A Detailed Guide – Payables in Accounting

Payables in accounting is key for any business. It’s about managing the money the company owes to vendors, suppliers, and others. By tracking these debts, firms can run smoothly, avoid extra charges, and keep good ties with those they owe.

This guide will cover payables accounting in clear terms. We will look at what it is, why it matters, how it works, and tips for doing it right.

If you run a business, you may know accounts payable (AP) and accounts receivable (AR). This guide will show what they mean, why they matter, and how they differ.

What Is Accounts Payable?

Accounts payable is about keeping track of what a company owes. These debts are often owed to suppliers or other creditors and are usually short-term. They’re listed in the accounts payable ledger as current liabilities on the balance sheet. When a company buys goods or services on credit, it creates accounts payable. The goal is to pay on time, keep records correct, and avoid supply issues. Good payables management helps keep the company’s finances healthy.

In simple terms, when a business buys items on credit, it records the amount owed as AP. For example, if you buy $20,000 worth of goods from a supplier and agree to pay in 30 days, that $20,000 becomes accounts payable.

What Is the Accounts Payable Process?

The AP department handles the payment process of accounts payable. The steps include:

- Receiving the invoice: The supplier sends an invoice for the goods or services.

- Verifying details: Check the amount, pricing, and quantities.

- Recording invoices: Keep a record of all received invoices.

- Making payments: After all checks, payments are made to the supplier.

AP vs. AR (Accounts Receivable)

AP tracks what the business owes. AR tracks what customers owe.

For example, if you sell $10,000 in credit, that’s AR.

Accounts Payable (AP): Money the business owes.

Accounts Receivable (AR): Money that others owe the business.

Aspect | Accounts Payable (AP) | Accounts Receivable (AR) |

Definition | The amount a business owes to its creditors or suppliers. | The amount customers owe to the business for goods or services provided on credit. |

Nature | Liability (money owed by the business). | Asset (money owed to the business). |

Financial Impact | Increases liabilities and reduces cash flow. | Increases assets and improves cash flow when paid. |

Function | Tracks what the business has to pay to suppliers/vendors. | Tracks what customers owe to the business for credit sales. |

Example | A company owes $10,000 to its supplier for raw materials. | A company sells $10,000 worth of goods on credit to a customer. |

Balance Sheet Classification | Listed under current liabilities. | Listed under current assets. |

Cash Flow Effect | Outflows of cash occur when payments are made. | Inflows of cash occur when customers pay their bills. |

Management Focus | Ensuring timely payments to maintain supplier relationships and avoid late fees. | Ensuring the timely collection of receivables to maintain cash flow. |

Time Frame | Short-term liability, typically due within 30-90 days. | Short-term asset, typically expected to be paid within 30-90 days. |

Importance of Payables Accounting

1. Keeps Finances Healthy

- Good payables in accounting help the company pay bills on time. This avoids extra costs like fines and interest.

2. Builds Supplier Trust

- Paying on time keeps a good bond with suppliers. It can lead to better deals or discounts.

3. Helps with Cash Flow

- Paying on time and tracking debts helps predict cash needs. This makes it easier to plan.

4. Stops Fraud

- Accurate records can stop fraud, like overcharging or paying twice.

5. Shows Clear Financials

- Good payables accounting keeps liabilities clear on the balance sheet, helping overall records stay true.

Key Parts of Payables Accounting

1. Invoices

- An invoice shows the amount owed for goods or services, including the date and payment terms.

2. Accounts Payable Ledger

- This record lists what the company owes, including the amount, supplier, and due date.

3. Payment Terms

- These are the rules for when and how to pay. For example, “Net 30” means pay in 30 days.

4. Aging Report

- This report tracks overdue bills, showing how long each one has been unpaid.

5. Payment Processing

- This step covers how the company actually pays the bills, whether by check or wire.

6. Reconciliation

- This means checking the accounts payable ledger against bank records to find any errors.

