Business leaders today face constant pressure. They must grow revenue, manage teams, and control costs at the same time. Finance plays a key role in all of this. Even small issues in finance can affect growth and trust. Accounts payable is one of the most important finance tasks. It controls how money leaves the business. Every vendor bill must be received, checked, approved, and paid on time. When this process fails, problems start to grow. Many businesses still manage accounts payable in house. At first, this seems fine. But as the business grows, the number of bills, vendors, and rules increases. The workload becomes heavy and slow. Leaders spend time fixing small issues instead of planning ahead. This is why more leaders are now choosing accounts payable outsourcing services.

These services help businesses manage payables in a clean and steady way. Leaders also decide to outsource accounts payable services so their teams can focus on higher value work. Outsourcing accounts payable is no longer only for large firms. Small and mid size businesses now see it as a smart and safe move. It helps them stay flexible, accurate, and in control. This blog explains what accounts payable outsourcing services are, why leaders trust them, the key benefits, and when it makes sense to outsource.

What Are Accounts Payable Outsourcing Services?

Accounts payable outsourcing services mean hiring an outside accounting team to manage your vendor bills and payments. This team follows your rules and approval steps while handling daily work.

You still control decisions. The outsourced team handles the process.

What These Services Cover

When businesses outsource accounts payable, they get support for:

- Vendor invoice receipt

- Invoice checks and review

- Approval follow ups

- Data entry into systems

- Payment scheduling

- Vendor support

- Payables reports

Some companies choose full outsourcing. Others choose partial support. It totally depends on need and comfort level.

Why Outsourcing Works Well

Accounts payable is a process driven task. It follows very clear steps. When experts manage these steps every day, results improve. This is why accounts payable outsourcing services work well across many industries.

Trusted by hundreds of business leaders, Meru Accounting makes accounts payable outsourcing simple and error-free. See how we can help you process invoices faster, pay vendors on time, and gain full control over your cash flow. Get your free consultation with one of our accounts payable experts.

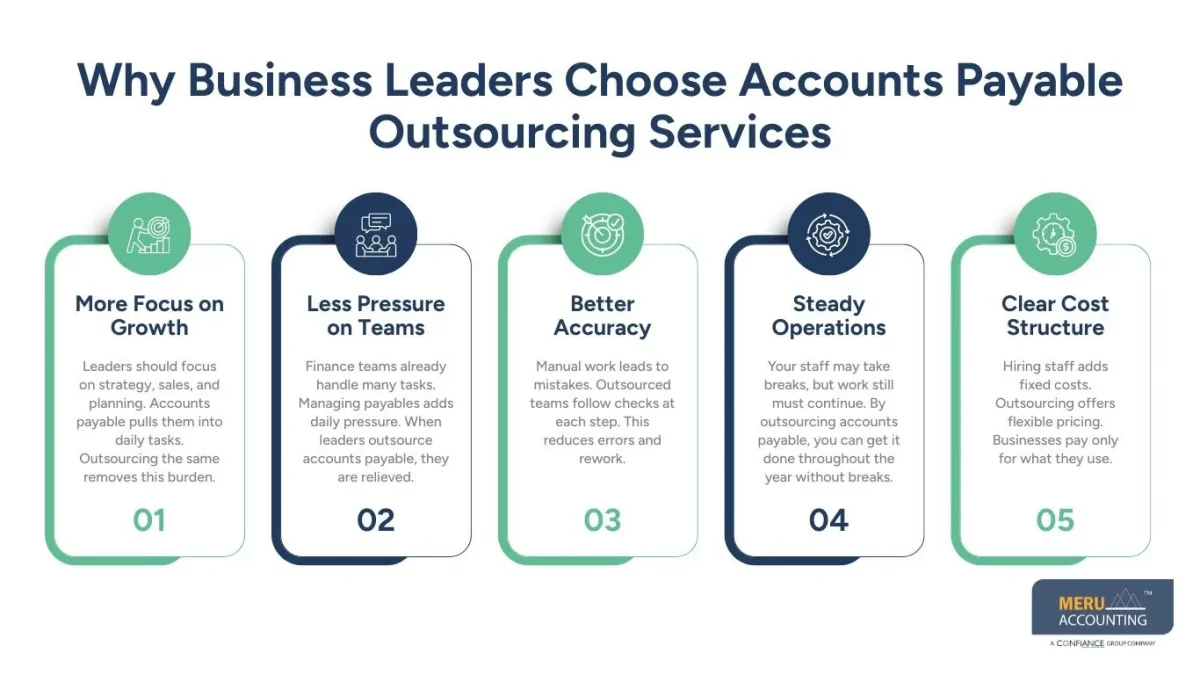

Why Business Leaders Choose Accounts Payable Outsourcing Services

Here’s why more and more business leaders are choosing outsourced accounts payable services:

1. More Focus on Growth

Leaders should focus on strategy, sales, and planning. Accounts payable pulls them into daily tasks. Outsourcing the same removes this burden.

2. Less Pressure on Teams

Finance teams already handle many tasks. Managing payables adds daily pressure. When leaders outsource accounts payable, they are relieved.

3. Better Accuracy

Manual work leads to mistakes. Outsourced teams follow checks at each step. This reduces errors and rework.

4. Steady Operations

Your staff may take breaks, but work still must continue. By outsourcing accounts payable, you can get it done throughout the year without breaks.

5. Clear Cost Structure

Hiring staff adds fixed costs. Outsourcing offers flexible pricing. Businesses pay only for what they use.

Key Business Benefits of Accounts Payable Outsourcing Services

Here are some key business benefits of outsourcing accounts payable:

Cost Control

Accounts payable outsourcing services help reduce costs linked to:

- Hiring and training

- Staff benefits

- Extra work hours

- Software upkeep

This helps businesses keep budgets stable.

