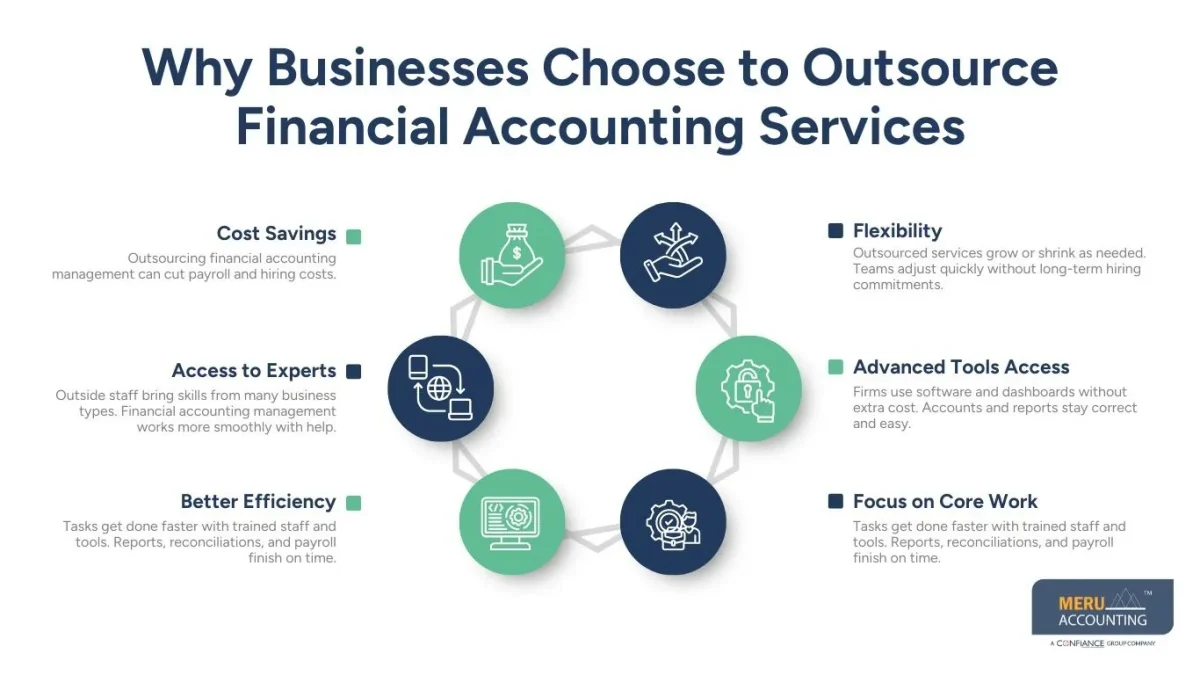

Why Businesses Choose to Outsource Financial Accounting Services

Cost Savings

Outsourcing financial accounting management can cut payroll and hiring costs. Companies save with outsource financial accounting services at a fixed monthly fee.

Access to Experts

Outside staff bring skills from many business types. Financial accounting management works more smoothly with help.

Better Efficiency

Tasks get done faster with trained staff and tools. Reports, reconciliations, and payroll finish on time.

Flexibility

Outsourced services grow or shrink as needed. Teams adjust quickly without long-term hiring commitments.

Advanced Tools Access

Firms use software and dashboards without extra cost. Accounts and reports stay correct and easy.

Focus on Core Work

Internal teams focus on sales, growth, and strategy. Experts manage accounts and reports efficiently.

Instead of maintaining an internal receivables team, businesses partner with these companies to handle tasks such as:

- Invoice generation and delivery

- Payment tracking and allocation

- Customer follow ups and reminders

- Dispute management

- Aging analysis and reporting

These companies combine accounting expertise with process discipline. They follow best practices that many in-house teams struggle to maintain due to workload, staffing issues, or lack of systems.

More importantly, these companies offer scalable accounts receivable solutions. As your business grows, your receivables process grows with it, without the need to hire or train new staff.

Understanding Financial Accounting Management Before Outsourcing

Track Income and Expenses

Keep a note of all money in and out for smooth financial accounting management. This stops errors and missed payments easily.

Maintain Clear Records

Write books, bills, and invoices clearly for better financial accounting management. Clear records are maintained efficiently with outsource financial accounting services.

Follow Rules

Do all work according to tax and law rules. Mistakes can cause fines or slow reports.

Plan Budgets

Look at past costs to plan for the next month. This helps spend smart and save funds.

