How to Save Time on Property Management Accounts Payable

For property managers, the way of managing incoming and outgoing money is not as simple as it looks. It involves dealing with a lot of invoices, vendor calls, and never-ending approval chains. Property management accounts payable silently impacts on how smooth your business runs.

Managing bills, vendor payments, and service costs takes time. But time is one thing every property manager seems short of. What if you could save hours each week just by changing how you handle accounts payable? In this blog, we will look at some practical ways of saving time on property management accounts payable.

Understanding Property Management Accounts Payable

Every building needs something every now and then. Costs of repairs, cleaning, utilities, and maintenance are always ongoing. Accounts payable is simply the money you owe to others for such services.

But in property management, things can get messy fast. Each property might have its own set of vendors. You may also receive some bills late. Others might get misplaced in a pile of paper or stuck in someone’s inbox.

You may have a team that tries to manage everything on time. Yet invoices pile up, payments delay, and vendors start sending reminders. That’s how the cycle begins — endless follow-ups, repeated data entry, and confusion about who approved what.

Even though it feels routine, your payable system affects your whole business. When vendors get paid on time, relationships stay strong. When payments delay, you might face late fees or lose trust. Good payable management keeps your financial picture clear. You always know what’s due, what’s paid, and what’s coming next.

Why time gets wasted in managing Accounts Payable

Somewhere between receiving an invoice and making a payment, time disappears. Property management accounts payable may need hours every week to fix tiny errors or search for missing files. Let’s see where most of the time goes while managing property management accounts payable:

1. Manual Data Entry

Typing each invoice detail by hand can drain your energy. Mistakes may sneak in easily — a wrong amount or missed date. Once errors appear, fixing them can take double the time.

2. Missing or Misplaced Invoices

A single lost invoice can break the flow. You may spend half a day trying to find it, call the vendor again, or recheck your email threads.

3. Long Approval Chains

Some companies need three or more approvals before a payment is cleared. While this keeps control in place, it may also create bottlenecks.

4. Vendor Follow-ups

When payments delay, vendors start calling. Those small calls may take minutes, but they soon add up to hours of distraction.

5. Lack of Automation

Many property managers still work on paper or spreadsheets. That method feels simple at first but soon turns into a web of files. Without automation, every small task takes more time than it should.

