A Simple Guide to Reconciling Undeposited Funds in QuickBooks

Getting started with QuickBooks might seem hard at first, especially when you’re trying to manage your accounts smoothly. One common challenge for new users is managing undeposited funds in QuickBooks during the deposit process. To avoid confusion, it’s important to understand how undeposited funds work in QuickBooks. These funds act like a virtual drawer for your payments until you’re ready to group and deposit them. This guide breaks it down in simple steps to help you track, organize, and reconcile this account without stress.

What are Undeposited Funds in QuickBooks?

When you get paid by a customer, the money does not always go straight to your bank. Instead, it goes into the Undeposited Funds account in QuickBooks. This works as a holding spot for payments you have received but have not yet deposited. It helps you track multiple payments before you make a single bank deposit. Using Undeposited Funds makes sure your bank deposits match the payments in QuickBooks. It also reduces mistakes when handling checks, cash, or online payments.

Why Does QuickBooks Do This?

QuickBooks uses this method to track which payments have been received but not yet taken to the bank. It matches your books with your bank deposits. This is key for clean records.

You received three checks today, but only deposit them in the bank tomorrow. QuickBooks holds these in “undeposited funds” until you group and deposit them together. This helps you match your bank feed and books.

Why QuickBooks Uses the Undeposited Funds Account

The QuickBooks Undeposited Funds account exists to prevent confusion. It allows you to collect multiple payments and record them as one deposit.

Keeps Your Records Clear

It helps avoid mistakes. Without this account, you’d record each payment as a deposit. That won’t match your actual bank deposit.

Helps Reconcile Easier

This system makes it easier to do monthly bank reconciliations. It links grouped payments to a single deposit.

Supports Accurate Reporting

Grouped deposits allow your income and bank balances to reflect real-time numbers. This improves the accuracy of your books and builds trust.

Improves Workflow for Teams

If you have multiple staff handling payments, this account helps you manage deposits. It brings better control and visibility to your process.

Common Issues with Undeposited Funds in QuickBooks

Sometimes, QuickBooks undeposited funds build up when payments are not moved to a bank deposit. If not resolved, this can cause wrong reports and unmatched balances.

Unrecorded Bank Deposits

Some users receive payments but forget to record the deposit. These payments stay in the undeposited funds account and never hit the bank.

Duplicate Payment Entries

You might post the same customer payment twice by mistake. This skews your income and leaves duplicate entries in the system.

Payments Left Undeposited

Some payments sit in the undeposited funds account for weeks or months. This creates confusion and inaccurate income reports.

Incorrect Deposit Grouping

Deposits must match what goes to the bank. Mixing payments that weren’t deposited together leads to mismatches during reconciliation.

Misuse of Bank Accounts

Sometimes users choose the wrong bank account when creating a deposit. This sends funds to the wrong place in QuickBooks.

Manual Journal Entries

Creating manual journal entries to move payments without linking them to a bank deposit can disrupt the whole process.

Reporting and Reconciliation Problems

When undeposited funds are not cleared correctly, income and bank reports show wrong totals. Reconciliation becomes a time-consuming task.

You’ll see payments sitting in the undeposited funds account for weeks or months. Your income reports may also look inflated. Reconciling will also become harder each month.

How to View and Access the Undeposited Funds Account

If you’re unsure whether you have issues with QuickBooks Undeposited Funds, it’s easy to check and view the account.

Steps to Check Undeposited Funds

- Go to the Chart of Accounts.

- Look for “Undeposited Funds.”

- Click “View Register.”

- Look through the list for payments that haven’t been matched.

- Use filters to find old or ungrouped entries.

What to Look For

Check if any payments are sitting there too long. You should only see recent payments that are about to be deposited. If you see payments older than 7–10 days, it may point to an issue.