Cut Errors

Use clear steps to avoid wrong entries or double bills. Experts help keep books right.

Help Decisions

Good records give data for smart choices each day. Managers see money flow, costs, and gains.

Core Tasks Included When You Outsource Financial Accounting Services

Bookkeeping

Experts write down all the money in and out each day. Books stay up-to-date for reports and quick review.

Accounts Payable and Receivable

Providers take care of bills, invoices, and client pay. Paying on time keeps cash flow smooth and safe.

Bank Reconciliation

Bank reconciliation ensures accurate financial accounting management. Outsource financial accounting services to handle reconciliations to avoid errors.

Payroll Processing

Payroll handled correctly improves financial accounting management. Timely payroll is easier with outsource financial accounting services.

Financial Reporting

Profit and loss reports are done each month. Managers use reports to make smart and fast choices.

Tax Filing and Budgeting

Taxes are filed on time with all rules followed. Budgeting helps plan next costs and track cash flow.

How Outsourcing Improves Financial Accounting Management Efficiency

Clear Workflows

Outsource financial accounting services to ensure tasks follow clear steps. Experts improve financial accounting management and reduce errors.

Use of Tools

Software handles work like invoice entry and checks. Time is saved, and errors are reduced each day.

Team Skill

Outside teams do hard accounting tasks with care. They handle tricky payments and entries without help.

Reports on Time

Reports are sent on time every single month. Managers use data to make fast, smart choices.

Less Workload

Staff can focus on growth while experts manage books. Outsourcing frees time for plans and key tasks.

Flexible Services

Work grows or shrinks quickly based on the company’s needs. Teams adjust load without stress or slowdowns.

Key Benefits of Outsource Financial Accounting Services for Businesses

Save Costs

Outsourcing stops the need to hire full-time staff each month. Fixed monthly fees make it easy to plan budgets.

Access Skilled Experts

Outside staff with real work skills handle all books. Work is done right and tasks finish on time.

Accuracy and Trust

Reports and accounts stay correct with expert help. Few mistakes happen, which builds trust in the results.

Better Cash Flow

Paying on time keeps money moving in and out. Managers can track costs and avoid cash shortages.

Focus on Growth

Teams spend time on sales, clients, and plans. Experts take care of payroll, books, and reports.

Flexible Services

Work can grow or shrink as business needs change. Temporary projects or busy months are handled fast.

Potential Risks of Outsourcing Financial Accounting Services

Data Security

Sharing money data outside may cause risk each day. Providers must use safe systems and strong locks.

Compliance Issues

Mistakes in reports or taxes can cause fines. Providers must follow local laws and rules at all times.

Reduced Control

Fewer checks can make teams depend on the provider. Regular review helps keep accounts right and clear.

Communication Gaps

Delays happen if updates are slow or unclear. Regular talks help avoid mistakes and lost work.

Dependency on Provider

Too much trust can hurt staff learning fast. Keep internal teams aware to check all work.

Transition Delays

Switching providers may cause short slowdowns at first. Good planning helps handover work smoothly and fast.

Important Factors to Evaluate Before You Outsource Financial Accounting Services

Check Provider Reputation

Look at past clients and reviews very carefully. Trusted firms help lower the risk of errors and delays.

Skill and Training

Make sure the team knows the rules for books and accounts. Trained staff follow the correct steps for all tasks.

Tools and Software

Ask which programs are used for records and reports. Good tools help speed work and cut mistakes fast.

Data Safety

Check locks, storage, and who can see data. Strong security keeps money and data safe from theft.

Cost vs Value

Compare fees with the gains from outsourced work. Do not pay more than needed for basic tasks.

Service Flexibility

See if services can grow or shrink with needs. Good firms handle busy months or small projects fast.

Cost Comparison: In-House Accounting vs Outsource Financial Accounting Services

In-House Costs

Hiring staff adds payroll, benefits, and training costs quickly. Offices also need to buy software for all tasks.

Outsource Costs

Outsource financial accounting services with fixed fees is cheaper than in-house staff. They improve financial accounting management accuracy.

Seasonal Workload

Outsourcing works well for busy months each year. No need to hire extra staff for peak times.

Operational Savings

Companies save on space, tools, and extra staff. Outsourcing cuts overhead while keeping work done right.

Return on Investment

Outsourcing boosts speed and cuts mistakes in accounts. Companies recover costs through better control of funds.

Scalable Cost

Services can grow or shrink based on business needs. Pay only for the work that is done now.

