Law firms face unique financial challenges that can easily lead to costly mistakes. From trust account issues to billing errors, even small slips can cause big problems. That is why hiring a legal bookkeeper is one of the smartest steps a law firm can take.

A legal bookkeeping expert ensures that every financial detail is handled correctly, helping firms avoid mistakes and stay compliant.

With accurate bookkeeping, law firms can focus on serving clients while keeping their finances organized and audit-ready. Professional bookkeeping also helps firms spot issues early and make better financial decisions for growth.

What You Will Learn From This Blog

In this blog, you will learn:

- What a legal bookkeeper does and why law firms need one

- The most common financial errors in law firms

- How a legal bookkeeper prevents mistakes

- The role of a legal bookkeeping expert in lawyers bookkeeping

- How professional bookkeeping improves cash flow and billing accuracy

- How legal bookkeepers ensure compliance and reduce risk

- The benefits of outsourcing lawyers bookkeeping

- A real case study showing how law firms were saved from financial errors

- Why Meru Accounting is the right choice for law firm bookkeeping

What Is a Legal Bookkeeper and Why Law Firms Need One

A legal bookkeeper is a financial specialist who handles bookkeeping specifically for law firms. Unlike general bookkeeping, legal bookkeeping includes trust accounts, client ledgers, case-related expenses, and strict compliance rules. Because law firms handle client money and bill based on time, accurate bookkeeping is critical.

Law firms need a legal accounting specialist because:

- Legal accounting rules are strict

- Trust account errors can lead to serious penalties

- Billing mistakes can damage client trust

- Financial mistakes can affect profitability

A legal bookkeeper ensures every financial record is accurate and up to date. This helps law firms make better decisions and avoid risks.

Common Financial Errors in Law Firms

Law firms often face several recurring financial mistakes. These errors may seem small, but can lead to major issues:

1. Trust Account Mistakes

Many law firms struggle with trust accounts. Common errors include incorrect client ledger entries, wrong disbursement amounts, or mixing firm funds with client funds.

2. Billing Errors

Billing mistakes can range from wrong hourly rates to missing billable hours. These errors reduce revenue and create trust issues with clients.

3. Poor Expense Tracking

When expenses are not tracked properly, firms may not know which cases are profitable. This can lead to wrong business decisions.

4. Inaccurate Payroll

Law firms often have multiple staff and varying pay structures. Incorrect payroll can cause compliance issues and unhappy employees.

5. Missing Financial Reports

Without regular financial reports, law firms cannot monitor cash flow or plan for future growth.

