Hire QuickBooks Bookkeeper for Your Business

Money flows in and out of your business every single day. Bills need to be paid on time. Employees expect salaries from you. Taxes wait at the end of the year. Customers need invoices. Vendors expect payments. Handling all this often feels like a never-ending task. A QuickBooks bookkeeper helps manage these responsibilities with skill and order. So, do you plan to hire QuickBooks bookkeeper for your business? This blog explains why your business needs a QuickBooks bookkeeper, when to consider it, and how to make the right choice.

A QuickBooks bookkeeper can help you organize transactions, track cash, and organize your records correctly. Before we proceed in this blog, remember bookkeeping is not just about numbers. It’s about leading your business with correct decisions, not random estimates.

Why Your Business Needs to Hire QuickBooks Bookkeeper

Almost every type of business faces challenges in managing money. Even a small shop has to handle several transactions everyday. Below are some key reasons why your business needs to hire QuickBooks bookkeeper:

1. Managing Money Gets Complex

A business constantly encounters sales, supplier payments, refunds, payroll, business taxes, etc. Handling all of them together is something you need help with. A QuickBooks bookkeeper enters every transaction correctly into the system and organizes records so nothing gets lost. Without properly maintaining records, you will notice small errors turn into big losses.

Example: A local shop is selling 50 items daily. Each sale, payment, and refund must be recorded. Without a bookkeeper, missing even a few entries can cause confusion at month’s end.

2. Accurate Records Improve Decisions

Good decisions always rely on strong records. Whether you are planning to hire new staff, buy stock, or manage cash, you need data you can trust. A QuickBooks bookkeeper can help you create reports showing you everything about profits, losses, and business spending patterns.

Example: When sales look positive but expenses keep rising, a bookkeeper can help you discover areas where costs can be reduced.

3. Save Valuable Time

Bookkeeping takes hours of attention. Reconciliation, sending invoices, and generating reports pull you away from clients or marketing. A bookkeeper takes care of these daily tasks, giving you more time to focus on growth.

4. Save you from costly mistakes

Errors in your business records can drain your money or cause legal problems. A skilled QuickBooks bookkeeper can help you record every payment and invoice with precision. Hence, you can catch mistakes early before they become serious problems.

5. Lower Stress Levels

Bookkeeping often brings anxiety—especially at month-end or tax time. Knowing a professional is managing your financial records brings peace of mind. You stay focused on business, not bookkeeping worries.

