Case Study: Success Stories in Outsourced Bookkeeping for CPAs

Outsourced bookkeeping for CPAs has grown in use. Many CPA firms now hire outside teams to save time, cut costs, and serve clients better. This blog shares real success stories from firms that used outsourced bookkeeping and saw strong results. You will learn how it can help you work smart and grow your firm.

By outsourcing bookkeeping, CPA firms can take on more clients without hiring more staff. This lets firms grow and meet deadlines with less stress. Many also say their teams have a better work-life balance since routine tasks are handled by experts outside the firm.

What Is Outsourced Bookkeeping for CPAs?

Outsourced bookkeeping means hiring a team outside your firm to handle bookkeeping work. CPAs then focus on tax, audits, and advice, while experts keep financial records up to date. This helps firms give better service to clients.

This method brings in skilled teams and new tech without the cost of training or software. Outsourced bookkeeping teams often use cloud tools for real-time work, making it easy for CPAs and clients to see correct data anytime.

Why CPAs Choose Outsourced Bookkeeping

- Save Time: Outsourcing cuts time spent on data entry.

- Cut Costs: No need to hire full-time bookkeepers.

- Improve Accuracy: Experts reduce mistakes.

- Grow Easily: Scale up without hiring more staff.

- Focus on Core Work: CPAs spend time on high-value tasks.

Case Studies:

Case Study 1: Small CPA Firm Doubles Client Base

A small CPA firm in Texas had trouble managing bookkeeping for 50 clients. They switched to outsourced bookkeeping for CPAs.

What happened?

- The outsourced team handled bookkeeping well.

- CPAs had time for tax planning.

- Client reports came faster.

- In one year, clients doubled to 100.

This shows that outsourced bookkeeping can help firms grow without adding staff.

Case Study 2: Mid-Sized Firm Cuts Overhead by 30%

A mid-sized firm with 200 clients spent a lot on bookkeeping salaries. They moved to outsourced bookkeeping for CPAs.

Results:

- Staff costs fell 30%.

- Expenses became steadier.

- Bookkeeping errors dropped.

- CPAs had more time for clients.

This proves that outsourcing saves money and raises quality.

Case Study 3: Large Firm Speeds Up Reporting

A big CPA firm with 500+ clients wanted faster reports. They hired an outsourced bookkeeping service.

Outcomes:

- Monthly reports came faster.

- Real-time updates were available.

- Clients trusted the firm more.

- CPAs focused on complex jobs.

Outsourced bookkeeping boosted speed and client trust.

Case Study 4: Startup CPA Firm Cuts Staff Training Time

A startup CPA firm with limited staff struggled with training new bookkeepers. They chose outsourced bookkeeping for CPAs.

What happened?

- Outsourced experts handled bookkeeping without training delays.

- The firm saved time and money on hiring.

- CPAs spent more time on client growth strategies.

- Client satisfaction improved with timely financial reports.

This shows that outsourcing helps new firms save time and costs on staff training.

Case Study 5: CPA Firm Improves Cash Flow Management

A CPA firm in New York faced challenges managing clients’ cash flow due to late bookkeeping updates. They switched to outsourced bookkeeping.

Results:

- Bookkeeping was updated daily.

- Cash flow reports became timely and accurate.

- Clients made better financial decisions.

- CPAs strengthened client relationships.

Outsourced bookkeeping helped improve client cash flow and trust.

How Outsourced Bookkeeping Works for CPAs

- Assess Needs: Decide which bookkeeping tasks to outsource.

- Pick Provider: Choose a trusted bookkeeping company.

- Integrate Systems: Connect bookkeeping software.

- Outsource Tasks: Bookkeepers do data entry, bank checks, and payroll.

- CPA Review: CPAs check reports and advise clients.

This keeps the workflow smooth and smart.

