Difference Between Production Accounting and Cost Accounting

Manufacturing runs on movement, effort, and smart control of resources. Raw goods enter the unit, machines shape them, and labor adds value at every step. Behind this visible flow, there’s a system that records, tracks, and guides every cost and output detail. This system is shaped by two vital methods, production accounting and cost accounting.

Many business owners believe these two terms carry the same meaning. In reality, they serve different roles that support separate yet connected areas of management. Production accounting focuses on what happens inside the production process and how efficiently physical resources are used. Cost accounting focuses on how much money is spent, how those expenses affect profit, and where financial improvements can be made.

Understanding the difference between production accounting and cost accounting gives businesses clearer control over operations, spending, and long term planning. It also helps firms avoid confusion in reporting, prevent misallocation of funds, and improve coordination between finance and production teams. When these systems are clearly defined, decision making becomes more accurate and performance tracking becomes more meaningful.

This blog explains both concepts in detail and shows how they support manufacturing growth when used together.

What Is Production Accounting?

Production accounting is the process of recording and managing data linked to manufacturing activity. It tracks the movement of raw materials, labor effort, machine usage, and production output through each stage of the manufacturing cycle. Every step of conversion from raw input to finished output is observed and recorded.

The core purpose of production accounting is to provide a clear view of daily production performance. It helps management know what is being produced, how resources are used, and whether actual output matches planned goals. It also allows businesses to track bottlenecks, identify slow production lines, and measure productivity in real terms.

By maintaining detailed production records, this system supports better scheduling, smoother workflow, and consistent quality control. It ensures that production decisions are based on real operational data rather than estimation.

Key Components of Production Accounting

Material

Material refers to all raw stock used in the production process. This includes both primary resources and supporting items required to complete the product. It tracks how much material enters production, how much is consumed at each stage, and how much remains unused or wasted.

This component helps highlight excess usage, shortage risks, and inefficient storage practices. Accurate material tracking prevents over-ordering and ensures steady availability of stock without blocking capital unnecessarily.

Labor

Labor represents the workforce involved in production. It includes direct production staff and workers who support the manufacturing flow. Labor data records time spent, output achieved, and efficiency levels across shifts.

This information helps management understand staff performance, identify training needs, and plan better workforce allocation. It also supports fair wage distribution and productivity comparison across departments.

Overheads

Overheads are indirect costs such as electricity, machine repair, factory rent, and utilities. These costs support production but are not linked to one specific unit. Production accounting tracks these expenses to understand their impact on daily operations.

By monitoring overhead patterns, businesses can control areas of high consumption and adjust usage without disturbing production quality.

Work in Progress

Work in progress refers to goods that are partially completed. These products are still moving through production and carry intermediate value. Tracking WIP helps determine how much capital is locked in semi-finished items and where delays occur.

Proper WIP tracking ensures that incomplete goods do not accumulate unnecessarily and that production lines flow without interruption.