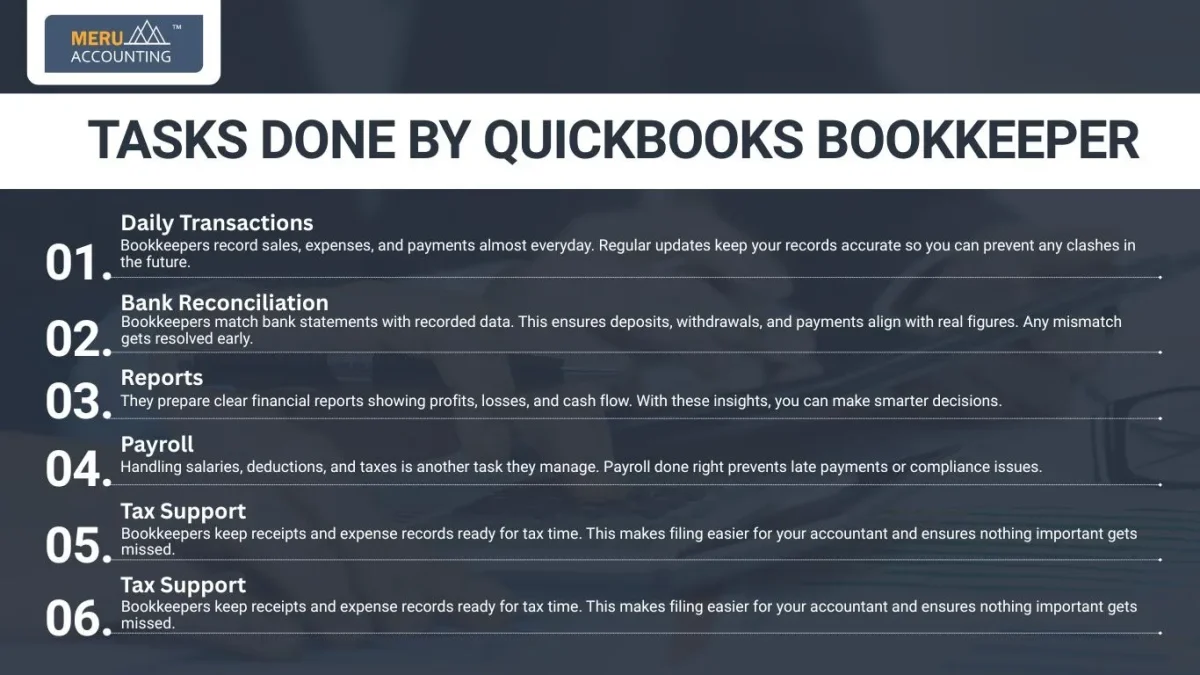

Tasks Done by QuickBooks Bookkeeper

Before you hire QuickBooks bookkeeper, you must understand the role it plays in the business. A QuickBooks bookkeeper deals with daily financial tasks that keep your business running efficiently.

Daily Transactions

Bookkeepers record sales, expenses, and payments almost everyday. Regular updates keep your records accurate so you can prevent any clashes in the future.

Tip: Share receipts and invoices with your bookkeeper daily. It keeps tracking easier and faster.

Bank Reconciliation

Bookkeepers match bank statements with recorded data. This ensures deposits, withdrawals, and payments align with real figures. Any mismatch gets resolved early.

Reports

They prepare clear financial reports showing profits, losses, and cash flow. With these insights, you can make smarter decisions.

Scenario: When cash flow seems low, a report can reveal unpaid invoices. You can follow up with clients before issues grow.

Payroll

Handling salaries, deductions, and taxes is another task they manage. Payroll done right prevents late payments or compliance issues.

Tax Support

Bookkeepers keep receipts and expense records ready for tax time. This makes filing easier for your accountant and ensures nothing important gets missed.

Budgeting Help

Some bookkeepers also assist in budgeting. They point out unnecessary spending and suggest practical ways to control costs.

Signs You Should Hire QuickBooks Bookkeeper

Not every business needs to hire QuickBooks bookkeeper. But, there are certain indicators that suggest that your business needs one.

- Huge number of transactions: When sales or client work grows, keeping track of daily entries/transactions becomes harder.

- Lack of Time: If bookkeeping of your business consumes a lot of time from sales, growth, or client service, help is needed.

- Frequent Errors: Repeated mistakes in invoices, bills, or reconciliations show it’s time for a pro.

- Stressful Tax Seasons: If taxes feel overwhelming each year, a bookkeeper keeps things organized.

- Business Expansion: New products, staff, or branches add more records to manage.

- Unclear Reports: If you’re unsure about profits or losses, accurate reports can guide you better.

Steps to Hire QuickBooks Bookkeeper

Finding the right bookkeeper for your business takes careful planning. Follow these steps easily hire QuickBooks Bookkeeper for your business:.

Step 1: Know What You Need

Every task starts with a clear plan. Before you even post a job, take a note of what you truly need help with. It can be daily record work, payroll help, or tax prep that keeps getting delayed. When you list out each task, your search becomes smoother. You may also find that some work can be done weekly, not daily. That helps you manage cost better too.

Step 2: Find Real Experience

Anyone can say they know QuickBooks. Yet not everyone can handle it well. The tool looks simple, but its parts can get tricky. A person who has worked with your kind of business can understand your cash flow faster. When someone knows the version you use, fewer errors slip through. So, before you decide, ask where they used QuickBooks and what kind of work they did.