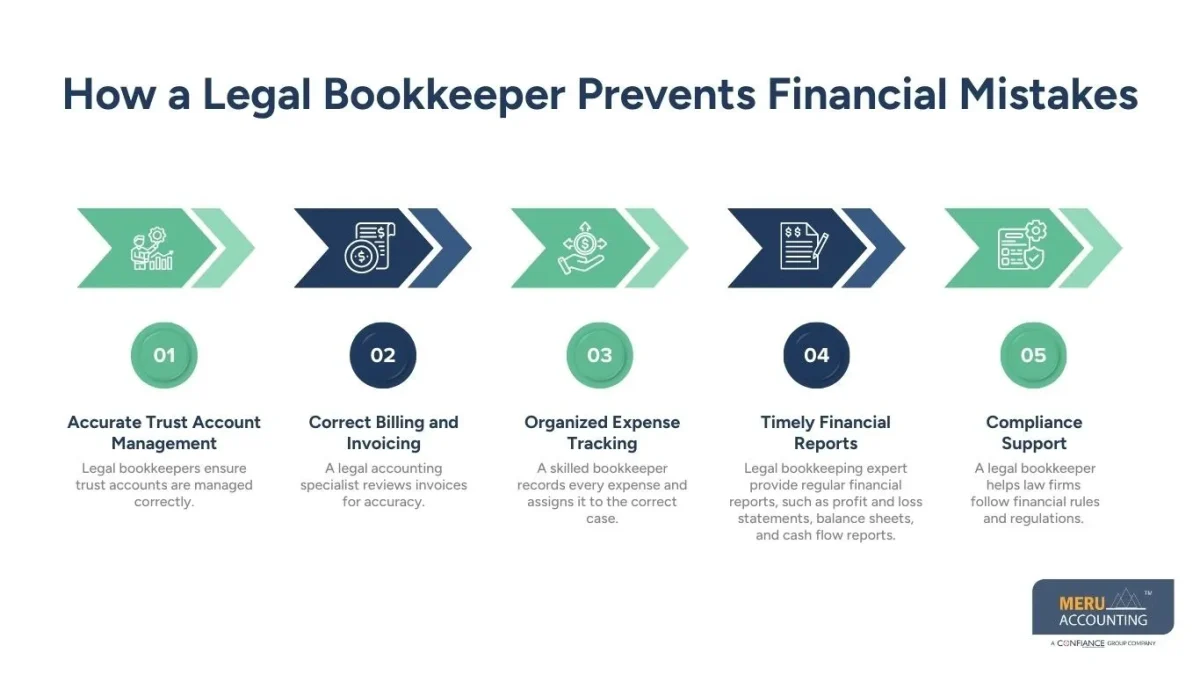

How a Legal Bookkeeper Prevents Financial Mistakes

A legal bookkeeper helps law firms avoid financial errors in several ways:

Accurate Trust Account Management

Legal bookkeepers ensure trust accounts are managed correctly. They track client funds, record all deposits and withdrawals, and reconcile accounts regularly. This reduces the risk of trust account violations.

Correct Billing and Invoicing

A legal accounting specialist reviews invoices for accuracy. They check billable hours, confirm rates, and ensure expenses are billed correctly. This helps law firms maximize revenue and avoid disputes.

Organized Expense Tracking

A skilled bookkeeper records every expense and assigns it to the correct case. This helps firms understand which cases are profitable and which are not.

Timely Financial Reports

Legal bookkeeping expert provide regular financial reports, such as profit and loss statements, balance sheets, and cash flow reports. These reports help law firms monitor performance and plan ahead.

Compliance Support

A legal bookkeeper helps law firms follow financial rules and regulations. They ensure records are accurate and audit-ready at all times.

The Role of a Legal Bookkeeper in Lawyers Bookkeeping

Lawyers bookkeeping is different from general bookkeeping because law firms deal with unique financial activities such as trust accounts, client billing, and case-related expenses. A legal bookkeeper plays a key role in making sure these tasks are handled correctly.

A legal bookkeeper performs the following tasks in lawyers bookkeeping:

- Managing trust accounting and client ledgers

- Recording client payments and refunds

- Tracking case-related expenses

- Preparing billing and invoices

- Reconciling bank accounts

- Producing financial reports

- Supporting audits and compliance

Lawyers bookkeeping requires precision and knowledge of legal accounting rules. A legal bookkeeper ensures every entry is accurate and every report is ready for review.

Improving Cash Flow and Billing Accuracy with Professional Bookkeeping

Cash flow is the lifeblood of any law firm. When billing is delayed or inaccurate, cash flow suffers. A legal bookkeeping expert helps law firms improve cash flow by:

1. Ensuring Timely Billing

Legal bookkeepers ensure invoices are prepared and sent on time. They also follow up on unpaid bills to maintain a steady cash flow.

2. Tracking Payments Accurately

A legal bookkeeper records payments correctly and reconciles them with invoices. This prevents missed payments and reduces billing disputes.

3. Managing Client Retainers

Law firms often handle retainer funds. A legal bookkeeping expert manages retainer balances and ensures accurate reporting.

4. Improving Financial Planning

With accurate financial reports, law firms can plan better for expenses, staff costs, and growth. This prevents cash shortages and helps maintain stability.

How Legal Bookkeepers Ensure Compliance and Reduce Legal Risk

Law firms must follow strict compliance rules, especially regarding client funds and trust accounts. A legal bookkeeping expert helps reduce legal risk by:

Proper Trust Account Reconciliation

Legal bookkeeping expert reconciles trust accounts regularly. This helps prevent errors and ensures client funds are safe.

