The Future of AI in Finance Services: Trends and Innovations in 2025 and Beyond

AI is changing the world of finance. Tasks that once took hours can now be done in just minutes. AI in finance services is helping companies work faster, safer, and smarter. From banks to small accounting firms, AI tracks numbers, spots fraud, and even talks to clients. AI does not just speed up work. It also helps reduce mistakes. By reading large data sets, AI can show trends that humans may miss. This is why more companies are investing in AI in financing services.

In 2025 and beyond, this shift is only going to grow. Finance teams will not just use AI tools but also they will rely on them daily.

Key Trends in AI in Finance Services for 2025

Many new trends are shaping AI in finance services this year. Here are some key ones to watch:

1. AI for Real-Time Decisions

With smart tools, firms can make choices quickly. Real-time credit checks, loan approvals, and fraud alerts help speed up services and build trust.

2. Natural Language Processing (NLP)

Smart systems now read and understand human words. They can answer questions, write reports, and even review emails for signs of fraud.

3. AI in Risk Management

Tools scan market data, news, and past events to see the dangers ahead. This helps firms protect assets before problems grow.

4. AI-Powered Chatbots

Bots now handle client support, guide users, and give fast help. They also free up staff time for complex tasks.

5. AI for Compliance

Smart systems track rules and spot gaps in the process. They give alerts if laws change or if reports are off track.

6. Automated Investment Tools

More firms use systems that study markets and suggest trades. These tools help investors stay ahead without guesswork.

7. Predictive Cash Flow Tools

New tools use past data to guess future cash trends. This helps firms plan payments and avoid cash gaps.

AI is no longer a future idea. It is here now, and 2025 will only bring more tools, better speed, and higher trust in these systems.

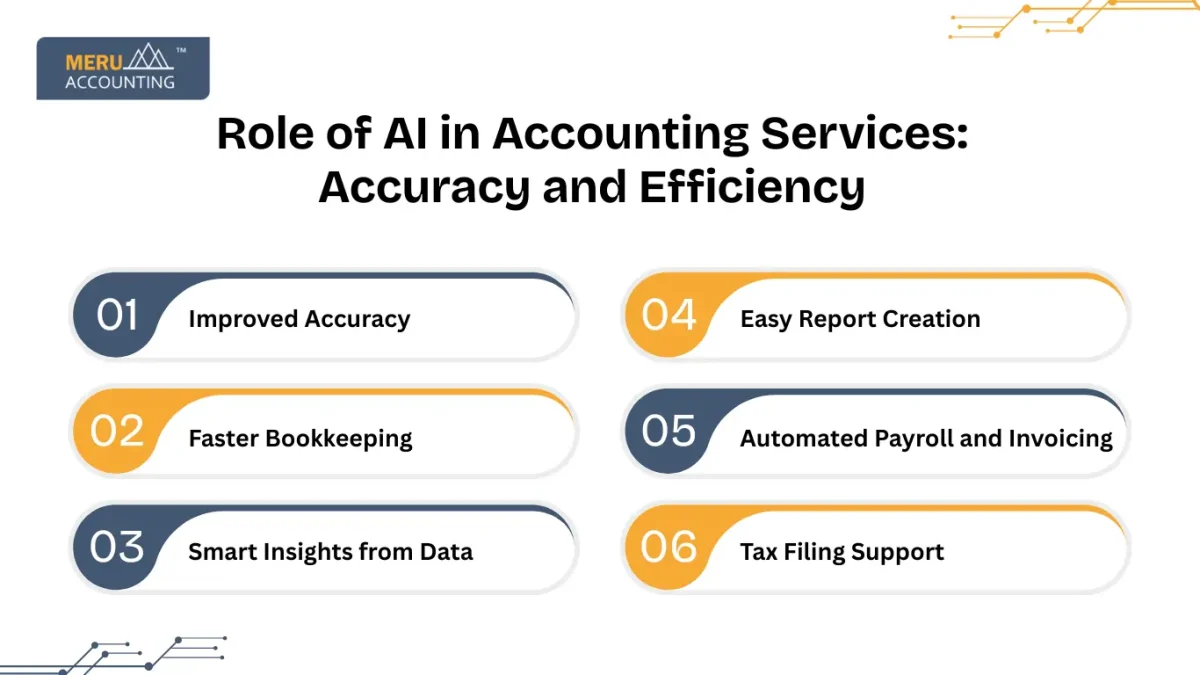

Role of AI in Accounting Services: Accuracy and Efficiency

AI in accounting services is changing the way numbers are handled. Tasks like data entry, invoice scanning, and tax filing are done by smart software.

