How do I choose the right payroll outsourcing company for my business?

Payroll outsourcing helps all kinds of businesses. It makes payroll easy, keeps you following the rules, and cuts down on errors. But how do you pick the best company for you? This guide shows the main things to check when you choose a payroll service. Business is tough, and you must focus on growth to stay ahead. Payroll is key, but not your main work. It matters for HR and rules, but it is not the core task. Outsourcing payroll is a smart way to handle it.

Doing payroll can be hard for any business. It takes time and care. Payroll mistakes can cause fines and legal trouble. That’s why more businesses hire trusted firms to do payroll for them.

What is Payroll Outsourcing?

Payroll outsourcing means you hire a firm to do all your payroll work. This includes paying staff, handling taxes, and making sure your business follows all rules. A payroll firm saves time and helps avoid costly errors. It also keeps staff happy by making sure they are paid right and on time.

Most firms also help with leave, hours, and end-of-year forms. They stay up to date with law changes, so you don’t have to. With payroll off your plate, you can focus more on running and growing your business.

Why Should You Consider a Payroll Outsourcing Company?

Many businesses choose to outsource payroll for good reasons. Here are the main benefits:

Saves Time

Payroll takes a lot of time. When you outsource it, your team can focus on key work. You spend less time on paying tasks and more time growing the business. This helps staff use their skills where they are needed most. It also lowers stress and frees up time and money, so your business runs smoothly and grows strong.

Reduces Errors

Payroll errors can cause fines or upset workers. Payroll firms know the rules well. They check everything to make sure the pay is right and on time.

Ensures Compliance

Tax laws and work rules change often. Payroll companies keep up with these changes. They help you stay within the law and avoid costly fines.

Cost-Effective

Hiring people to do payroll in-house can be expensive. For small and mid-size businesses, outsourcing usually costs less. You get expert help without extra staff costs.

Expert Support

Payroll firms have trained staff who know payroll inside out. They handle the work fast and right, so you don’t have to worry.

Better Security

Payroll data is private and must be kept safe. Payroll companies use strong systems to guard your information from theft or loss.

Easy to Scale

When your business grows, payroll gets more complex. Outsourcing lets you add or change payroll services with ease, so you stay on track.

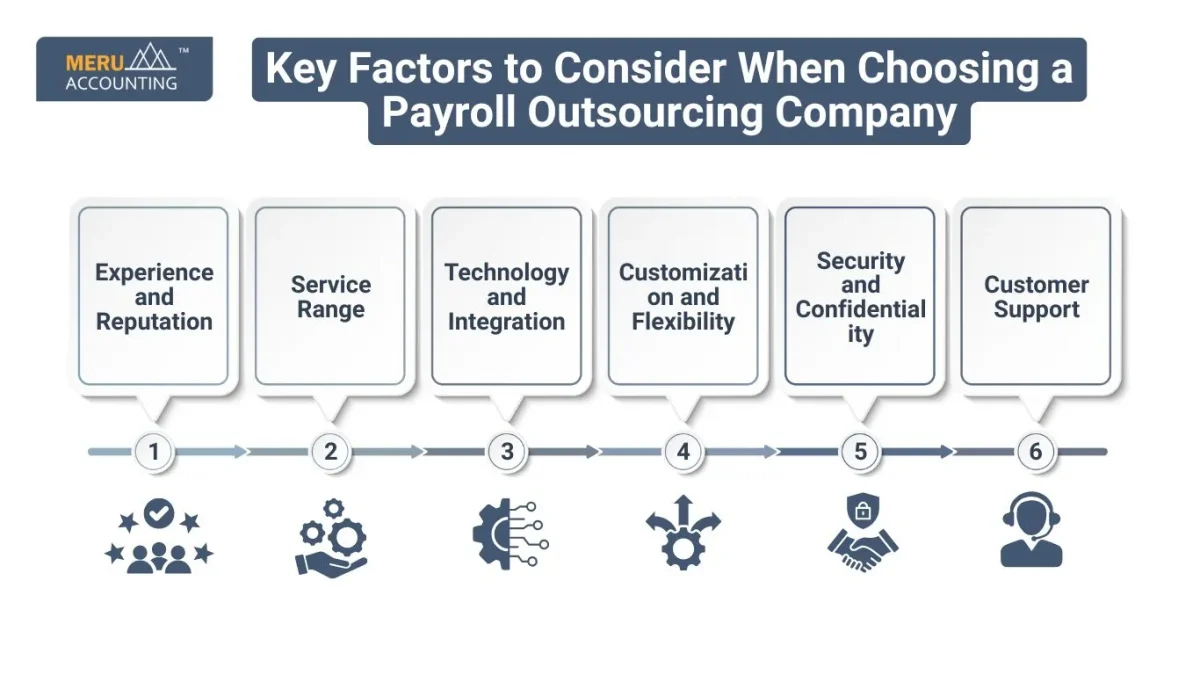

Key Factors to Consider When Choosing a Payroll Outsourcing Company

Now, let’s look at some important factors to consider when selecting a payroll outsourcing company:

1. Experience and Reputation

A payroll company with experience and a good name is key. A company that has been around a while is more likely to be reliable.