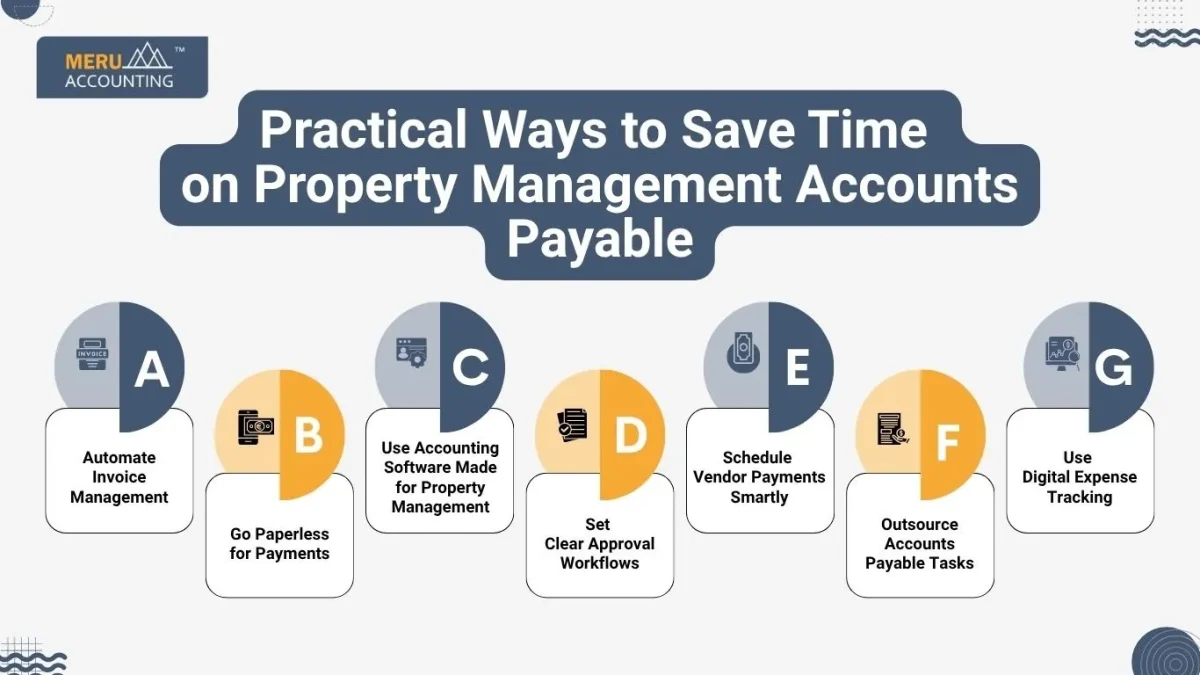

Practical Ways to Save Time on Property Management Accounts Payable

Time-saving may not come from big moves. Often, it comes from small daily habits and smart systems. Here are ways that can help you simplify property management accounts payable and gain back those lost hours.

A. Automate Invoice Management

Automation may sound complex, but it’s actually simple once set up. You can use software that scans invoices, extracts key details, and matches them with your records.

Instead of typing vendor names and amounts, the system does it for you. You only review and approve. That alone can cut hours of work every week.

What it can do for you:

- Auto-capture invoices from email

- Match them to purchase orders

- Flag duplicates or errors

- Keep everything stored in one place

B. Go Paperless for Payments

Paper checks and manual signatures eat up time. Switching to digital payments may solve that. Online transfers or ACH payments let you pay vendors in minutes.

Some property management systems even allow you to set recurring payments. That way, monthly bills like utilities or landscaping get paid automatically. You just review the list once and relax.

Why it helps:

- Less physical work

- No more check printing or mailing

- Easier to track payment records

C. Use Accounting Software Made for Property Management

Generic accounting tools may not suit property managers well. You deal with multiple properties, vendors, and tenants. You need a tool that can tag every transaction to the right property.

A good property management accounting system may handle payables, receivables, and reporting — all under one roof.

Look for software that can:

- Track each property separately

- Allow easy vendor setup

- Create automatic reports

- Link with your bank for quick reconciliation

D. Set Clear Approval Workflows

Approvals can be the biggest time sink if there’s no structure. Some invoices wait for days simply because no one knows who should approve them.

Create a simple workflow:

- Low-value bills can go to the property manager directly.

- Mid-range bills can go through one supervisor.

- Only high-value or unusual bills go to senior management.

When everyone knows their role, the process moves faster.

E. Schedule Vendor Payments Smartly

Instead of paying invoices one by one, pick a fixed schedule. Maybe twice a month. Gather all pending bills, review, and pay together.

This batch system keeps your focus sharp. It also helps vendors know when to expect payment, reducing those follow-up calls.

Tip: Keep a calendar alert for payment days. It keeps everyone aligned and avoids missed deadlines.

F. Outsource Accounts Payable Tasks

Sometimes, the best way to save time is to let experts handle it. Many property management firms outsource accounts payable to specialized bookkeeping companies.

These teams manage your vendor list, handle invoices, and make sure payments go out on time. You only get reports to review.

You may gain:

- More free time for property issues

- Fewer payment delays

- Professional handling of vendor communication

G. Use Digital Expense Tracking

Small property expenses often go unnoticed. A maintenance worker buys supplies. Someone pays for parking or cleaning materials. These small receipts may get lost.

Use a mobile app that lets staff snap a photo of receipts and upload instantly. That way, every expense is recorded in real time, and you don’t have to chase missing bills later.

Benefits of Streamlining Your Accounts Payable

A faster payable process doesn’t just save time. It changes how your whole operation feels. Let’s look at the benefits of automating property management accounts payable:.

1. Fewer Errors

Automation reduces human mistakes. You can trust your data more and spend less time double-checking figures.

2. Better Vendor Relations

Paying vendors on time builds trust. They may offer better rates, faster service, or priority scheduling.