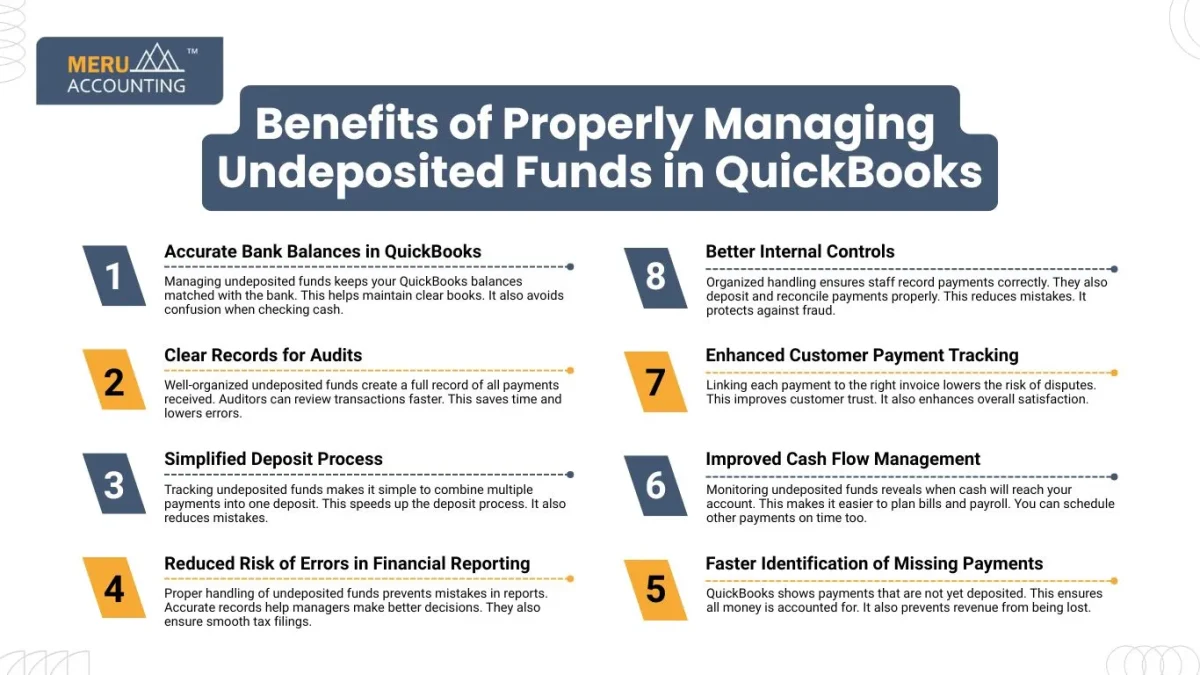

Benefits of Properly Managing Undeposited Funds in QuickBooks

Accurate Bank Balances in QuickBooks

Managing undeposited funds keeps your QuickBooks balances matched with the bank. This helps maintain clear books. It also avoids confusion when checking cash.

Clear Records for Audits

Well-organized undeposited funds create a full record of all payments received. Auditors can review transactions faster. This saves time and lowers errors.

Simplified Deposit Process

Tracking undeposited funds makes it simple to combine multiple payments into one deposit. This speeds up the deposit process. It also reduces mistakes.

Reduced Risk of Errors in Financial Reporting

Proper handling of undeposited funds prevents mistakes in reports. Accurate records help managers make better decisions. They also ensure smooth tax filings.

Faster Identification of Missing Payments

QuickBooks shows payments that are not yet deposited. This ensures all money is accounted for. It also prevents revenue from being lost.

Improved Cash Flow Management

Monitoring undeposited funds reveals when cash will reach your account. This makes it easier to plan bills and payroll. You can schedule other payments on time too.

Enhanced Customer Payment Tracking

Linking each payment to the right invoice lowers the risk of disputes. This improves customer trust. It also enhances overall satisfaction.

Better Internal Controls

Organized handling ensures staff record payments correctly. They also deposit and reconcile payments properly. This reduces mistakes. It protects against fraud.

Steps to Reconcile Undeposited Funds in QuickBooks

Let’s walk through the steps to fix Undeposited Funds in QuickBooks. This process ensures your books match your bank records.

1: Open the Bank Deposit Window

Go to “+ New” and choose “Bank Deposit.”

2: Select Payments to Group

You’ll see a list of payments in the QuickBooks Undeposited Funds account. Select the ones you want to deposit.

3: Choose the Right Bank Account

Pick the bank where the money is going. Double-check that it matches the real bank deposit.

4: Review and Save

Check that your total deposit matches your bank slip. Hit “Save and Close.”

5: Match in Bank Feed

Go to the bank feed. Find the bank deposit. Match it with the entry you just made.

6: Review Your Reports

Run a report on the undeposited funds account. Make sure no old or wrong items are left behind.

How to Clear or Fix Old Transactions in Undeposited Funds

If you’ve left payments in QuickBooks Undeposited Funds for too long, don’t worry. You can still fix it.

1: Create a Bank Deposit

Select old payments and group them in a new deposit. Save it. Match it with your bank statement.

2: Delete Duplicate Payments

If you posted the same payment twice, delete the extra one. Make sure the correct one is matched.

3: Use Journal Entries (Advanced)

If there’s a mismatch you can’t fix, use a journal entry. But be careful, this is best for advanced users or with expert help.

4: Reclassify Transactions

Use the reclassify tool to move wrong entries. You may find payments posted to the wrong income account.

5: Consult a Professional

If you’re unsure, speak to a pro. Fixing undeposited fund issues wrong can break your entire books.

Tips to Prevent Future Undeposited Funds Errors

A few simple habits can help you avoid Undeposited Funds issues in QuickBooks.

1: Deposit Payments Often

Don’t wait too long to deposit payments. Do it daily or weekly.

2: Always Use the “Bank Deposit” Feature

Avoid posting deposits manually. Use the built-in tool to group and post.

3: Check Reports Weekly

Review your undeposited funds account each week. Catch issues early.

4: Match Bank Deposits Right Away

As soon as the money hits your account, match it with the deposit in QuickBooks.

5: Train Your Team

If others post payments, train them to use the right steps. Mistakes are often from bad habits.

6: Add Review Step in Process

Add a checklist or review step each week. This helps you catch unmatched deposits or unposted payments.

7: Keep Records and Receipts

Keep scanned receipts or notes for deposits. If there’s a mismatch later, you’ll know where it came from.

At Meru Accounting, we use QuickBooks every day to manage real accounts. This daily work gives us the skill to help our clients well. We handle undeposited funds, match deposits, fix past mistakes, and set up easy workflows so your books stay correct. By tracking each payment and linking it to the bank, we make sure your accounts are clear, reports are accurate, and your business runs smoothly.

FAQs

- What is the undeposited funds account in QuickBooks?

It’s a temporary holding account for customer payments that haven’t been deposited into a bank yet.

- Why does my QuickBooks show a large undeposited funds balance?

You may have ungrouped or unmatched payments sitting in the account. Review and deposit them properly.

- Can I delete Undeposited Funds in QuickBooks?

You should not delete them unless they are errors or duplicates. Instead, deposit them correctly.

- How often should I reconcile undeposited funds?

Check and reconcile weekly to avoid long-term errors.

- Is it okay to use journal entries to clear undeposited funds?

Only if you’re confident in accounting. Use this for complex corrections or consult a professional.

- How do I match deposits in QuickBooks with my bank statement?

Use the “Bank Deposit” feature, then go to the bank feed and match the deposit.

- What happens if I ignore undeposited funds in QuickBooks?

It can inflate your income, cause reporting issues, and make reconciliation hard.