Faster Invoice Processing

Bills are handled daily. Payments are planned on time. Late fees reduce.

Improved Vendor Trust

Vendors trust firms that pay on time. Strong trust leads to smooth business ties.

Better Cash Flow Planning

Clear reports show what is due and when. Leaders can plan cash with more ease.

Easy Scaling

As the business grows, bill volume grows too. Outsourced teams scale fast. No new hires are needed when you outsource accounts payable services.

Financial Control Benefits for Business Leaders

Clear Spend View

Outsourced reports show:

- Total open bills

- Paid bills

- Vendor wise spend

This helps leaders make smart choices.

Fewer Cash Surprises

With clear tracking, sudden payment shocks reduce.

Better Budget Planning

Accurate data helps plan future spend.

When business leaders outsource accounts payable services, finance data becomes easier to trust.

Expert teams help firms shift past data, fix old records, build neat workflows, and tune the tool so it matches the way the firm works. This saves time each day and avoids errors that can grow into bigger issues later.

Operational Benefits of Accounts Payable Outsourcing Services

Smooth Daily Flow

Bills move step by step without delay.

No Staff Gaps

Work continues even during leave or exits.

Easy Process Updates

Outsourced teams adapt quickly to new rules.

Faster Month End Close

Clean records help close books faster.

When Does It Make Sense to Outsource Accounts Payable Services?

Signs to Watch

It may be time to outsource if:

- Bills are often late

- Errors happen often

- Vendors complain

- Staff feel overloaded

- Cash flow feels unclear

Business Types That Benefit Most

Accounts payable outsourcing services work well for:

- Small businesses

- Mid size firms

- Growing startups

- Multi location firms

- Seasonal businesses

In these cases, leaders choose to outsource accounts payable services to regain control.

Risks of Managing Accounts Payable In House

High Error Risk

Manual data entry increases mistakes.

Vendor Trust Loss

Late payments hurt vendor ties.

Poor Cash Visibility

Unclear records cause stress.

Staff Burnout

Teams lose focus on key tasks.

Accounts payable outsourcing services reduce these risks.

Core Processes Included in Accounts Payable Outsourcing Services

Invoice Receipt

- Email invoices

- Vendor portals

- Digital scans

Invoice Review

- Vendor match

- Amount check

- Tax check

Approval Support

- Rule based routing

- Follow ups

- Status tracking

Data Entry

- Correct coding

- Clean records

- System updates

Payment Handling

- Due date planning

- Timely payments

- Proof storage

Vendor Support

- Query handling

- Issue resolution

- Vendor data updates

Reporting

- Aging reports

- Spend summaries

- Cash outflow view

These steps form the base of strong accounts payable outsourcing services.

How Accounts Payable Outsourcing Services Support Business Growth

Easy Scaling

More bills do not mean more staff.

Faster Expansion

New vendors are added with ease.

Better Control During Growth

Processes stay strong even as volume grows.

This is why growing firms outsource accounts payable services.

Why Choose Meru Accounting for Accounts Payable Outsourcing Services

Meru Accounting offers reliable and flexible accounts payable outsourcing services designed for real business needs.

Our Working Style

- Clear workflows

- Skilled teams

- Strong checks

- Simple reports

We work as part of your finance team.

What You Gain with Meru Accounting

- Fewer payment errors

- On time vendor payments

- Clear payables data

- Reduced staff pressure

When you outsource accounts payable services to Meru Accounting, you gain peace of mind.

Our accounts payable outsourcing services grow with your business and adapt to your needs.

Our Accounts Payable Outsourcing Services Include

At Meru Accounting, we provide comprehensive accounts payable outsourcing services to help your business save time, reduce errors, and manage payments efficiently. Our services cover all key processes, so you can focus on growing your business.

1. Invoice Processing

- Capture and record all incoming invoices

- Verify invoice details and check for errors

- Match invoices with purchase orders and contracts

- Route invoices for approvals in a timely manner

2. Payment Management

- Schedule and make payments on time

- Use multiple payment methods: checks, ACH, or wire transfers

- Ensure accurate and error-free payments

- Apply early payment discounts wherever possible

3. Vendor Management

- Maintain accurate vendor records and contacts

- Handle vendor queries and resolve disputes

- Track payment terms and ensure compliance with contracts

4. Reporting and Analytics

- Provide detailed reports on payments, pending invoices, and vendor balances

- Track key metrics such as processing times and discounts captured

- Offer insights to improve cash flow and working capital

5. Compliance and Audit Support

- Ensure adherence to local rules and tax regulations

- Maintain proper documentation for audits

- Provide records and reports in a clear, organized manner

6. Automation and Technology

- Use modern software and automated workflows for accuracy and speed

- Reduce manual errors and improve efficiency

- Enable real-time visibility of accounts payable data

By choosing Meru Accounting, you can outsource accounts payable services with confidence, knowing your bills, payments, and records are in expert hands. Our approach ensures your financial operations run smoothly while you focus on your core business.

Key Takeaways

- Accounts payable controls cash flow

- In house payables often struggle as firms grow

- Accounts payable outsourcing services improve speed and accuracy

- Firms that outsource accounts payable services gain control and time

- Meru Accounting delivers trusted payables support

FAQs

These services involve using an outside team to manage vendor bills, payments, and reports.

Small, mid size, and growing businesses benefit the most from outsourcing their accounts payable.

No. You can keep approval rights and process control to yourself.

Yes. At Meru Accounting, we use strong data security steps for our outsourced accounts payable services.

Meru Accounting offers simple, secure, and scalable accounts payable outsourcing services.