I Need to Hire a Bookkeeper, But Where Do I Start?

If you have ever thought, “I need to hire a bookkeeper”, you are not alone. Many small business owners get lost when it comes to financial management. Bookkeeping becomes more and more complex when your business keeps growing. It helps keep your business safe, neat, and ready to grow.

A bookkeeper makes sure bills are paid on time. They check that all records are right. They also handle tax work. They help you see where money comes from and where it goes. A good bookkeeper saves time, cuts stress, and keeps your business on track.

Hiring the right bookkeeper is crucial as it frees up your time for clients, sales, and other work that grows your business. This blog will show you where to start, what to look for, and how to hire the right person for your firm. It will also help you manage your bookkeeper and check their work without stress.

Signs You Need to Hire a Bookkeeper

You may need a bookkeeper if you notice:

- You spend hours every week on money work.

- Personal and business accounts are mixed.

- Tax time feels hard or scary.

- Bills are missed or late.

- Reports are often delayed or wrong.

Hiring early can prevent problems. Acting fast when you think “I need to hire a bookkeeper” keeps cash flow smooth.

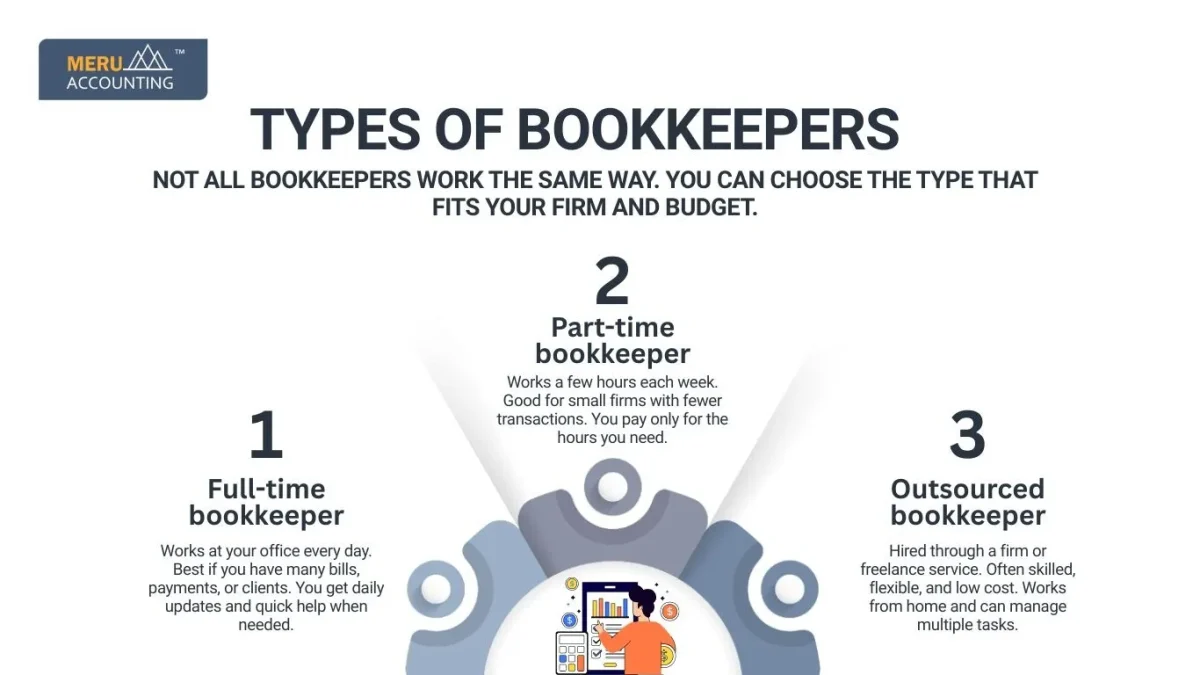

Types of Bookkeepers

Not all bookkeepers work the same way. You can choose the type that fits your firm and budget.

Full-time bookkeeper – Works at your office every day. Best if you have many bills, payments, or clients. You get daily updates and quick help when needed.

Part-time bookkeeper – Works a few hours each week. Good for small firms with fewer transactions. You pay only for the hours you need.

Outsourced bookkeeper – Hired through a firm or freelance service. Often skilled, flexible, and low cost. Works from home and can manage multiple tasks.

Pick the type that matches your firm size, workflow, and cash plan.