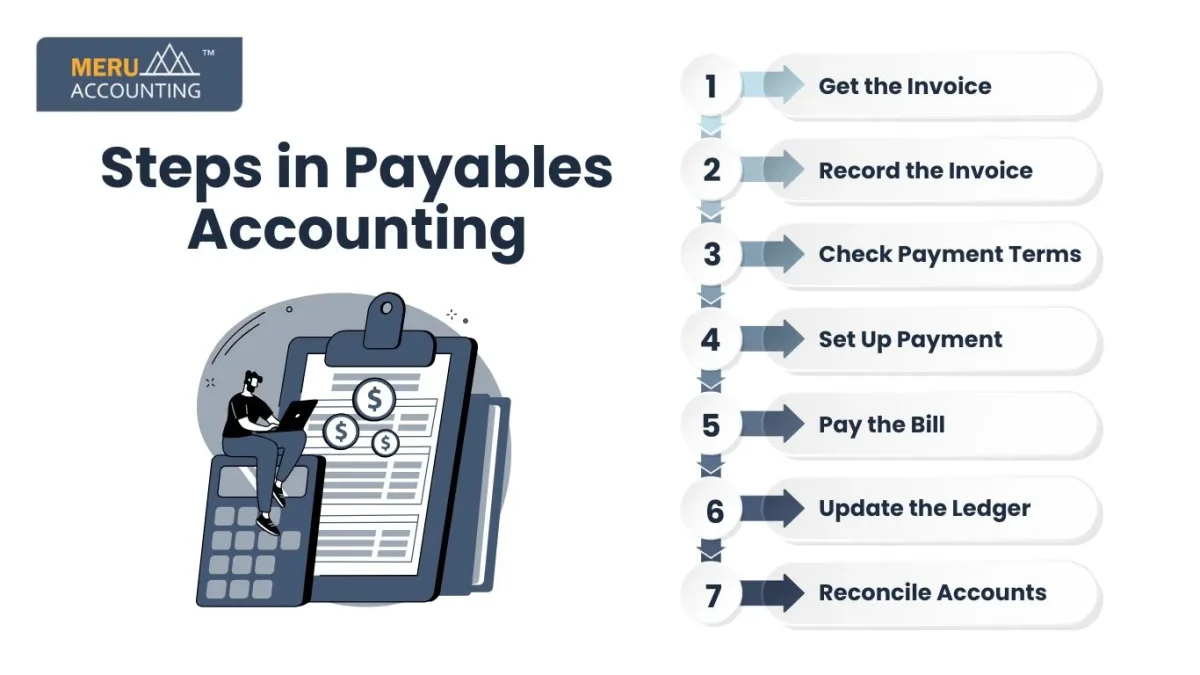

Steps in Payables Accounting

1. Get the Invoice

- Once goods or services arrive, the company gets an invoice. Check if it’s right.

2. Record the Invoice

- Add the invoice details to the accounts payable ledger.

3. Check Payment Terms

- Look at the invoice terms. If a discount is offered, pay early to save.

4. Set Up Payment

- Schedule the payment based on the invoice and terms.

5. Pay the Bill

- Pay the bill using the agreed method (check, transfer, etc.).

6. Update the Ledger

- Once paid, mark the bill as done in the ledger.

7. Reconcile Accounts

- Periodically, check the ledger against bank or supplier records for accuracy.

Best Practices for Payables Accounting

1. Have a Clear Approval Process

- Make sure invoices are checked before payment. This stops mistakes and fraud.

2. Use Software

- Accounting software can make the process easier and reduce errors.

3. Negotiate Terms

- Work out longer payment terms with suppliers. This helps manage cash flow.

4. Watch Overdue Bills

- Use reports to keep track of overdue debts and avoid late fees.

5. Set a Payment Schedule

- Pay bills on a set schedule to avoid missing deadlines.

6. Verify Supplier Info

- Double-check supplier details to prevent mistakes or fraud.

7. Keep Good Records

- Store invoices and receipts. It helps with audits and checks.

Challenges in Payables Accounting

1. Invoice Errors

- Sometimes, invoices have wrong amounts or missing details, causing delays. Always check details before paying. This helps avoid issues and delays.

2. Late Payments

- Late payments can lead to extra fees and harm supplier ties. Set alerts for due dates. This ensures bills are paid on time.

3. Fraud Risks

- Poor controls can lead to duplicate payments or fake vendors.

4. Cash Flow Problems

- Payables can cause cash shortages, especially if too many bills come due at once.

5. Different Vendor Terms

- Varying terms from suppliers make it hard to manage all debts well.

Common Errors in Payables Accounting and How to Avoid Them

Errors can happen in accounting payables. These mistakes can cause problems with finances, harm supplier ties, and cost extra money. Here are common errors and how to stop them:

1. Duplicate Payments

This happens when the same bill is paid twice. It can be caused by poor invoice tracking. It leads to extra costs and poor ties with suppliers.

How to Avoid:

- Use a system that flags duplicate invoices.

- Cross-check payments with the accounts payable list.

- Use software that checks for duplicates.

