Bookkeeping Tips For Small Business – You Can’t Afford to Ignore

Bookkeeping is super important for any business, even small ones. It means keeping track of all the money helps you understand how your business is doing. This helps you understand how your business is doing. When your books are correct, it’s easier to make smart choices, plan a budget, and file taxes. These small business bookkeeping tips help owners stay organized and avoid mistakes. Many businesses now use experts or outsource bookkeeping so it’s done right.

Getting help from professional services can give you better results. These small business bookkeeping tips are easy to follow and can help your business grow strong. Always remember, good bookkeeping is the key to better money management.

Why Small Business Bookkeeping is Important?

To understand your business in and out, an accurate and proper book of accounts helps you understand. It shows if you are making a profit and if there are any problems. But not every local bookkeeper knows how to do this job well. Some may not give you a solution that fits your business.

Small business owners choose outsourced bookkeeping services for their business. When you outsource your bookkeeping to experts like us, you get good results at a better price. Our team understands how to manage small business bookkeeping in the right way.

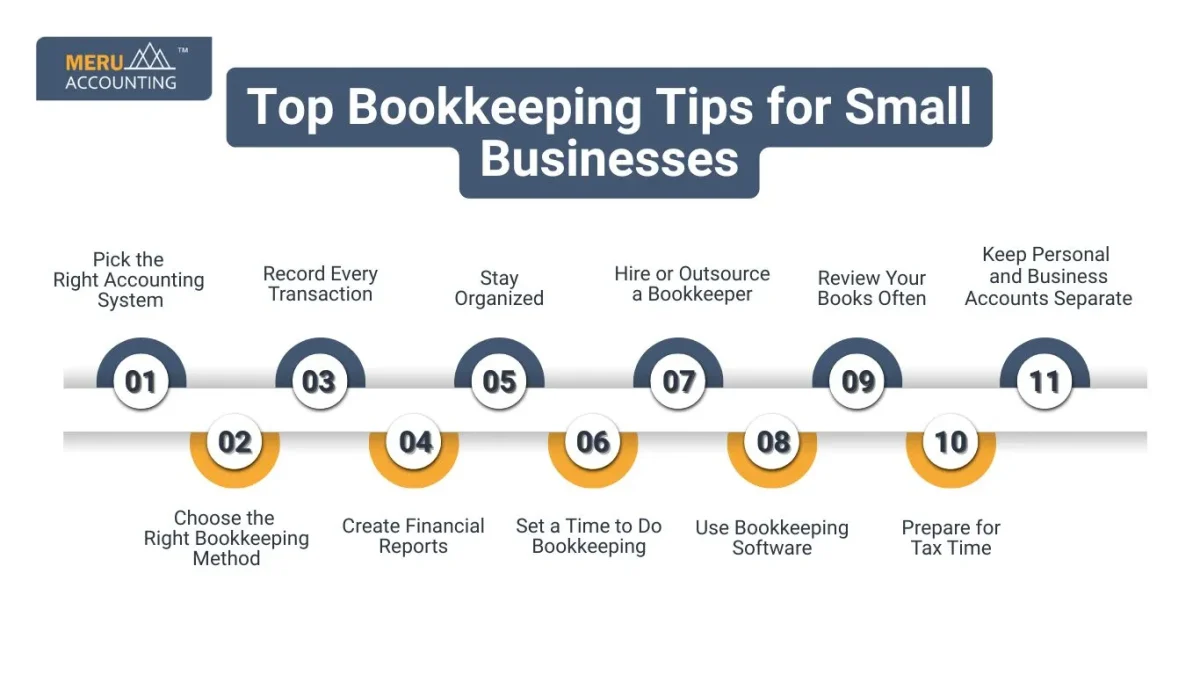

Top Bookkeeping Tips for Small Businesses

Here are some simple but powerful bookkeeping tips to help your small business:

1. Pick the Right Accounting System

There are two main ways to keep track of money in a business:

- Cash accounting: You write down income and expenses only when you get or spend the money. This way is easy and works well for small or new businesses.

- Accrual accounting: You write down income and expenses when they happen, even if no money has been paid yet. This way is better for big businesses and gives a more complete view of your finances.

2. Choose the Right Bookkeeping Method

There are two types of bookkeeping methods:

- Single-entry bookkeeping: You record each transaction only once. It’s simple but may not catch all errors.