Setting Clear Tasks

It is important to be clear about what your bookkeeper will do.

Daily tasks: Enter money coming in and going out. Check bank and card accounts. Track bills and invoices.

Weekly tasks: Prepare short reports. Check for mistakes. Pay bills on time.

Monthly tasks: Prepare full reports. Check taxes. Make sure accounts are neat.

Other tasks can include petty cash tracking, filing receipts, and preparing documents for your accountant.

Clear lists make hiring simple. They prevent mix-ups and confusion.

Planning Your Budget

Before hiring, know how much you can spend.

- Hourly – Pay for the hours worked. Good for short tasks.

- Monthly – Fixed cost for ongoing work. Predictable and easy to plan.

- Project – One-time pay for yearly accounts or special tasks.

Tips for budgeting:

- Remember software fees or other hidden costs.

- Add extra for busy months.

- Compare in-house vs outsourced costs.

A clear budget helps you pick the right person without stress.

Where to Find a Bookkeeper

You can find bookkeepers in different ways:

- Referrals – Ask friends, colleagues, or your accountant. These are often reliable.

- Job boards – LinkedIn, Indeed, or local sites. Many skilled bookkeepers post profiles here.

- Accounting firms – Some offer bookkeeping staff. Can be part-time or full-time.

- Freelance sites – Fiverr, Upwork, or local freelance options. Flexible and often affordable.

Always check experience, trust, and past work before hiring.

Qualities to Look For

When hiring, look for these traits:

- Trustworthy – Handles cash safely. Follows rules.

- Neat – Keeps files and accounts organized.

- Careful – Small mistakes can cost money.

- Good at explaining – Helps you understand reports.

- Dependable – Meets dates and completes tasks on time.

Other good traits:

- Flexible – Can handle extra work or changes.

- Patient – Can explain numbers to you or your staff.

- Proactive – Spots mistakes before they grow.

Skills and Training to look for when you need to hire a bookkeeper

Good bookkeepers have skills and training:

- Certified Bookkeeper (CB) – Shows they know the work.

- Software skills – QuickBooks, Xero, FreshBooks. Must use tools well.

- Experience in your field – Helps if your business has unique needs.

Other useful skills:

- Basic tax knowledge – Can help at tax time.

- Payroll experience – Handles paychecks and deductions.

- Reports – Can make clear charts and summaries.

Skill is key, but trust and care are more important for small firms.

Before hiring a bookkeeper ask these questions

Ask these questions:

- Which software do you use?

- How do you meet deadlines?

- Can you give past client names?

- How do you fix errors?

- Do you handle payroll?

Other tips:

- Ask how they plan tasks.

- Ask how they organize invoices and receipts.

- Check if they can work with remote software.

These questions help you see skill and fit.

Checking References Before you hire a Bookkeeper

Call past clients or bosses. Ask:

- Was work done right and on time?

- Were they honest and careful?

- Did they communicate well?

References show if the hire will be good.

Trial Period

Start with 1–3 months trial.

- See how they handle tasks.

- Check if deadlines are met.

- See if they fit your firm.

Other tips:

- Start with small tasks first.

- Observe how they use software.

- Watch how they communicate.

Trial reduces risk of a wrong hire.

Onboarding Your Bookkeeper

Give clear instructions:

- Software access

- Bank and card info

- Vendor and client list

- Task and report rules

- Privacy rules

Extra tips:

- Show filing system

- Give past reports

- Introduce key contacts

Good onboarding makes work smooth.

Communication Tips you need to coordinate with your bookkeeper

- Meet each week or month to check books.

- Use cloud software for live updates.

- Set clear deadlines.

- Use short notes for tasks.

Extra tips:

- Encourage updates and questions.

- Use shared checklists.

- Give feedback monthly.

Clear talk stops errors and stress.

Tech Helps

- Software tracks cash fast.

- Reports ready in clicks.

- Shows money in and out.

- Lets remote work happen.

Other tips:

- Store records in cloud.

- Automate repeat tasks.

- Set reminders for bills.

Outsourced vs In-House

Factor | In-House | Outsourced |

Cost | High | Low |

Flex | Fixed | Can scale |

Skill | Vary | Often more skilled |

Check | Full | Needs reports |

Small firms often pick outsourced for cost and flexibility.

