How is digital accounting affecting CPA Firms?

It is important for any Certified Public Accountant (CPA) firm to be updated with all the latest changes in accounting. These firms have a very high responsibility of providing proper accounting services to their clients. Some of these CPA firms outsource some of their services to other agencies. Bookkeeping service is the most outsourced service here. Bookkeeping Services for CPAs must be done as per the latest digital accounting trends.

The innovations and technologies have now made accounting activity technology-driven. This digital accounting has now brought drastic changes in how accounting is done. The CPA firms now have to adopt digital accounting while providing accounting services for Accountants. This has led to some effect on the working of the CPA firms. It will be more interesting to look in detail at these effects in more detail.

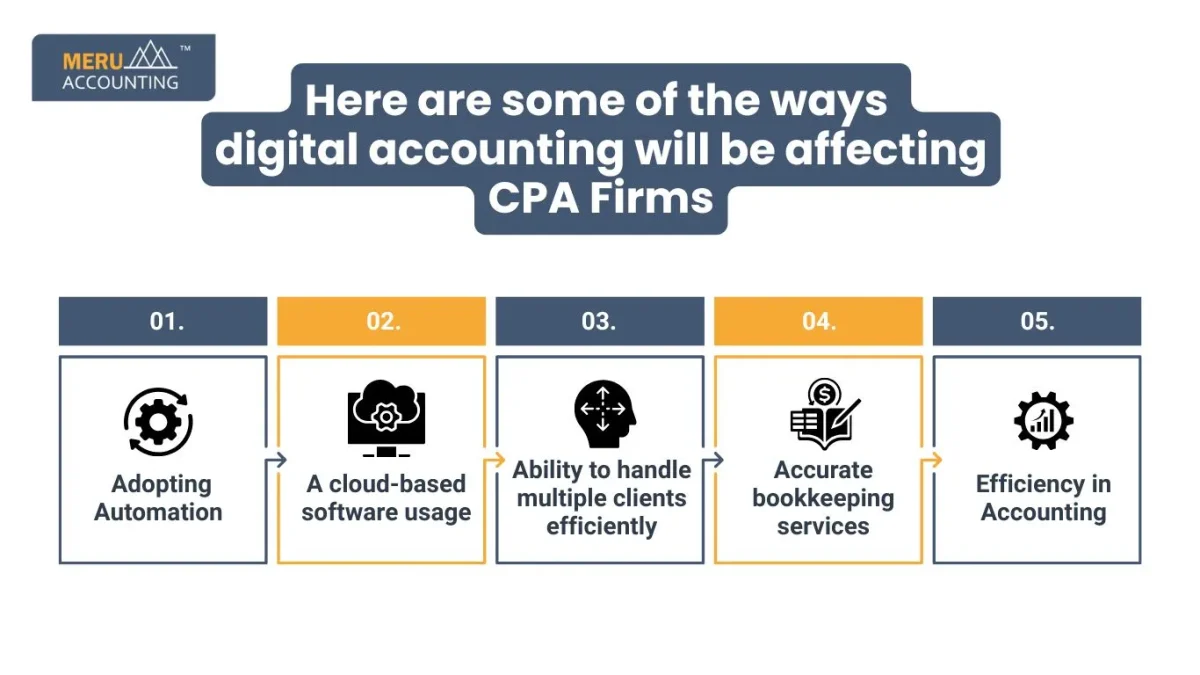

Here are some of the ways digital accounting will be affecting CPA Firms:

1. Adopting Automation

Through automation, the working pattern in accounting will be transformed completely. With automation, accounting activities can be done much faster. The accounting department can expect the results faster. Automated accounting can provide different features through which several tasks can be done easily.

2. A cloud-based software usage

One of the important effects of digital accounting on CPA firms is the use of cloud-based software. These software’ has the capability to handle a large amount of data. FreshBooks, QuickBooks, Xero, etc., are some examples of cloud-based software. Cloud-based software provides better security for the data. They even have the capability to perform multiple tasks quickly. Expense claim, asset management, purchase orders, multi-currency accounting, payroll management, etc., are some of the tasks done with cloud-based accounting software.

3. Ability to handle multiple clients efficiently

It was a hectic task to handle the multiple clients manually for the CPA firms. However, digital accounting has made it easier to handle multiple clients. Each client can get a personalized approach from the CPA firm. This can help CPA firms to achieve better client satisfaction.

