Tax filing can be hard for any business. Small mistakes or missed deadlines can lead to fines, fees, or audits. Many firms try to do taxes in-house. But this often brings more mistakes and risk. A smart choice is to outsource tax return preparation. Experts handle your taxes with care. They follow a clear tax return process, check every step, and meet deadlines. This cuts mistakes, saves time, and keeps your business safe.

Outsourcing also lets owners focus on growth and daily work instead of tax forms. In this blog, we will show why outsourcing tax return preparation works, how it cuts errors, and how it strengthens the tax return process for any business.

What You Will Learn From This Blog

- What it means to outsource tax return preparation

- Common errors and risks of in-house tax work

- How outsourcing cuts mistakes

- How the tax return process works

- How outsourced teams improve the tax return process

- Compliance benefits of outsourcing

- Which firms should outsource tax return preparation

By the end of this blog, you will see how outsourcing can save time, cut errors, and make tax season easier and safer.

What Does It Mean to Outsource Tax Return Preparation?

To outsource tax return preparation means hiring an outside firm or a tax expert to handle your taxes. You do not rely on internal staff or try to do everything yourself.

The outside team handles the full tax return process. They collect financial data, check your books, prepare returns, check rules, and file on time. They make sure calculations are correct and that deductions, credits, and breaks are applied.

Outsourced teams work with many clients and industries. This gives them broad knowledge of common mistakes and special rules. They know how to manage a full tax return process efficiently.

Outsourcing does not mean losing control. You still review and approve filings. You just let experts do the hard work. This makes tax time easier and safer for owners and staff.

Trusted by hundreds of businesses, Meru Accounting makes tax return preparation simple and error-free. See how we can help you reduce mistakes, stay compliant, and streamline your tax process. Get your free consultation with one of our tax preparation experts.

Common Errors and Compliance Risks in In-House Tax Preparation

Many firms try to do taxes in-house to save money. This can work for very small firms, but it carries risk. In-house tax preparation often leads to repeated errors and compliance issues.

Calculation Errors

Manual math and spreadsheets can cause mistakes. One wrong number can trigger fines or audits. Without a clear tax return process, errors can go unnoticed.

Missed Deadlines

Staff are busy. Tax dates can slip. Late filings cause fines, interest, or legal issues.

Outdated Knowledge

Tax rules change often. Staff may miss updates. This can cause wrong filings, missed deductions, or lost tax savings.

Poor Records

Proper records are key. Missing forms or wrong entries weaken the tax return process. Poor records also increase audit risk.

Audit Exposure

Errors or missing information attract tax authorities. In-house prep without checks increases audit risk.

These risks show why many firms now outsource tax return preparation. Professionals reduce errors and ensure compliance.

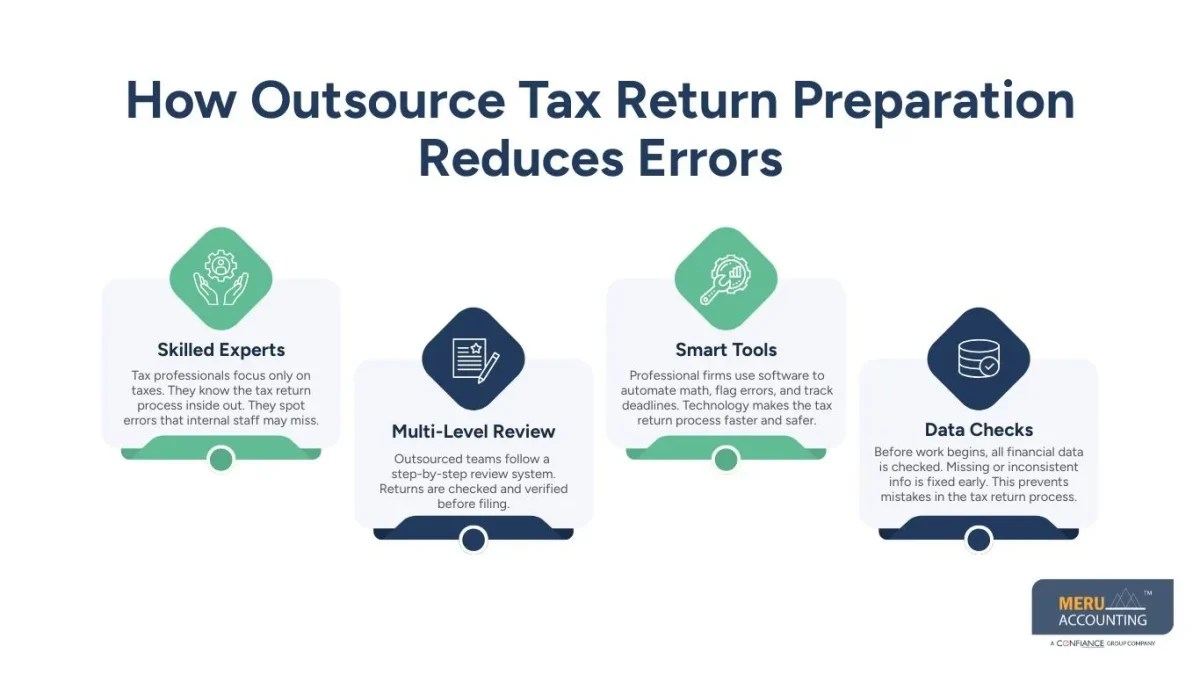

How Outsource Tax Return Preparation Reduces Errors

Here’s how errors are reduced when you outsource tax return preparation, making it more accurate and reliable:

