Small business owners often struggle to handle money well. Tracking bills, pay, and sales takes much time. This is why many hire a bookkeeper for small business. They keep records right and cut stress.

A good bookkeeper saves time, stops errors, and gives clear reports. When used with good bookkeeping software for small business, work is much easier. Right records help plan budgets, track growth, and pay taxes. Bookkeepers give tips that sheets alone cannot show.

Many owners spend hours on manual bookkeeping, which is why they hire a bookkeeper for small business. Mistakes happen when tired or in a rush. Hiring a bookkeeper keeps work correct and simple.

Bookkeepers also help owners make smart choices. They show where money goes and which costs are high. This helps owners plan for growth and save cash.

Also, having a bookkeeper cuts worry at tax time. Owners can trust the right records and clear data. This lowers stress and stops last-minute errors.

What You Will Learn From This Blog

- How to hire a bookkeeper for small businesses.

- Steps to choose the right bookkeeper easily.

- Benefits of having a professional bookkeeper.

- How to pick simple bookkeeping software.

- Ways to avoid errors and keep records clear.

- Tips to track money fast and right.

- How to improve cash flow and grow your business.

Hire a Bookkeeper for Small Business: Key Responsibilities

Hiring a bookkeeper for small business means getting a skilled expert. They record money entries, track payments, and make reports. Bookkeeping keeps accounts neat, clear, and ready for decisions.

Financial Record Maintenance

Bookkeepers enter money records daily and on time. They record sales, bills, and expenses each day. Right records cut mistakes and confusion. Reports from these records are clear and trustworthy, which is why many hire a bookkeeper for small business.

Tips to keep records right:

- Keep bills and receipts in files or online.

- Update records daily or at least weekly.

- Check small entries often to avoid future mistakes.

Invoice and Payment Tracking

Bookkeepers send invoices and track payments. They remind clients and pay vendors on time. Late payments hurt cash flow and slow work.

Tips for tracking payments:

- Set reminders for due dates and late bills.

- Use good bookkeeping software for small business.

- Keep a list of pending and paid invoices.

Expense Categorization and Management

Bookkeepers sort costs into clear groups. This helps see overspending, which is why owners hire a bookkeeper for small business. Organized costs make taxes easier and faster.

Tips to manage costs:

- Group costs: supplies, payroll, utilities.

- Track repeated bills for better budgets.

- Check categories each month for unusual spending.

Bank Reconciliation

Bookkeepers check bank statements against company records, a reason to hire a bookkeeper for small business. They find errors and fix them fast. Reconciliation keeps accounts right and clear.

Tips to reconcile accounts:

- Check accounts at least once a month.

- Track deposits, withdrawals, and bank fees.

- Fix unusual entries fast to avoid issues.

Financial Reporting

Bookkeepers make reports like profit and loss, balance sheets, and cash flow. Reports help owners make good choices. Timely reports also help with taxes.

Tips for reports:

- Make reports monthly or quarterly for insight.

- Compare current and past data to spot trends.

- Share reports with owners and team for clarity.

Integration with Bookkeeping Software

Good bookkeeping software for small businesses makes work easy and fast. Tools like QuickBooks, Xero, or Zoho Books cut repeated work. Automation saves time and avoids errors.

Tips for software use:

- Pick software for your business type and size, and hire a bookkeeper for small business to manage it.

- Train bookkeepers on all key software features.

- Back up data often to prevent loss.

Payroll and Tax Assistance

Bookkeepers handle payroll, track hours, and record benefits, helping owners hire a bookkeeper for small business with confidence. They prepare records for taxes and rules. Employees get paid right and on time.

Tips for payroll:

- Keep clear records of hours and leave.

- Use auto payroll features in the software.

- Check reports before final submission.

Data Security and Confidentiality

Bookkeepers keep money data safe using secure tools. Confidentiality protects sensitive data from misuse.

Tips for safety:

- Use strong passwords and encrypted tools.

- Limit access to key staff only.

- Audit access logs often for safety.

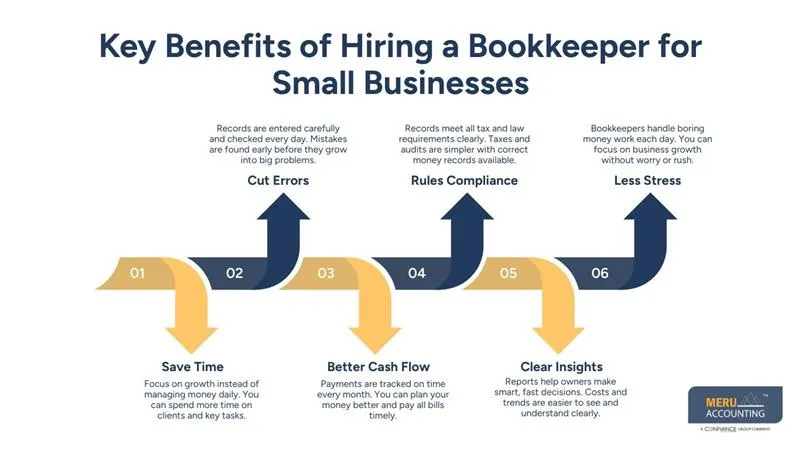

Key Benefits of Hiring a Bookkeeper for Small Businesses

Hiring a bookkeeper for small business gives many benefits:

Save Time

Focus on growth instead of managing money daily. You can spend more time on clients and key tasks.