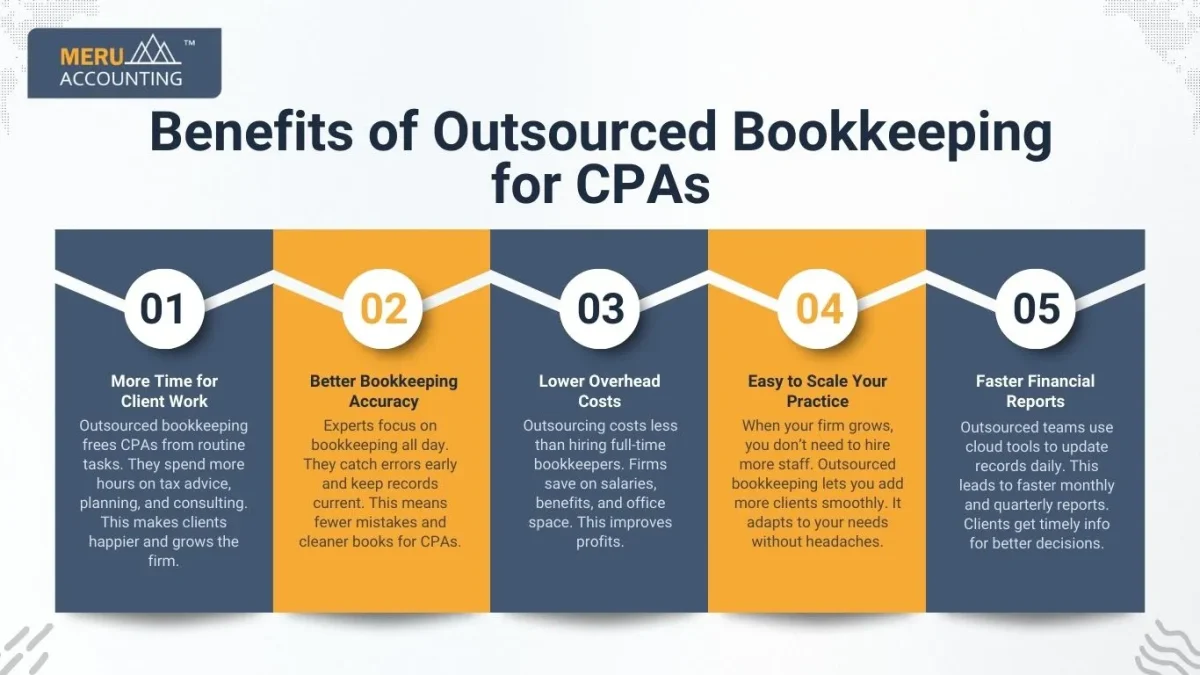

Benefits of Outsourced Bookkeeping for CPAs

How to Choose the Right Outsourced Bookkeeping Provider

Look for Relevant Experience

Choose firms that know CPA needs and have served similar clients.

Skilled providers handle your work well and on time.

Check Data Security Measures

Make sure they use strong systems to protect your data.

Keeping your info safe is very important.

Prefer Tech-Savvy Providers

Pick partners who use current accounting software.

New tools help boost speed and accuracy.

Ensure Good Communication

Work with teams who are easy to reach and quick to reply.

Clear talk stops errors and delays.

Find a Flexible Partner

Choose providers who can adjust as your firm grows.

They help you add or cut services as needed.

Verify Compliance Knowledge

Check that they know tax laws and accounting rules well.

This lowers the chance of fines or mistakes.

Ask for Clear Pricing

Get clear fees so you avoid surprises.

Knowing costs helps you plan your budget.

How to Integrate Outsourced Bookkeeping Smoothly

Use Cloud Accounting Tools

Cloud systems let you and your partner share data fast.

This helps teamwork and keeps info up to date.

Set Clear Goals and Deadlines

State tasks and due dates in clear terms.

This keeps all work on schedule.

Schedule Regular Check-Ins

Have weekly or biweekly calls to review work.

Regular talks help fix problems fast.

Share Feedback Early and Often

Give honest and quick feedback.

This keeps work moving in the right way.

Train Your Staff on New Processes

Help your team learn new steps and tools.

Good training makes teamwork smooth.

Keep Documentation Updated

Keep clear and current notes on steps and contacts.

Good records speed up work and cut errors.

Build Trust and Respect

Treat your outsourced team as part of your firm.

Strong bonds help get better results.

Common Challenges and How to Fix Them

Challenge | How to Fix It |

Data Security Fears | Pick providers with good security. |

Losing Control | Keep reviewing work often. |

Tech Problems | Choose compatible software. |

Poor Communication | Hold regular meetings. |

When Should CPAs Use Outsourced Bookkeeping?

Managing Large Bookkeeping Tasks

Daily bookkeeping takes up too much time. Outsourcing lets CPAs focus on more important work while keeping records up to date.

Cutting Down on Costs

Hiring a full bookkeeping team is costly. Outsourced help offers skilled support at a lower price.

Handling Fast Client Growth

A quick rise in clients can stretch resources. Outsourcing helps CPAs serve more clients well.

Making Sure Books Are Accurate

Mistakes can cause big problems. Expert teams keep books precise and follow all rules.

Freeing Up Time for Advice

Outsourcing lets CPAs spend more time giving advice and planning for clients.

Managing Busy Seasons

Tax time and audits mean more work. Outsourced teams offer help when it’s needed most.

Filling Skill Gaps

Some work needs special skills or software. Outsourcing brings in experts without hiring full staff.

Growing Along with Your Firm

Outsourced services can grow as your firm grows.

Extra Tips to Get the Most from Outsourced Bookkeeping

Common Services Included in Outsourced Bookkeeping for CPAs

Outsourced bookkeeping covers many key services, such as:

- Data Entry: Recording all financial transactions correctly. This keeps your books current and correct.

- Bank Reconciliation: Matching bank statements with your records. It helps find errors and stop fraud.

- Accounts Payable and Receivable: Managing bills and client payments. This keeps cash flow smooth and steady.

- Payroll Processing: Calculating and paying employee wages on time. It meets legal rules and keeps staff happy.

- Financial Reporting: Preparing monthly, quarterly, or yearly reports. Reports help track growth and guide choices.

- Tax Preparation Support: Organizing data to simplify tax filing. Good records mean fewer tax issues and faster filing.

These services help CPAs save time and avoid mistakes.

Outsourced bookkeeping for CPAs has many benefits. As these success stories show, it saves time, cuts costs, and improves client service. If you want your CPA firm to grow smartly, consider outsourcing bookkeeping today. At Meru Accounting, we offer skilled outsourced bookkeeping for CPAs. Our team uses new technology to keep your books correct and reports on time. We keep your data safe and secure. When you work with Meru Accounting, you get steady help to grow your firm while you focus on serving your clients well.

FAQs

Q1: What bookkeeping tasks do CPAs outsource?

Data entry, bank reconciliations, payroll, and reports.

Q2: Is outsourcing bookkeeping safe?

Yes, with providers who follow strong data security.

Q3: How much can I save by outsourcing?

Usually, 20% to 40% of staff costs.

Q4: Will outsourcing hurt client service?

No, it often improves it by freeing CPAs.

Q5: How fast can outsourcing start?

Usually within 2 to 4 weeks.

Q6: Does outsourcing help in tax season?

Yes, it ensures clean books for filing.

Q7: Do CPAs lose control by outsourcing?

No, CPAs always review and approve work.