Skilled Experts

Tax professionals focus only on taxes. They know the tax return process inside out. They spot errors that internal staff may miss.

Multi-Level Review

Outsourced teams follow a step-by-step review system. Returns are checked and verified before filing. This ensures errors are caught early.

Smart Tools

Professional firms use software to automate math, flag errors, and track deadlines. Technology makes the tax return process faster and safer.

Data Checks

Before work begins, all financial data is checked. Missing or inconsistent info is fixed early. This prevents mistakes in the tax return process.

Outsourcing gives firms accuracy, peace of mind, and fewer risks.

Understanding the Tax Return Process

The tax return process is more than filling forms. It has steps that must be done right.

Step 1: Data Collection

Gather income, costs, receipts, and statements. Missing info causes errors in the tax return process.

Step 2: Classification

Sort transactions and apply rules. Mistakes here can affect tax amounts.

Step 3: Tax Calculation

Compute taxable income, deductions, and credits. Errors here may cost money.

Step 4: Review

Check numbers and documents carefully.

Step 5: Filing and Record Keeping

File forms with tax authorities. Keep records for future use and audits.

A weak tax return process can cause errors and risk. Outsourced teams follow each step carefully.

How Outsourced Teams Improve the Tax Return Process

When you outsource tax return preparation, you improve the tax return process in many ways:

Clear Workflows

Teams follow a step-by-step plan. Every step is logged and checked. Nothing is skipped.

Clear Communication

Teams ask for data in a clear format. Fewer papers get lost.

On Time

Deadlines are tracked closely. Returns are filed on time.

Easy to Scale

As your firm grows, the tax return process remains smooth. Outsourcing handles extra work without hiring new staff.

With outsourcing, tax preparation is predictable, reliable, and low-risk.

Compliance Benefits of Outsourcing Tax Return Preparation

Compliance is a major reason to outsource. Here are some compliance benefits you get when you outsource tax return preparation:

Up-to-Date Rules

Outsourced teams track all changes in laws. The tax return process remains compliant.

Reduced Penalties

Correct and timely filings cut fines and fees.

Audit Ready

Records and steps are documented. Audits become easier.

Standard Reporting

Reports follow consistent rules. This makes compliance simple.

Outsourcing ensures compliance is proactive, not reactive.

Who Should Outsource Tax Return Preparation?

Outsourcing works for all sizes of firms.

- Small and Medium Firms: Get expert help without extra staff

- Growing Firms: Handle more transactions safely

- Accounting Firms: Manage seasonal work and deadlines

- Startups: Focus on growth while experts handle taxes

Any business that wants fewer mistakes, smoother workflow, and safer compliance should outsource.

Meru Accounting’s Outsourced Tax Return Preparation Services

Meru Accounting helps firms outsource tax return preparation. Our outsourced tax return preparation services reduce errors, strengthen compliance, and simplify the tax return process.

What We Offer

- Complete outsourced tax preparation

- Step-by-step tax return process

- Skilled staff managing returns

- Multi-level checks to cut errors

- On-time filing and support

Why Choose Meru Accounting?

Every firm is different. We adapt the tax return process to your size and industry. Outsourcing with Meru Accounting saves time, cuts risk, and helps your firm grow. We have been doing tax return preparation for almost every type of business. We are also aware of your local tax laws as well as international laws. Hence, when you outsource tax return preparation to us, you can rest assured about everything.

Outsourcing tax return preparation saves time, cuts stress, and protects your business. Contact us now to get a customized outsourcing plan for your business.

Key Takeaways

- In-house prep can bring mistakes and risk

- Outsourcing cuts errors and improves accuracy

- A clear tax return process keeps work smooth

- Skilled staff, software, and checks ensure reliability

- Compliance improves and audits are easier

- Meru Accounting provides complete outsourced tax return services

FAQs

Yes. At Meru Accounting, we keep data secure and ensure returns are correct.

We follow a clear tax return process and check work step by step.

No. You can review and approve returns once we have made them. At Meru Accounting, we let only experts handle the work.

Yes. Outsourcing saves time, cuts errors, and avoids extra hires.

Contact us. We will create a simple tax return process and manage your filings.