- Talk to Others: Ask other businesses that used the service for feedback.

- Check Reviews: Look online to see what past clients say.

2. Service Range

Make sure the company offers the services you need. Some companies only handle payroll, but others can help with taxes, benefits, and more.

- Payroll: The company should handle paying employees on time and correctly.

- Tax Filing: Ensure they deal with taxes, like sending payments to the IRS.

- Benefits: If your business offers benefits, check if the company can handle this.

3. Technology and Integration

Technology and Tools

Good technology is key for smooth payroll work. Pick a company that uses the latest tools to make payroll simple and fast.

- Cloud-Based System: A cloud system lets you get payroll info from any place, giving you ease and choice.

- Integration: Make sure the payroll system works well with your HR and accounting software for smooth data flow.

4. Customization and Flexibility

Each business has its own needs. Choose a payroll provider that can shape its services to match your needs.

Employee Types: If you have full-time, part-time, or freelance staff, be sure the provider can manage all of them.

- Payment Options: The provider should give you ways to pay staff, like checks or direct deposit, to suit your workers.

5. Security and Confidentiality

Payroll has sensitive data, so security is key. The company should protect your data at all costs.

- Data Encryption: They should use strong encryption to protect their data.

- Confidentiality: The company must sign agreements to keep your data safe.

6. Customer Support

Good support is important. Check if the company offers quick help if needed.

- 24/7 Support: It’s best if they offer help around the clock.

- Easy to Reach: Ensure you can contact them by phone, email, or chat.

Steps to Choose the Right Payroll Outsourcing Company

Here’s how to pick the best payroll outsourcing company for your business:

1. Know Your Needs

Before you start, know what your business needs. Think about how many workers you have, how hard your payroll is, and if you need extra help with things like benefits or tax work. This helps you find a company that fits.

2. Do Your Research

Once you know what you need, research payroll companies. Check reviews, their reputation, and how much experience they have. Make sure they offer the services you need and compare their prices.

3. Get Proposals

Ask the companies you like to send proposals. These will show you what they offer, their prices, and how they do payroll. This helps you compare and decide which company is the best fit.

4. Check for Legal Compliance

Make sure the payroll company follows all laws, including tax rules and labor laws. They should know the rules in your area and be up to date with any changes. Ask how they keep up with laws.

5. Check the Software

Ask for a demo of the software they use. See if it’s easy to use and if it works with your other systems, like accounting or HR. The right tech makes payroll faster and more accurate.

6. Talk to Your Team

Get feedback from your HR or finance team. They can tell you what features are important to them. Their input helps you pick a service that fits with your business.

7. Review the Contract

Once you pick a company, read the contract carefully. It should clearly list the services, prices, and any other terms. Make sure you understand all the details before signing.

Choosing the right payroll company is key for your business. Look at their skill, services, and cost to find a good fit. A trusted firm helps you stay in line with rules, saves time, and cuts payroll mistakes. Make sure they keep data safe, give the services you need, and have clear costs. Partner with Meru Accounting for reliable payroll services you can trust. Our skilled team makes sure your payroll is right, safe, and follows the law, so you can focus on growing your business with ease.

FAQs

- How Much Does Payroll Outsourcing Cost?

The cost depends on your business size and needs. It usually costs a few hundred to a few thousand dollars each month. - Can Payroll Outsourcing Help with Tax Compliance?

Yes. A good payroll company files taxes on time and does them right. This helps your business stay in line with tax rules. - Is Payroll Outsourcing Secure?

Yes. Most payroll firms use safe systems and encryption to keep worker data safe. - Can I Switch Payroll Outsourcing Companies?

Yes, you can switch anytime. Just make sure you pick the right time to avoid problems with tax forms or reports. - What Should I Do if There’s a Payroll Error?

If there’s an error, contact your payroll provider right away. Most firms will fix errors fast to avoid delays.