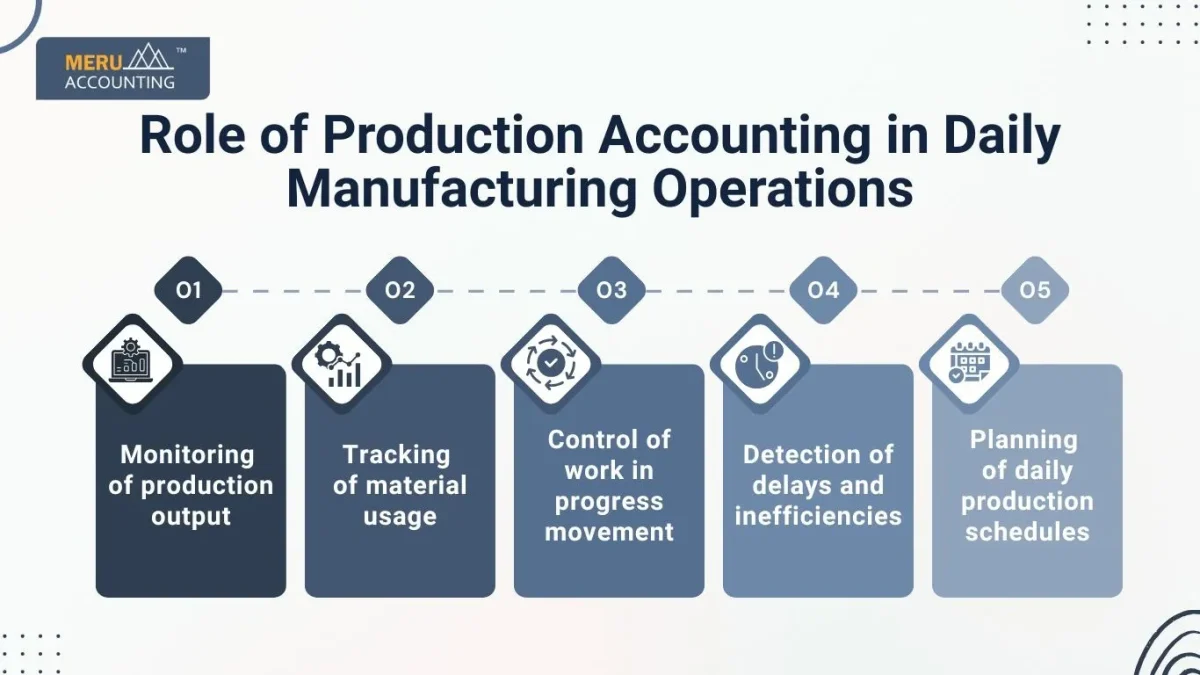

Role of Production Accounting in Daily Manufacturing Operations

Production accounting plays a key role in everyday factory activity. It supports:

- Monitoring of production output

- Tracking of material usage

- Control of work in progress movement

- Detection of delays and inefficiencies

- Planning of daily production schedules

It creates visibility into actual shop floor performance and enables supervisors to act quickly when performance deviates from plan. For example, if output drops or waste rises, the system highlights the issue promptly. This allows for immediate corrective steps instead of delayed reaction.

This system ensures that production stays balanced and smooth across all departments while supporting stable delivery timelines and resource optimization.

Impact of using Production Accounting Software

Production accounting software improves visibility and accuracy. It captures real time data and presents it in clear and structured reports. Manual entry is reduced and process automation increases speed and reliability.

Benefits include:

- Live production tracking

- Reduced manual effort

- Faster reporting

- Improved planning clarity

- Better control over inventory flow

It also helps integrate different units such as inventory, procurement, and finance into one unified workflow. This makes production supervision easier, more transparent, and more responsive to change.

What Is Cost Accounting?

Cost accounting is the process of identifying, measuring, analyzing, and controlling business costs. It determines how much it truly costs to produce goods and supports financial planning across all business layers.

The main objective of cost accounting is to guide pricing strategies, cost reduction, and profit planning. It helps businesses understand where money is spent, where savings can be created, and which products contribute most to profit.

It goes beyond record keeping and focuses on improving financial efficiency, supporting sustainable pricing models, and assisting management in building long term cost strategies.

Key Focus Areas of Cost Accounting

Cost Allocation

Cost allocation distributes indirect expenses across departments or product lines to reflect true cost contribution. This ensures accurate pricing and realistic profit calculation for each product.

It also helps identify departments with high cost exposure and directs attention to areas needing financial correction.

Cost Control

Cost control focuses on managing expenses and keeping them within planned limits. It helps set cost benchmarks and track deviations in real time.

This process promotes spending discipline and protects business margins from unnecessary erosion.

Variance Analysis

Variance analysis measures the difference between expected costs and actual costs. It helps identify gaps and improve future planning. By explaining why deviation occurred, businesses can refine budgeting and operational strategy.