Mistakes to Avoid before hiring a bookkeeper

- Hiring without references

- No clear tasks

- Overload one person

- Skip software training

- Wait too long

Other mistakes:

- Ignoring small errors

- Not updating procedures

- Choosing cheapest blindly

Avoiding mistakes saves time, cash, and nerves.

Signs of a Good Bookkeeper

- Books are right and on time

- Reports are clear

- Deadlines are met

- Communicates well

- Adapts to firm style

Other signs:

- Suggests improvements

- Keeps work neat

- Handles multiple tasks

Right hire makes your firm run smooth.

Hiring Cost

- Beginner: $15–$25/hour

- Skilled: $30–$50/hour

- Full-time small firm: $3000–$5000/month

- Outsourced monthly: $500–$1500

Tips:

- Think of cost as investment

- Compare part-time vs full-time

- Budget for busy months

Some Extra Tips

- Keep daily, weekly, monthly checklists

- Use a separate bank for business

- Ask for monthly reports

- Let bookkeeper suggest savings

- Keep backup copies

- Review books weekly

- Track progress monthly

- Encourage questions to avoid mistakes

These tips will keep the coordination clear and safe.

If you think you need to hire a bookkeeper, check your needs, tasks, and budget first. Look for trust, skill, and care. Check references so you can get an idea about the expertise and experience of the bookkeeper. Meru Accounting’s bookkeeping services help you save time, reduce stress, and manage finances. The right hire, in-house or remote, makes your firm smooth and ready to grow. Contact us now and get a reliable bookkeeper for your business.

FAQs

- Why do people say “I need to hire a bookkeeper”?

Because managing money alone takes too much time. A bookkeeper helps you stay neat, pay bills on time, and keep stress low while you run your firm. - How do I know when it’s time to hire a bookkeeper?

If tax time feels tough, or your books take more hours than your real work, it’s time. Early help keeps your money flow steady and safe. - What does a bookkeeper really do?

They track income, costs, and bills. They keep your books neat, match records, and share reports so you always know where your money goes. - Can a bookkeeper help with taxes?

Yes. They make sure your data is clean and ready for your tax pro. It cuts stress and stops costly tax errors. - Should I get a full-time or part-time bookkeeper?

Pick what fits your work size. Big firms need daily help, but small ones may need a few hours a week. Start small and scale when work grows. - What is an outsourced bookkeeper?

An outsourced bookkeeper works from another place, often online. They can cost less but still offer skilled, fast work through cloud tools. - How much does it cost to hire a bookkeeper?

A starter may cost $15–$25 per hour, while skilled ones charge $30–$50. Outsourced plans may range from $500–$1500 per month. - Where can I find a bookkeeper I can trust?

Ask friends or your accountant first. Check job boards or freelance sites too. Always read reviews and ask for past work samples. - What should I look for before I hire a bookkeeper?

Look for honesty, neat work, and clear talk. They must meet dates, use software well, and care about small details. - What skills must a bookkeeper have?

They should know tools like QuickBooks or Xero, understand taxes, and know how to make clear reports that you can read with ease. - What should I ask before hiring a bookkeeper?

Ask how they manage work, what tools they use, and how they meet deadlines. A short talk tells you a lot about their style. - Should I test a bookkeeper before hiring?

Yes. Try a one-month trial with small tasks. You’ll see how fast they work and how they deal with reports and errors. - How do I share data with my bookkeeper?

Give them safe access to your bank, cards, and reports. Use cloud tools to share files. Always keep your own backup too. - Can my bookkeeper work from another city or country?

Yes. Remote bookkeepers are common now. Cloud tools let them update your books daily while you see every change in real time. - How can I keep track of their work?

Ask for weekly or monthly reports. Review key numbers like profit, bills, and cash. Small checks often keep big errors away. - What are signs I picked the wrong bookkeeper?

If reports come late, errors stay, or replies take too long, it’s a red flag. A good bookkeeper stays alert and keeps you informed. - Can a bookkeeper save me money?

Yes. They track spend, find leaks, and suggest better ways to plan cash. A clean record means fewer fines and better savings. - Is it okay to switch bookkeepers later?

Yes, if things don’t feel right. Just hand over all data and reports safely so the new person can start smooth. - Do I still need to check the books if I hire one?

Yes, but it takes less time. You’ll only review key reports. Your bookkeeper handles the daily work for you. - What’s the best first step if I need to hire a bookkeeper?

List what you need help with, set your budget, and talk to a few people. Pick one who feels honest, clear, and easy to work with.