How tax optimization strategies can help your business grow?

Tax optimization means using smart and legal ways to pay less tax. It is part of something called tax planning and optimization. When you learn about what is tax optimization, you can make better choices with your money. This means you don’t pay more tax than you need to. With tax planning and optimization, you can keep more money in your business.

That money can help you buy tools, hire workers, or grow your shop. Even small businesses can use tax optimization. It helps you follow the tax rules while saving more. That’s why smart business owners use it every year to stay ahead and grow strong.

What is Tax Optimization?

Tax optimization means finding smart and legal ways to lower the tax you pay. You still follow all the rules, but you use smart tricks to pay less tax. This helps you save money, and you can use that money to buy tools, hire workers, or grow your business. Many smart businesses do this to stay ahead.

Let’s say you earn some money from your business. You will need to pay tax on it. You keep more of your money and use it in ways that help your business grow. That’s why smart planning matters.

How Tax Planning and Optimization Works

1. Make a Yearly Plan

Tax planning and optimization is like a money map for the year. You write down what you want to earn, save, and spend. When you plan well, you can pay less tax and keep more money for your needs.

2. Look at What You Earn

You must know how much your shop or job pays. Write down all the money that comes in each month. This shows your real income and helps you guess how much tax you may owe.

3. Check What You Spend

Make a list of what you spend on things like rent, gear, travel, or bills. These are called “costs” or “business spends.” When you list them, they help lower your tax because they get taken off your total money.

4. Read the Tax Rules

Tax rules tell you what you can or can’t do. Some expenses, like gear or work trips, can lower your tax. If you know the rules, you stay out of trouble and may save cash.

5. Pick the Right Business Type

The way your shop is set up (like being on your own or in a group) changes how much tax you pay. Some types get to pay less. Picking the right one helps with smart planning.

6. Get Help from Experts

If tax feels too hard or confusing, ask someone who knows. Tax helpers (like pros or firms) can show you what to do. They know the newest rules and help you plan in the best way.