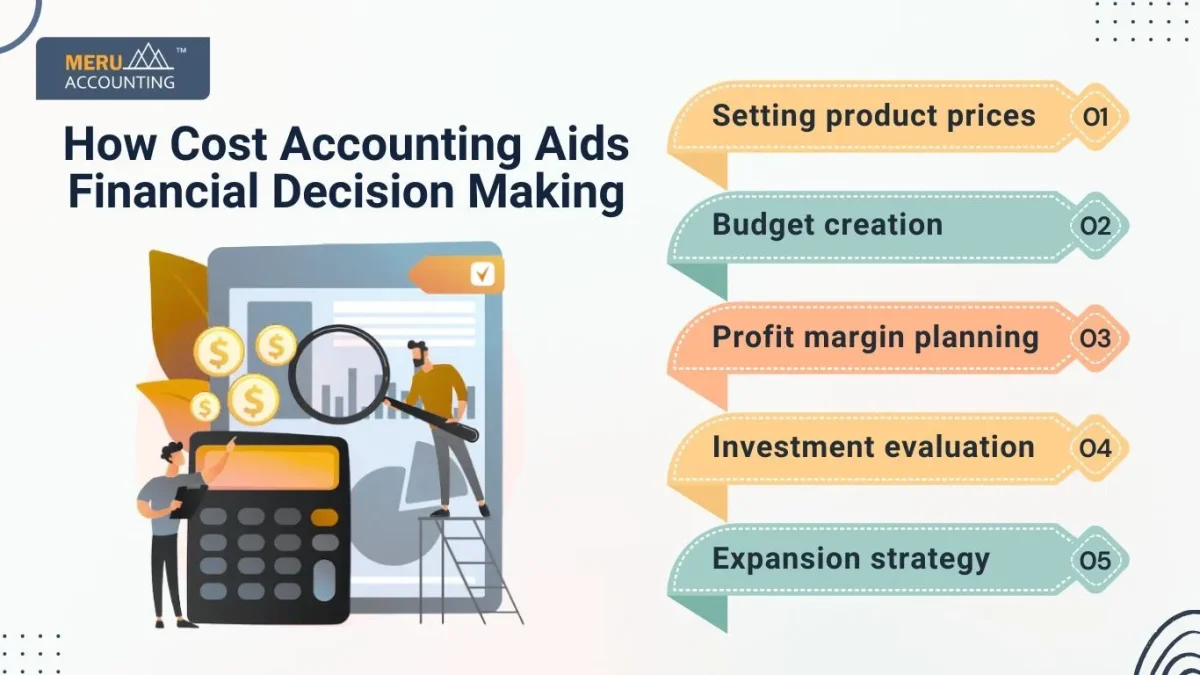

How Cost Accounting Aids Financial Decision Making

Cost accounting supports key decisions such as:

- Setting product prices

- Budget creation

- Profit margin planning

- Investment evaluation

- Expansion strategy

It enables management to choose suppliers wisely, decide make or buy options, and revise pricing based on true cost patterns. This system strengthens financial stability and ensures that strategic decisions are data backed rather than assumption based.

Key Differences Between Production Accounting and Cost Accounting

Scope and Process Comparison

Production accounting focuses on physical production operations. It records how goods move through the manufacturing stages and how efficiently each stage performs.

Cost accounting deals with the financial side of costs. It covers production expenses along with administrative and selling costs, offering a broader business view.

Reporting Focus

Production accounting reports focus on:

- Output levels

- Material consumption

- Work in progress status

- Production efficiency

Cost accounting reports focus on:

- Cost sheets

- Profit analysis

- Budget variance

- Expense trends

Each report type supports a distinct managerial function while contributing to overall business insight.

Use of Data

Production accounting uses operational data such as machine time and labor hours.

Cost accounting uses financial data that converts operational figures into monetary value and evaluates their business impact.

Frequency and Tracking Method

Production accounting works on a daily or continuous basis and supports immediate operational decisions.

Cost accounting follows periodic cycles such as monthly or quarterly reviews and supports financial analysis and planning.