Accurate Record Keeping

Legal bookkeeping experts keep detailed records of all transactions. This makes it easier to prove compliance during audits.

Regular Review of Financial Policies

Legal bookkeepers help law firms review and improve their financial policies. This reduces the chance of mistakes and ensures compliance.

Audit-Ready Records

Legal bookkeeping expert keeps all records organized and ready for audits. This reduces stress and helps law firms avoid penalties.

The Benefits of Outsourcing Lawyers Bookkeeping

Many law firms choose to outsource lawyers bookkeeping to a professional firm. Outsourcing offers several benefits:

1. Cost Savings

Hiring a full-time bookkeeper can be expensive. Outsourcing allows law firms to get professional support at a lower cost.

2. Expert Knowledge

Outsourced legal bookkeeping experts have experience working with law firms. They know the rules and best practices for legal accounting.

3. Improved Accuracy

Professional bookkeepers reduce errors and ensure accurate records. This protects law firms from financial mistakes.

4. More Time for Lawyers

Outsourcing bookkeeping frees lawyers to focus on client work. They can spend more time practicing law rather than managing financial tasks.

5. Scalable Support

Outsourced bookkeeping can grow with the law firm. Whether a firm is small or large, outsourced services can adapt to their needs.

Case Study: Law Firm Saved from Financial Errors by Professional Bookkeepers

Case Study 1: Trust Account Error Prevention

A mid-size law firm was facing trust account discrepancies due to incorrect entries and poor reconciliation. Their financial records were messy, and they risked penalties. After hiring a professional legal bookkeeper, the firm:

- Cleaned up trust account records

- Reconciled client ledgers accurately

- Reduced errors and improved compliance

The firm avoided penalties and gained confidence in its financial system.

Why Meru Accounting Is the Right Choice for Law Firm Bookkeeping

At Meru Accounting, we specialize in legal bookkeeping services tailored for law firms. Our team understands the specific needs of law firms and provides accurate, audit-ready bookkeeping support.

Trust Account Management and Reconciliation

Ensuring client trust funds are managed correctly and reconciled regularly. This prevents trust account mistakes and keeps client money secure.

Client Ledger Tracking

Keeping accurate records of client transactions and balances. This helps law firms track every client payment and maintain transparency.

Accurate Billing and Invoicing

Preparing error-free invoices and managing billing records. This ensures timely payments and reduces billing disputes.

Case-Based Expense Tracking

Tracking expenses by case to help monitor profitability. This helps law firms understand which cases are profitable and which need improvement.

Monthly Financial Reporting

Preparing monthly financial statements to help law firms make informed decisions. This provides a clear view of cash flow and overall financial health.

Compliance Support and Audit Preparation

Ensuring financial records meet legal standards and are audit-ready at all times. This reduces the risk of penalties and audit issues.

With Meru Accounting, law firms can trust that their finances are handled correctly. Our professional legal bookkeepers help law firms stay organized, compliant, and financially secure.

Key Takeaways

- A legal bookkeeper is essential for law firms to avoid financial mistakes

- Law firms face common errors such as trust account mistakes, billing errors, and poor expense tracking

- A legal bookkeeping expert ensures accurate trust account management and billing

- Lawyers bookkeeping requires specialized knowledge and precise record-keeping

- Outsourcing lawyers bookkeeping offers cost savings, expert support, and improved accuracy

- Meru Accounting provides professional legal bookkeeping services to protect law firms from financial errors

FAQs

A legal bookkeeper is a specialist who handles bookkeeping for law firms, including trust accounts, client billing, and compliance.

Law firms need a legal bookkeeping expert because legal accounting rules are strict, and mistakes can lead to penalties and financial loss.

Yes, a legal bookkeeping expert helps manage trust accounts, track client funds, and reconcile records to prevent errors.

Legal bookkeeping involves specific tasks like trust account management, client ledgers, and case-based expenses, which are not part of general bookkeeping.

Outsourcing lawyers bookkeeping saves time and money, improves accuracy, and allows law firms to focus on client work.