2. Missing or Late Payments

Missing or paying bills late can lead to extra fees or upset suppliers.

How to Avoid:

- Set up reminders for due bills.

- Check accounts payable aging reports.

- Stick to a clear payment schedule.

3. Incorrect Amounts

Sometimes, the wrong amount is entered. This can happen from errors or when an invoice doesn’t match the order.

How to Avoid:

- Double-check all invoices before entering them.

- Use software that matches orders, goods, and invoices.

4. Failure to Apply Discounts

Suppliers often give discounts for early payments. Not using these can cost money.

How to Avoid:

- Train staff to use early payment discounts.

- Use software that tracks and alerts you to discounts.

Internal Controls in Payables Accounting

Internal controls in payables accounting are needed to stop fraud, errors, and poor financial management. Here are key controls for payables accounting:

1. Segregation of Duties

- Split tasks between people, such as getting invoices, approving payments, and recording them. This reduces fraud and mistakes.

2. Approval Process for Payments

- Set up a check for each payment. A manager should review each bill before paying to make sure the amount is right.

3. Vendor Verification

- Check the legitimacy of each vendor before adding them. This stops fraud, like paying fake vendors.

4. Reconciliation and Audits

- Regularly check your accounts with vendor records. Conduct internal audits to find errors or fraud early.

5. Limiting Access to Financial Systems

- Only allow authorized staff to access financial systems. This keeps unauthorized transactions from happening.

The Role of Automation in Payables Accounting

Automation helps speed up accounting payables, cut errors, and save time. Here’s how it changes things:

1. Invoice Capture and Data Entry

- Automated systems pull data from invoices and add it to the payable list.

Benefit: Fewer errors, faster work. It saves time and cuts manual tasks.

2. Matching Invoices with Orders

- Automation links invoices with orders to ensure correct payments.

Benefit: Reduces over- or underpayment. This makes payment matching quick and easy.

3. Payment Scheduling and Alerts

- Automation can schedule payments based on each supplier’s terms. It also sends alerts for early payment discounts or overdue bills.

Benefit: Ensures on-time payments and helps save money with discounts.

4. Automated Vendor Communications

- Systems can send payment confirmations and reminders, keeping vendors updated.

Benefit: Saves time and keeps vendors informed.

5. Audit Trail and Reporting

- Automated systems create records of every transaction. This makes audits and tracking easier.

Benefit: Improves transparency and makes audits easier.

The Impact of Technology on Accounts Payable

Technology is changing the way payables in accounting works. Here are some key tools:

1. Cloud-Based Accounting Software

- Tools like QuickBooks, Xero, and SAP Concur help automate payables and give real-time access to data.

2. AI and Machine Learning

- AI can predict payment trends and spot mistakes. Machine learning makes invoice matching more accurate.

3. Blockchain Technology

- Blockchain tracks deals clearly, cuts fraud, and speeds up checks.

4. Electronic Payments

- ACH, wire, or digital wallets make payments fast and cheap, with fewer mistakes.

5. Robotic Process Automation (RPA)

- RPA tools do tasks like invoice work, cut errors, and speed up the process.

Payables Accounting in Different Industries

Payables accounting differs by industry. Here’s how it works in some key sectors:

1. Manufacturing

- Manufacturers deal with large orders for materials, machines, and supplies. Timely payments keep production running smoothly.

2. Retail

- Retailers deal with frequent purchases for inventory and logistics. Cash flow is important due to rapid sales and stock restocking.

3. Technology

- Tech firms often manage software subscriptions and services. Accurate tracking of renewals is key.

4. Healthcare

- Healthcare deals with many different payables for medical supplies, equipment, and services. Billing and rules add complexity.

Payables accounting keeps a business’s money in check. Paying bills on time helps avoid fees, stay strong, and keep good supplier ties. Outsourcing AP tasks saves time, keeps things accurate, and runs smoothly. Meru Accounting helps by handling payables, reducing errors, and making your records clearer.

FAQs

- What is accounts payable?

It’s money a company owes for goods or services bought on credit. - How does it affect cash flow?

It sets when bills are due and affects how much cash the company has. - What is aging of accounts payable?

It’s a report showing how long each bill has been unpaid. - Why is it important?

It helps manage debts, avoid fees, and keep good relationships with suppliers. - How do you record accounts payable?

Record the amount owed, along with payment terms, in the accounts payable ledger. - What are common payment terms?

Net 30″ and “2/10, Net 30” (pay in 30 days or get a 2% discount) are common.