Benefits and Drawbacks of Running a Paperless Business

Cloud-based business is no longer a trend. It is now a smart way to save time, cut costs, and work better. A paperless business means less clutter, faster work, and fewer errors. Many business owners have already moved to digital bookkeeping. It helps them manage money with ease and without a mess.

In this blog, we will look at what paperless bookkeeping is, the benefits, the drawbacks, and how to do it right. We will also see how Meru Accounting makes this shift smooth and stress-free.

Introduction to Paperless Business

A paperless business works with digital records. It keeps data in the cloud or on secure systems instead of paper files. This shift helps business owners cut costs and save space. Many small and mid-size firms now choose this model.

Why Digital Business Makes Sense

- No paper means no printing costs or storage needs.

- Cloud systems give access to records anytime.

- Staff waste less time on filing and searching.

- Data stays safe with strong backups.

- It helps reduce bookkeeping costs, too.

What Is Paperless Bookkeeping?

Paperless bookkeeping means all your financial data is stored and shared online. It uses tools that help manage bills, receipts, and reports with ease. Digital bookkeeping also cuts down on manual errors.

How Digital Bookkeeping Works

- Use apps to scan and store receipts.

- Link bank accounts to bookkeeping software.

- Share files with your accountant using cloud tools.

- Track costs, taxes, and income in real time.

- Access data from your phone or computer.

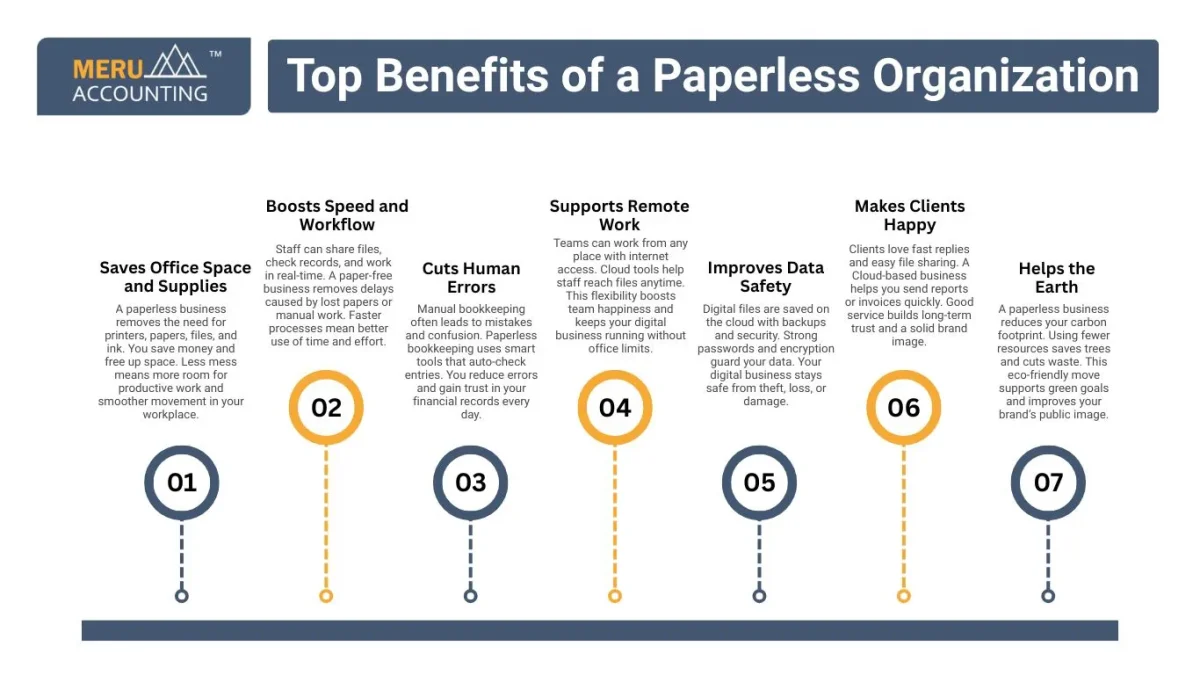

Top Benefits of a Paperless Organization

Going paperless brings many wins. It saves time, money, and stress. With fewer files to manage, teams work better and faster.

1. Saves Office Space and Supplies

A paperless business removes the need for printers, papers, files, and ink. You save money and free up space. Less mess means more room for productive work and smoother movement in your workplace.

2. Boosts Speed and Workflow

Staff can share files, check records, and work in real-time. A paper-free business removes delays caused by lost papers or manual work. Faster processes mean better use of time and effort.

3. Cuts Human Errors

Manual bookkeeping often leads to mistakes and confusion. Paperless bookkeeping uses smart tools that auto-check entries. You reduce errors and gain trust in your financial records every day.

4. Supports Remote Work

Teams can work from any place with internet access. Cloud tools help staff reach files anytime. This flexibility boosts team happiness and keeps your digital business running without office limits.

5. Improves Data Safety

Digital files are saved on the cloud with backups and security. Strong passwords and encryption guard your data. Your digital business stays safe from theft, loss, or damage.

6. Makes Clients Happy

Clients love fast replies and easy file sharing. A Cloud-based business helps you send reports or invoices quickly. Good service builds long-term trust and a solid brand image.