- Double-entry bookkeeping: Every transaction has two sides—a debit and a credit. It helps keep things balanced and gives more accurate results.

Double-entry is more advanced and usually better for most small businesses.

3. Record Every Transaction

Every time you spend or earn money, it should be recorded. This is the heart of small business bookkeeping. If you forget to write something down or record it in the wrong place, your numbers won’t match. This can cause big problems later.

4. Create Financial Reports

Bookkeeping tips are not just about writing down numbers. You have to make the report to keep the data in record. These reports help you understand your finances:

- Balance Sheet: Shows what your business owns and owes.

- Profit and Loss Statement: It shows the amount your business made and spent over time.

These reports help you make smart choices and show how your business is growing.

5. Stay Organized

Always keep your receipts, bills, and invoices in one place. This helps you during tax season or when you need to check something later. Organized books mean less stress and better control.

6. Set a Time to Do Bookkeeping

Don’t wait till the end of the year to look at your books. Do it every week or every month. Set a reminder to update your books on a regular basis. This way, you won’t miss anything.

7. Keep Personal and Business Accounts Separate

Many new business owners mix personal and business money. This is a bad idea. Always have a separate bank account and credit card for your business. By this, you can track business spending easily and keep your books clean.

8. Use Bookkeeping Software

There are many tools like QuickBooks, Xero, and others that make small business bookkeeping easier. They can track your sales and expenses. It even helps you make reports, which helps you avoid mistakes.

9. Hire or Outsource a Bookkeeper

You can hire an expert if you don’t know much about bookkeeping. Outsourcing your bookkeeping to professionals gives you more time to focus on your business. You’ll also get better results and fewer mistakes.

10. Prepare for Tax Time

Taxes can be scary if you’re not ready. Good bookkeeping makes tax season easier. To file taxes on time and avoid penalties you should keep the financial records ready.

11. Review Your Books Often

Look at your financial reports every month. Ask questions like:

- Are we making a profit?

- Are our expenses too high?

- Can we save money somewhere?

Reviewing your books helps you spot problems early and fix them before they grow.

Challenges in Small Business Bookkeeping

Not Recording Transactions Daily

Many small businesses forget to record sales or expenses every day. This can lead to missing or wrong numbers in the [small business bookkeeping] records.

Mixing Personal and Business Finances

Some people use the same bank account for personal and business money. This makes it hard to follow good [bookkeeping tips] and stay organized.

Choosing the Wrong Accounting System

Picking between cash or accrual accounting is tricky. It is the wrong choice that can make the process of small business bookkeeping confusing.

Not Using Bookkeeping Software

Trying to do everything on paper or in a notebook is slow and can cause mistakes. Without tools, following [bookkeeping tips] becomes harder.

Falling Behind on Bookkeeping Tasks

Business owners often get busy and skip bookkeeping work. This makes it hard to know how the business is doing or to get ready for taxes.

Missing Tax Deadlines

If your books are not up to date, you might miss tax dates. This can cause stress or lead to paying penalties.

Lack of Bookkeeping Knowledge

Some local bookkeepers or business owners don’t have the training or skills to do [small business bookkeeping] properly. This affects the quality of your financial records.

If you want to grow your business, then small business bookkeeping is very important. It helps you understand your finances. With the right bookkeeping tips, you can keep your records neat, prepare for taxes, and make better decisions. Many small businesses struggle because they don’t have the time or skills to do proper bookkeeping. That’s why small business bookkeeping should not be ignored.

If you want expert help, Meru Accounting is a great option. We offer affordable and professional bookkeeping services made just for your needs. Using these small business bookkeeping tips and working with a good team like ours can really help your business do well.

FAQs

- What is bookkeeping in a small business?

Bookkeeping means writing down all the money your business makes and spends. It helps you know if you are earning a profit or losing money. - Why is bookkeeping important for small businesses?

Bookkeeping helps small business owners keep track of money, plan budgets, pay taxes on time, and make smart choices for the future. - Can I do bookkeeping by myself?

Yes, you can! But it takes time and care. If it feels hard, you can ask a professional bookkeeper to help you. - What is the best way to keep my books organized?

Write down every sale and expense. Keep your receipts safe. Use a notebook, a computer spreadsheet, or accounting software to help you.