4. Accurate bookkeeping services

While providing bookkeeping services for CPAs, it is important to maintain to keep accuracy. The manual bookkeeping services had to encounter several errors that affected the whole accounting process. However, digital accounting has made it possible to achieve accuracy in bookkeeping services.

5. Efficiency in Accounting

With the use of digital accounting, CPA firms are experiencing a better way of working. The accounting department can now process the activities in proper order. The elimination of errors and swift processing has made it simpler for accounting. CPA firms are now able to achieve better efficiency in accounting.

By adopting digital accounting, CPA firms are now able to achieve better accounting. Many CPA firms are now outsourcing their different accounting activities to other agencies that are well-equipped with digital accounting.

How Digital Accounting Helps Client Service

CPA firms need to do more than basic accounting. Clients want advice, plans, and insights—not just numbers. Digital accountants use tech to give quick, clear insights that meet these new needs.

1. Real Time Data

Clients can now see data in real time, thanks to the cloud. No more waiting for reports. They can track finances and make fast decisions, staying competitive in a fast-paced world.

2. Personalized Insights

Digital accountants spot trends and give advice based on data. This helps clients plan for the future. By looking at financial patterns, they offer ways to improve cash flow, cut costs, and boost profits.

3. Data Driven Decisions

With digital tools, clients can make smart choices using up-to-date financial data. Whether deciding on a new investment or adjusting a budget, clients can act with confidence.

4. Faster Reporting

No more waiting for monthly or quarterly reports. Digital platforms give clients automated, real time financial reports and insights, so they get the info they need right away.

5. Proactive Advisory

Digital accountants don’t just report numbers—they guide clients. By using real time data, they can spot problems early and offer advice to fix them before they grow. This helps build strong client relationships.

How Cloud Tech Changes Digital Accounting

Cloud tech is the core of digital accounting. It lets firms access data anytime, from anywhere. This opens new ways to work with clients.

1. Easy Access

With the cloud, clients and accountants can view data on any device with internet. It makes teamwork simple.

2. Safe Data

Cloud tech keeps data safe with encryption and extra security steps.

3. Real Time Collaboration

Cloud platforms let accountants and clients work together in real time. This cuts delays and helps both sides make decisions faster.

4. Reduced Errors

Cloud tools help accountants automate tasks, cutting down on mistakes. This makes data more accurate and gives clients more trust in their reports.

5. Scalability

Cloud tools grow with a firm. As a business expands, the system handles more data and complex needs, without needing costly upgrades. This makes cloud tech ideal for firms of all sizes.

Challenges of Digital Accounting

Switching to digital systems has its challenges. These include:

1. Upfront Costs

New software can be costly at first. But the savings and time saved later often balance out the cost.

2. Learning and Training

Digital accountants must keep up with new tech. This means ongoing training, which can be a barrier for some firms.

3. Moving Data

Switching old data to the cloud can take time. Firms need to plan well to avoid problems.

4. Integration Issues

New systems don’t always work well with old ones. This can cause extra work and slow things down.

5. Technical Support

A strong tech support team is needed. Without it, firms may face issues when systems break or need updates.

The Future of Digital Accounting

Tech is always changing, and digital accounting will change too. Some future trends include:

1. AI and Machine Learning

AI will help accountants spot patterns and predict trends more quickly.

2. Blockchain

Blockchain will make records more secure and easier to track. It can also cut down fraud and speed up audits.

3. More Automation

More tasks, like payroll and invoicing, will be automated. This frees up accountants to focus on bigger work.

4. Advanced Data Analytics

Data tools will get better. This will help accountants give even more useful advice.

5. Real-Time Reporting

As systems improve, clients will get reports instantly. This will help them make quicker decisions.

Digital accounting is reshaping how firms work. It makes things faster and more accurate. Though the change can be tough, those who adapt will thrive. Meru Accounting provides a better digital accounting service for CPA firms. They have experts who can handle several CPA firms’ activities properly. They used the latest cloud-based software that can fit your requirements. Meru Accounting is a well-known accounting firm that provides different accounting services across the globe.

FAQs

- What is a digital accountant?

A digital accountant uses tech to manage finances and offer better services. - How does digital accounting help firms?

It makes work faster, more accurate, and improves client relationships. - What tools do digital accountants use?

Cloud software, data tools, and automation systems. - Is digital accounting safe?

Yes, with the right cloud platforms that have encryption and extra security steps. - What challenges come with digital accounting?

High startup costs, the need for training, and data migration. - How does it improve client service?

It gives clients real-time data, quick insights, and faster reports. - What are the future trends in digital accounting?

AI, blockchain, and more automation will change the field.