3. More Time for Core Work

When your team isn’t stuck with data entry, they can focus on tenants, maintenance, or new properties.

4. Clearer Cash Flow

With an organized system, you always know what’s pending. No surprises at month-end.

5. Easy Auditing and Reporting

Everything stays recorded and accessible. You can pull up vendor histories, expense lists, and payment reports anytime.

Building a Simple Routine for Payables

Even the best software won’t help if there’s no routine in management. A small, steady process may save more time than you think. Here’s a simple weekly and monthly pattern that can work for most property managers.

Weekly Routine

- Review all new invoices once a week

- Check for duplicates or missing documents

- Approve small payments right away

- Schedule larger payments for your next batch day

Monthly Routine

- Reconcile your bank account with vendor payments

- Review total spending by property

- Look for any recurring issues like late invoices or missing details

- Send vendors a quick note if any payment is delayed

By following such a pattern, your payables stay under control, and surprises drop.

Common Mistakes That Waste Time

Even with the best intentions, some habits can slow you down. These are small errors but can turn into big time traps.

1. Ignoring Reminders

Sometimes, alerts come in, but you delay checking them. A missed reminder can turn into a late fee. Always respond quickly to your payable notifications.

2. Not Updating Records Regularly

If invoices are recorded only once a month, data piles up. A small weekly update can save you hours later.

3. Overlooking Small Bills

Tiny payments often slip through. Yet, when added together, they affect cash flow. Always track even minor bills like repair costs or cleaning supplies.

4. Mixing Property Records

Keeping all property expenses in one account may confuse reports. Always label invoices with the correct property name.

5. Waiting Till the Last Minute

Rushing payments near the due date increases the risk of mistakes. Process invoices a few days before they are due.

Managing property management accounts payable will become simpler after following everything mentioned in this blog. Every payment tells part of your business story — how organized you are, how you value vendors, and how well you manage time. Hence, it is a very essential part that determines how people may look and feel about your business.

Saving time doesn’t always mean doing less. Sometimes, it means doing smarter. With the right process, tools, and routine, you may find your payable tasks no longer eat up your week. If you aren’t able to spend time doing these things, the best solution is to outsource it.

At Meru Accounting, we offer outsourced property management accounts payable services. You will no longer need to look after outstanding payments. Our property management accounting experts will look after all your outstandings carefully. Contact us now to eliminate the burden of looking after payables.

FAQs

- What does property management accounts payable mean?

It means all the bills and payments a property manager must handle for vendors and services. - Why is accounts payable important for property managers?

It helps track expenses and ensures vendors are paid on time. - Can automation help with accounts payable?

Yes, automation can cut down on manual work and reduce errors. - What’s the best way to organize invoices?

Keep them stored digitally under clear property names and vendor categories. - How often should I review my payables?

Weekly reviews work best to catch mistakes early. - Should I still keep paper copies of invoices?

Not needed if you have secure digital backups of all documents. - What’s the risk of late vendor payments?

Late fees, poor vendor relations, and extra stress may arise. - How can software help save time?

It can process invoices, match payments, and auto-generate reports. - Is outsourcing accounts payable safe?

Yes, if you choose a trusted and experienced bookkeeping firm. - What makes property management payables harder?

Multiple vendors, properties, and service bills make tracking tough. - How can I handle small property expenses better?

Use expense tracking apps where receipts can be uploaded instantly. - What happens if I mix up property payments?

Reports may become unclear, and it could confuse your accounting. - Can I pay vendors in batches?

Yes, batch payments can save hours each week. - Should I use separate bank accounts for each property?

Many property managers do; it helps keep transactions clear. - How do I prevent duplicate payments?

Automation and software checks may alert you to duplicates. - What if an invoice gets lost?

Ask vendors for re-issues and keep all files digital next time. - Can approval delays be avoided?

Yes, by setting clear approval levels and roles for each invoice. - Why should I review cash flow monthly?

It helps you plan payments and avoid running short on funds. - Are property management accounting tools expensive?

Some are free or affordable, especially for small portfolios. - Can I manage accounts payable alone?

You can, but using tools or outsourcing may save more time.