Transition Process for Outsource Financial Accounting Services

Assess Current Processes

Check books, reports, and workflows with care each day. See where outside experts can help and add value.

Define Responsibilities

List which tasks will be done by outside staff. Teams know clearly which work stays in-house at all times.

Secure Data Transfer

Share accounts, bills, and records using safe methods. Avoid sending via email or public online storage.

Step-by-Step Onboarding

Providers give training and guided setup for staff. Smooth workflow is kept without errors or delays.

Regular Updates

Set frequent updates while the transition is underway. Tasks get done on time and correctly each day.

Performance Monitoring

Track work output closely in the first few months. Mistakes or issues are fixed quickly by the team.

Best Practices for Managing Outsourced Financial Accounting Services

Clear Communication

Talk with providers to ensure smooth financial accounting management. Regular updates improve outsource financial accounting services.

Set Goals and KPIs

Define targets for accuracy, reports, and work done. Helps track provider output and check performance clearly.

Routine Checks

Review reports, reconciliations, and payroll all the time. Early checks help stop mistakes and audit problems.

Secure Channels

Use encrypted tools to send and store data. Sensitive info stays safe and cannot leak outside.

Feedback Mechanism

Give feedback to help improve processes over time. Keeps providers aligned with goals and expectations clearly.

Documentation

Keep notes of processes, updates, and completed work. Records ensure clarity and accountability for outsourced tasks.

Common Mistakes to Avoid When Outsourcing Financial Accounting Services

Not Checking Credentials

Do not hire without checking provider skills and past work. Poor credentials can lead to costly mistakes and delays.

Undefined Responsibilities

Not assigning tasks clearly leads to missed or double work. Teams must know which duties are done by providers.

Ignoring Security Protocols

Weak security raises the risk of data breaches and leaks. Always use locks, encryption, and safe access methods.

Over-Reliance on Provider

Do not lose all internal knowledge of accounting tasks. Keep team oversight to check outsourced work quality.

Delaying Communication

Slow updates can cause errors and missed deadlines. Talk often to keep the workflow smooth and on track.

Skipping Performance Reviews

Not checking reports can hide mistakes and errors. Regular review keeps accuracy high and avoids compliance issues.

How Outsource Financial Accounting Services Support Business Growth

Time Savings

Outsource financial accounting services saves time on routine work. Teams focus on growth and better financial accounting management.

Cost Optimization

Outsourcing cuts overhead and avoids extra expenses quickly. Funds can be used for growth or new projects.

Accurate Reporting

Reports are ready on time and easy to read. Managers plan businesses using real numbers and facts.

Investor Confidence

Correct books build trust with investors and partners. Stakeholders feel safe when accounts are true and clear.

Scalable Operations

Businesses grow without hiring extra in-house accounting staff. Outsourced teams handle extra work when the business expands.

Strategic Focus

Teams focus on clients, markets, and product growth. Experts handle daily financial accounting tasks reliably and fast.

Why Choose Meru Accounting for Outsource Financial Accounting Services

Global Expertise

Meru Accounting provides outsource financial accounting services worldwide. We help companies in many fields with skill and care.

Certified Professionals

Our team has trained experts in accounting and management work. Books stay correct, and reports are ready on time.

Secure and Compliant

We follow strict rules and security methods always. Your data and reports stay safe and private at all times.

Advanced Tools

We use modern software and simple dashboards for work. Clients see reports and cash flow in real time.

Tailored Solutions

Services are made to match each company’s needs clearly. Plans can grow or shrink to fit your business fast.

Reliable Support

Our team gives help and guidance every working day. Questions or concerns are answered quickly to keep the workflow smooth.

Key Takeaways

- Outsourcing financial accounting services saves time and reduces costs.

- Financial accounting management becomes accurate, clear, and reliable.

- Experienced providers with strong security are essential to choose.

- Outsourcing supports business growth and faster decision-making.

- Careful evaluation reduces risks and ensures a smooth transition.

FAQs

Bookkeeping, payroll, tax filing, reports, and budgets are done. They also check invoices, bank accounts, and cash flow.

Experts cut errors and do tasks fast and right. Reports finish on time with books kept clear and true.

Data leaks, rule mistakes, and too much trust in providers. Slow updates or weak security may cause big problems too.

Check skills, papers, tools, and past clients before hiring. Make sure they keep data safe and adjust work fast.

Yes, it cuts pay, staff training, and extra costs. It also stops spending on software or office space.