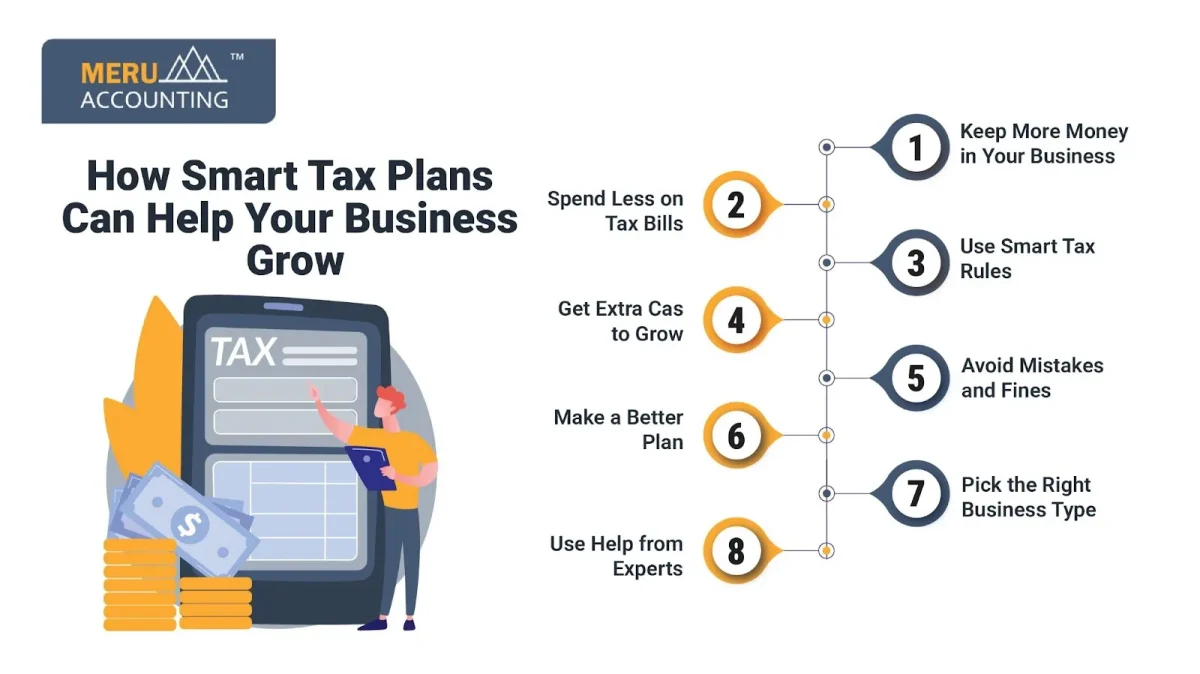

How Smart Tax Plans Can Help Your Business Grow

1. Keep More Money in Your Business

Smart tax plans help you pay only what is fair. You don’t pay more than needed. That means you keep more money in your shop or workplace. You can use that extra money to buy new tools, stock, or expand your place.

2. Spend Less on Tax Bills

With tax planning and optimization, you find ways to lower your tax bill. When you pay less, you have more to spend on your team, on ads, or to fix things in your store. That makes your business stronger.

3. Use Smart Tax Rules

There are rules that help small shops pay less tax if they follow them correctly. Smart tax optimization means knowing those rules and using them in a legal way. You still follow the law, but you save more.

4. Get Extra Cash to Grow

When you pay less tax, you are left with more cash. That cash can be used to hire new staff, open more branches, or build a better website. More money means more chances to grow.

5. Avoid Mistakes and Fines

If you don’t plan well, you may forget to pay tax on time or pay the wrong amount. That can cause big problems. You might even get a fine. Tax planning and optimization help you stay safe and clean so you don’t get in trouble.

6. Make a Better Plan

When you know how much tax you’ll owe, you can plan ahead. You can save money in the right months and spend smartly. This makes your business easy to run all year long.

7. Pick the Right Business Type

The way your business is set up, like being a sole trader, a firm, or a company, can change how much tax you pay. Picking the right type helps you pay less and keep more.

8. Use Help from Experts

If you feel lost, talk to a tax expert. These are people who know all about smart tax tips. They can guide you step-by-step so your business can save and grow the right way.

Challenges in Tax Planning and Optimization

1. Hard to Understand the Rules

Tax rules can be tricky. There are many rules, and they keep changing. It can be hard for small business owners to keep up and know what to do.

2. Missing the Right Time

Some tax plans need to be done at the right time. If you wait too long, you may miss out on saving money. Planning late can cost you more tax.

3. Picking the Wrong Business Type

If you don’t choose the best setup for your business, you might pay more tax. Many people don’t know which type is right for them.

4. Not Knowing What You Can Claim

Some costs can lower your tax. But many people don’t know which costs they can use. They may miss out on saving money.

5. Making Mistakes in Records

If your books or files are wrong, it can mess up your tax plan. Bad records can lead to fines or extra taxes.

6. Not Getting Help

Some people try to do it all alone. But without expert help, they may make mistakes or miss chances to save. A tax expert can guide you better.

7. Too Many Changes in Laws

Tax laws change often. If you don’t keep up, you may follow old rules by mistake. This can lead to wrong tax plans.

8. Not Enough Time

Running a business is busy. Many owners don’t have time to plan their taxes. Without time, they may rush and miss savings.

Tax optimization is a smart way to pay less tax and still follow the rules. It is part of tax planning and optimization. When you understand what is tax optimization, then you can make better choices with your money. You keep more money in your business and use it to grow, hire people, or buy tools.

With help from Meru Accounting, you can learn how to use these tips the right way. Good planning means fewer mistakes and more savings. Start early, make a smart plan, and use tax optimization to build a strong business.

FAQs

- What is tax optimization?

Tax optimization means using smart and legal ways to lower how much of tax you pay. - Why is tax planning and optimization important?

It helps your business keep more money and avoid tax mistakes. - Can tax optimization help small businesses?

Yes! Small businesses can save a lot with good tax planning. - When should I start planning my taxes?

It’s best to start at the beginning of the tax year to get the most out of it. - Who can help me with tax optimization?

A tax expert can guide you through the steps and show you how to save in a smart way.