Cut Errors

Records are entered carefully and checked every day. Mistakes are found early before they grow into big problems.

Better Cash Flow

Payments are tracked on time every month. You can plan your money better and pay all bills timely.

Rules Compliance

Records meet all tax and law requirements clearly. Taxes and audits are simpler with correct money records available.

Clear Insights

Reports help owners make smart, fast decisions. Costs and trends are easier to see and understand clearly.

Less Stress

Bookkeepers handle boring money work each day. You can focus on business growth without worry or rush.

Importance of Hiring a Bookkeeper for Small Business

Small business owners often miss the value of bookkeeping. Hiring a bookkeeper keeps accounts neat and right. Records stay clear, and money errors drop.

Stop Money Mistakes

Bookkeepers record all money entries with care. This stops wrong numbers from causing trouble. Small mistakes do not grow into bigger problems.

Keep Payments On Time

Invoices and bills are tracked each day. Bookkeepers remind clients and pay vendors on time. Cash flow stays smooth and easy to manage.

Make Taxes Simple

Bookkeepers keep all records needed for tax work. Filing taxes becomes fast and less hard. You avoid fines and follow the law.

Save Time for Owners

Owners can focus on clients, sales, and growth after they hire a bookkeeper for small business. Daily financial task is done smoothly when you hire a bookkeeper for small business. This gives more time for important tasks.

Help Business Choices

Bookkeepers make clear reports on costs and sales. You can make smart choices for growth or projects. Data helps plan budgets and track spending.

Use Software Well

Good bookkeeping software for small business helps with work. Bookkeepers make sure the software is set up right. Auto tools save time and keep records correct.

Step-by-Step Process to Hire a Bookkeeper for Small Business

Hiring a bookkeeper for small business follows clear steps.

Define Your Business Needs

List tasks for the bookkeeper. Include daily records, reconciliation, payroll, and reports. Decide on full-time, part-time, or remote.

Search for Professionals

Look for bookkeepers with industry experience. Check reviews, past work, and skills. Use local or online services.

Evaluate Skills and Software Knowledge

Ensure they know good bookkeeping software for small business. Ask about QuickBooks, Xero, or Zoho Books. Check if they understand your business needs.

Interview Candidates

Ask about errors, reporting, and team communication. Check reliability and skill. A good bookkeeper keeps the work smooth.

Negotiate Terms and Agreements

Agree on rates, payment plans, and duties. Include rules for confidential info. Set expectations for reports and deadlines.

Onboard and Set Up Software

Give access to accounts and software. Teach company procedures. Start with the first reconciliation and setup after you hire a bookkeeper for small business.

Regular Review and Feedback

Check reports and reconciliation monthly. Give feedback to improve work. Ongoing review keeps the work right and fast.

Optimize Financial Processes

Bookkeepers suggest better workflows and auto tools. Using good bookkeeping software for small business reduces mistakes. Better processes save time and money.

Common Challenges & How to Overcome Them

Even with skilled help, issues can still appear in bookkeeping.

Software Choice

Pick good bookkeeping software for small business. Check tools that fit your firm’s size and work needs.

Data Mistakes

Check all entries two times each day. Ask your bookkeeper to look at the records before use.

Bad Communication

Set updates to avoid mix-ups with your team. Use calls or notes to keep everyone on the same page.

Cost

Part-time or outside bookkeepers can lower your costs, so some businesses hire a bookkeeper for small business. Look at rates to pick services that fit your plan.

Slow Decisions

Use reports to act fast and stay clear. Set due dates so choices are made on time.

Setup Issues

Try the software before full work starts for safety. Start with small jobs to test that the system works correctly.

Real-Life Example

A small shop could not track invoices well, so they decided to hire a bookkeeper for small business. They hired a bookkeeper for small business and used good bookkeeping software for small business. In three months, errors fell 70 percent. Cash flow improved, and reports were clear. The owner focused on sales and growth.

Why Choose Meru Accounting for Small Business Bookkeeping

Expert Bookkeeping Support

Meru Accounting helps you hire a bookkeeper for small business needs. Our team handles daily records with care and accuracy.

Use of Good Bookkeeping Software

We use good bookkeeping software for small business work. This helps track income, costs, and reports with ease.

Accurate Records and Timely Reports

We make sure all records stay correct and updated. Reports are shared on time for better planning and control.

Compliance and Peace of Mind

We follow all rules and basic tax needs. This keeps your business safe from errors and fines.

Time and Cost Savings

Our service saves time and lowers work pressure. You can focus on growth while we manage the books.

Contact Meru Accounting today to hire a skilled bookkeeper. Get clean records, clear reports, and steady financial control. Let our team support your business growth with trusted care.

Key Takeaways

- Hiring a bookkeeper for small business keeps tasks simple.

- Good bookkeeping software for small businesses speeds work and cuts errors.

- Bookkeepers save time, stop mistakes, and give insight.

- The following steps ensure smooth hiring and setup.

- Check work often to keep records right.

FAQs

Hiring a bookkeeper for small business saves time and cuts money errors. It helps keep records clean and supports better business growth.

A bookkeeper tracks sales, costs, and daily money flow. They keep records clear and ready for reports or tax work.

Good bookkeeping software for small business includes QuickBooks and Xero. These tools help track income, costs, and reports with ease.

A bookkeeper keeps tax records clean and well-sorted. This makes tax filing easy and helps avoid costly mistakes.

Monthly checks help spot issues early and fix them fast. Regular reviews keep money records clear and correct.