Step 3: Ask for Honest Words from Others

No review speaks louder than real stories. When you talk to their past clients or employers, listen for clues. Were they on time? Did they make fewer mistakes? Did they stay calm when things went wrong? These small details may help you see if they fit your work style. People who have worked with them before can give you the clearest view.

Step 4: Pick Between Remote or Office Based

Some people like face to face work. Others are fine with online help. Both ways can work. Remote bookkeepers often cost less and can join from anywhere. In-office ones may be easier to train and can talk to your team in real time. Look at your workflow and what fits best with your pace. The choice may depend on how much you want someone to stay near your main team.

Step 5: Talk and Try Before You Hire

An interview is not only about questions. It is a short test of skill and comfort. Ask how they would fix an error or record a new entry. Give them a small task if you can. Watch how they check numbers, make notes, or prepare reports. In these small acts, their way of thinking becomes clear. You may even find small gaps that you can train later.

Step 6: Make All Terms Clear

Every good start comes with clear words. Pay, duty, and hours must be set before work begins. This may sound plain, but it saves both sides from mix-ups later. You can also set how updates will be shared and how data will stay private. The more open you are in the start, the fewer issues rise later.

Step 7: Bring Them Into the Team

A bookkeeper works best when part of a team, not outside it. When they meet your staff and learn the routine, records stay more in sync. You can ask them to join short team calls or share a weekly note. Over time, trust grows, and so does the flow of work. When everyone knows what the other does, errors fade and reports stay clean.

Benefits of Hiring QuickBooks Bookkeeper

- Accurate Records: Clean books reduce mistakes and improve report quality.

- Save Time: Spend less time on accounting records and more on business.

- Increased Efficiency: End-of-month tasks and tax filings become much more easier.

- Better Cash Flow: Tracking payments and invoices helps avoid delays.

- Smarter Planning: Reports give you smarter insights for future spending or investments.

- Legal Protection: Organized records help you stay ready for audits anytime.

- Scalability: As business grows, your bookkeeper can easily manage the workload off the business.

Common Mistakes to Avoid

- Hiring without knowing exact needs.

- Skipping background or reference checks.

- Not defining work terms clearly.

- Overlooking QuickBooks skill levels.

- Micromanaging every small task.

Cost of a QuickBooks Bookkeeper

Rates can vary a lot as there’s a lot of demand for a QuickBooks bookkeeper. For freelancers, you may be charged hourly or monthly. If you hire full-time, you need to pay salaries. Remote QuickBooks bookkeeping services often cost less and deliver equal quality work.

Looking to hire QuickBooks bookkeeper online? At Meru Accounting, we offer QuickBooks bookkeeping services for businesses around the world. We house certified QuickBooks professionals who can end the need of both QuickBooks software and professional bookkeeper together. Contact us now to enjoy the benefits of both of them together for your business.

FAQs

- What does a QuickBooks bookkeeper do?

They track sales, bills, payments, and make simple reports. - Why hire a QuickBooks bookkeeper?

They keep books right, save time, and help your business. - When should I hire a bookkeeper?

You need one if sales are many, mistakes rise, or taxes stress you. - Is a remote bookkeeper safe?

Yes, with login security and clear rules. - Can a bookkeeper help with taxes?

They organize records, but do not file taxes. - How often should books be updated?

Daily or weekly updates keep numbers right. - Which businesses need a bookkeeper most?

Any business with many sales or growing staff needs a bookkeeper the most. - Can QuickBooks bookkeepers improve cash flow?

Yes, by tracking payments and invoices. - Do I need a full-time bookkeeper?

Not always. Part-time or remote help can work with the same quality and lesser costs. - How do I check a bookkeeper’s skill?

Ask for past work or give a small QuickBooks task. - What mistakes should I avoid when hiring?

Skip unclear duties, ignore references, or micromanage. - Can bookkeepers help with budgets?

Yes, they show where to cut cost and save money. - Can a bookkeeper save time?

Yes, they handle reports, invoices, and reconciliations. - Are QuickBooks reports correct?

Yes, if entries are done and accounts checked often.