Smart tools are making accounting fast, clean, and less costly. They take care of tasks while reducing mistakes and saving time.

1. Improved Accuracy

- Manual errors in math or dates can cause losses. Smart systems double-check all inputs and flag issues right away.

2. Faster Bookkeeping

- What once took days now takes minutes. Systems pull data from invoices, banks, and files with just a few clicks.

3. Smart Insights from Data

- Tools find key patterns in records that would take humans days. They point out overspending, tax gaps, or cost-saving ideas.

4. Easy Report Creation

- Tools now build reports, charts, and summaries in simple words. Owners and managers understand results faster and make smarter choices.

5. Automated Payroll and Invoicing

- Firms now use tools to pay staff and send bills on time. This cuts delay, builds trust, and keeps records clean.

6. Tax Filing Support

- Smart systems now help prep and file taxes. They spot changes in tax rules and update reports with ease.

- Firms using AI in accounting services are seeing fewer mistakes and quicker service. They can spend more time advising clients instead of entering numbers.

Challenges and Ethical Concerns in Financial AI Adoption

AI brings many gains, but there are still some problems to fix. These challenges must be handled with care.

1. Data Privacy

AI tools use client data to learn and improve. But this data must be kept safe. Firms must make sure it is not shared or misused.

2. Bias in AI Tools

If an AI tool is trained on biased data, its results can be unfair. This is a real risk in loan approval or fraud checks.

3. Job Changes

AI can do work faster than people. This may change jobs. But it also opens new jobs in AI setup, training, and audit.

4. High Setup Cost

Some AI tools are still costly for small firms. Over time, we expect costs to drop, making it easier for all to join in.

What Lies Ahead in Finance After 2025

The tools we use in finance are changing fast. In the past, finance teams worked with books, files, and slow tools. Now, they use smart systems.

The future of AI in finance services will not just be smart but it will be fully connected, quick, and more helpful than ever. Here’s what we can expect after 2025.

1. Smarter and Safer AI Tools

- As tools grow, they will get better at learning and fixing mistakes. They will spot errors early and stop fraud before it starts. They will also protect user data with new tech like zero-trust systems and blockchain.

2. Self-Improving Systems

- Future tools will teach themselves without extra help. These systems will look at new data, learn from trends, and improve their own rules. This means less manual setup and fewer updates needed.

3. Total System Sync

- Finance, HR, sales, and supply tools will all talk to each other. A single click will show a full view of a company’s money health. This will help leaders make fast, smart choices.

4. Global Finance Made Simple

- Cross-border trade is hard now. But future tools will handle many rules, taxes, and laws in real time. They will support all currencies, languages, and tax codes in one place.

5. Voice and Visual AI

- Typing may not be needed. Future tools will use voice and image inputs. You’ll be able to say, “Show me last month’s cash flow,” or scan a bill and it will post itself in your books.

6. Personalized Help for All Users

- AI will especially serve each user. A store owner may see cost tips, while a bank manager may get fraud alerts. The help will change based on role, task, and history.

7. Wider Use in Small Firms

- Today, some tools are used only by large firms. But by 2027, even a solo shop or a small start-up will have access. Costs will fall, and tools will be easier to use.

8. Real-Time Planning and Forecasting

- Firms will no longer wait till month-end to review data. Future tools will show live cash flow, cost shifts, or tax duties. Teams will act faster and plan better.

- AI in accounting services will also grow with tools that learn from users and improve every week. The shift is not just in tools, but in the way finance is done.

Conclusion

AI in finance services is transforming the way businesses handle money and make decisions. It speeds up work, improves accuracy, and helps firms stay secure. Moving beyond 2025, embracing these smart tools will be essential for companies aiming to grow and stay competitive in a fast-changing market.

FAQ:

- Is AI safe to use in finance?

Yes, when used right. AI helps spot fraud and protect data better than many older systems. - Will AI take over all accounting jobs?

AI does tasks, not judgment. Accountants will still lead in advice, planning, and audits. - How can small firms use AI?

Many cloud-based tools now offer AI features at low cost. They help in bookkeeping, tax, and reports. - What’s the main gain of using AI in accounting services?

Speed and accuracy. It helps do work faster and with fewer mistakes.