Practical Examples

- Tracking daily unit production uses production accounting

- Setting selling price relies on cost accounting

- Monitoring raw material use involves production accounting

- Evaluating profit margins uses cost accounting

These examples show how each system serves a unique purpose while supporting business continuity.

Where Production Accounting and Cost Accounting Work Together

Sharing Data for Accurate Costing

Production figures feed into cost accounting for realistic costing and pricing accuracy. Without precise production data, cost results cannot reflect real business performance.

Supporting Production Planning

When cost trends align with production data, businesses can plan workflow more effectively and balance output with budget limits.

Reducing Waste and Cost Overruns

Early identification of material misuse or rising costs prevents losses from growing and strengthens cost efficiency.

Improving Financial and Operational Alignment

Finance teams and production teams work together with shared reports and unified goals, improving coordination and decision clarity.

Why Understanding This Difference Matters

A manufacturing business that understands both systems gains:

- Strong cost control

- Improved operational efficiency

- Better resource planning

- Increased profit clarity

- Long term stability

Balanced use of both systems creates a steady foundation for growth and performance sustainability.

Meru Accounting Production and Cost Accounting Services

Meru Accounting offers expert production accounting and cost accounting services tailored to manufacturing businesses. Our approach ensures accurate tracking of production flow, structured work in progress recording, and clear cost analysis that supports sound financial decisions. We help reduce wastage, control rising expenses, and improve profit transparency. With Meru Accounting, businesses receive reliable data, improved clarity, and steady operational support that strengthens long term success and builds consistent financial confidence.

If your manufacturing unit needs clearer production tracking and smarter cost control, Meru Accounting is here to help. Connect with our team today to strengthen your production accounting and cost accounting systems and achieve better financial clarity. Let us support your path toward stable growth and improved profitability.

FAQs

- What is production accounting in simple terms?

Production accounting tracks all materials, labor, and expenses used during the making of goods. It shows what happens on the shop floor each day. - What is cost accounting mainly used for?

Cost accounting is used to calculate total product cost and analyze spending to improve profit and control waste. - How are production accounting and cost accounting different?

Production accounting focuses on daily operational data, while cost accounting focuses on financial analysis and cost control. - Can both systems work together?

Yes, both systems share data and support each other for accurate costing and smooth production flow. - Does production accounting help reduce waste?

Yes, it highlights excess material use and process gaps, which helps reduce waste and loss. - Is cost accounting useful for pricing products?

Yes, it helps set correct prices by calculating the true cost of making each product. - What data does production accounting capture?

It captures material usage, labor hours, machine output, and work-in-progress details. - Does cost accounting include overhead expenses?

Yes, it includes indirect costs like rent, power, maintenance, and admin expenses. - Is production accounting only for large industries?

No, it suits both small and large manufacturing units that want better control over production data. - How often is production data updated?

It is updated daily or in real time, based on shop floor activity. - How often is cost analysis performed?

Cost analysis is usually done monthly, quarterly, or as needed for planning. - Can software support both production and cost accounting?

Yes, modern accounting software can handle both systems in one integrated platform. - Does cost accounting help in budgeting?

Yes, it provides data to plan future budgets and manage expenses wisely. - What is work-in-progress (WIP)?

WIP refers to goods that are halfway through the production process but not yet finished. - What is variance analysis?

Variance analysis compares planned costs with actual costs to find gaps and improve control. - Can these systems improve overall manufacturing efficiency?

Yes, together they streamline operations and cut unnecessary spending. - Does Meru Accounting handle both production and cost accounting services?

Yes, Meru Accounting offers complete support for both production tracking and cost management needs. - Why is it important to understand the difference between the two?

It helps businesses choose the right system for daily operations and financial planning. - Which system supports daily production decisions?

Production accounting supports daily decisions related to output and resource use. - Which system guides long-term financial planning?

Cost accounting guides long-term planning through cost analysis and profit forecasting.