7. Helps the Earth

A paperless business reduces your carbon footprint. Using fewer resources saves trees and cuts waste. This eco-friendly move supports green goals and improves your brand’s public image.

How Paperless Bookkeeping Enhances Efficiency

Paperless bookkeeping transforms how small firms manage accounts. It improves speed, clarity, and accuracy, making financial tasks easier to handle.

1. Easy File Tracking

You can locate records, invoices, or bills in seconds. No need to dig through cabinets. Digital bookkeeping makes document search fast, reliable, and stress-free for every team member.

2. Quick Updates

Your records update in real time with smart software tools. You always see current balances, unpaid invoices, and cash flow. This keeps your decisions sharp and fully informed.

3. Better Cash Flow Control

You can watch every payment in and out. Charts show trends clearly. Digital bookkeeping helps you avoid late fees and track where money goes, boosting financial control.

4. Simple Tax Filing

Your financial data stays sorted, clean, and ready for audits. Filing taxes becomes fast and smooth. Digital bookkeeping also reduces errors in reports, which lowers audit risks.

5. Less Paper, More Clarity

Digital reports are easier to read and share. Staff can open the same file and leave notes. Digital bookkeeping gives structure and flow to your data.

6. Shared Access

Team members can work on files together from different places. You don’t need to wait for someone to finish. This shared view improves speed and teamwork daily.

7. Strong Backup and Safety

Your data is saved in the cloud with backup copies. Even if one tool fails, your files remain safe. This feature keeps your cloud-based business protected around the clock.

Common Drawbacks of a Paperless Business

Going paperless has many benefits, but there are a few challenges. With smart steps, these can be handled with ease.

1. Setup Cost

Starting a paperless business may need investment in tools and training. You buy devices and pay for software. But over time, savings from space, supplies, and staff time cover the cost.

2. Tech Skills Needed

Staff must learn new systems to work without paper. Some may take longer to adapt. With the right help and training, most people adjust well to paperless tools.

3. Risk of Data Breach

Online files are at risk from hackers or leaks. A digital business needs strong passwords and secure networks. Simple changes can keep your data safe from attacks.

4. Power or Wi-Fi Issues

When electricity or internet fails, work may pause. A digital business should plan for this. Keep battery backups and mobile data to avoid major delays or downtime.

5. Legal or Audit Issues

Some rules still need printed documents. Your digital business should check tax laws and retain copies where needed. Smart scanning tools can help meet legal standards.

6. Screen Time Stress

Staff spend long hours looking at screens. This can cause eye strain or fatigue. Plan short breaks and provide good lighting to keep your team productive and healthy.

7. Tech Tool Failures

Software may crash or freeze. This stops work and affects deadlines. Your digital business must use reliable tools and keep backup systems to stay safe from errors.

How to Overcome the Drawbacks of Paperless Bookkeeping

Smart steps can solve most issues in paperless bookkeeping. Planning and tools make your business safer, faster, and easier to manage.

1. Train Your Team

Teach your team how to use paperless tools well. Offer short, clear lessons or guides. When people feel confident, they work faster and avoid mistakes.

2. Use Strong Passwords

Create passwords with numbers, letters, and symbols. Change them often. Add two-factor login to stop hacking. This keeps your Digital bookkeeping secure and under control.

3. Keep Offline Copies

Save copies of key files on USB or hard drives. Print only when laws require it. This backup system ensures no data loss in tough times.

4. Choose Good Software

Pick tools with high ratings and strong customer support. Try free versions first. Good software keeps your business efficient and reduces errors.

5. Plan for Power Cuts

Use laptops with long battery life. Keep mobile hotspots ready. These steps keep your team active, even when internet or power fails unexpectedly.

6. Review Data Rules

Know local and national laws on digital records. Check audit and tax filing rules often. Staying updated helps you avoid trouble and fines.

7. Set Screen Breaks

Encourage short breaks from screen every hour. Use eye-friendly settings and good chairs. These changes protect staff health and support long-term productivity.

Meru Accounting helps firms shift to smart, safe, and smooth paperless bookkeeping. We study your firm before we start. This helps us set the right plan. We help you go paper-free fast. Our team gives full help, step by step. Our team knows all tax and book rules. We work with care and speed.

FAQs

- What is a paperless business?

A business runs without using printed documents. It uses digital tools to send, store, and manage files. This method saves space, time, and money while improving speed and accuracy.

- Is paperless bookkeeping safe for my business?

Yes, this bookkeeping is very secure when done right. Tools use encryption, password protection, and backups. This keeps your business data safe from loss, theft, or system failure.

- What are the biggest benefits of going paperless?

A digital business saves space, cuts costs, and improves speed. It supports remote work and reduces human errors. You also help the planet by using fewer resources like paper and ink.

- Are there any risks in running a paperless business?

Yes, there are a few risks, like data breaches or tech failure. But with strong passwords, backups, and training, your business can stay safe and avoid major losses or downtime.

- Can small businesses switch to Cloud bookkeeping?

Yes, small firms can easily move to cloud bookkeeping. It needs basic training and software setup. Over time, you save money and gain faster access to reports, invoices, and key data.