A Step-by-Step Guide on How to Do Payroll Online Processing

Online payroll processing is a smart and easy way for businesses to pay their workers using the internet. The payroll process becomes faster and more accurate when done online. Businesses collect employee data, set up payroll software, and let the system do all the work, like calculating salaries, taxes, and sending out payslips. The best part is that workers can check their pay anytime using a self-service portal. If a business wants to know how to do payroll online, it just needs to follow a few simple steps. Online payroll makes life easier for both business owners and employees.

What Is the Payroll Process?

Every business has workers. And workers need to be paid for their hard work. That’s where payroll comes in.

- Calculating how much money each person should get

- Taking out the correct taxes

- Giving out payslips (salary slips)

- Keeping records for future use

Now, many businesses do this using the internet. This is called online payroll processing. It’s a smart, fast, and easy way to manage payments using computers and payroll software. Online payroll processing is like having a helper that works 24/7 and never gets tired.

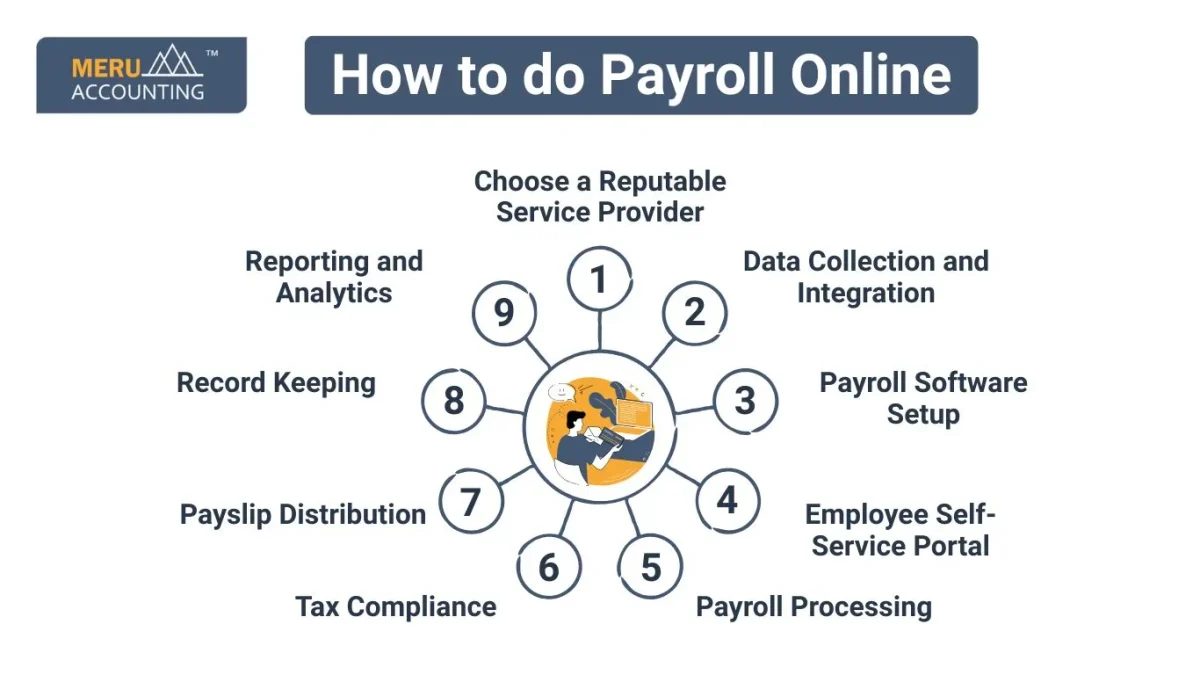

How to do Payroll Online

Step 1: Choose a Reputable Service Provider

The first step is picking a trusted company that offers payroll services online. It’s like choosing a good school if you want one with smart teachers (in this case, experts).

Many companies in India outsource payroll processing services to experienced firms. These companies know how to handle payroll correctly and on time.

Step 2: Data Collection and Integration

Now it’s time to collect important details about your employees:

- Full name

- Job title

- Salary amount

- Tax details

- Bank account info

This information is added to the payroll system. Good data helps everything go smoothly.

Step 3: Payroll Software Setup

Next, your service provider will set up special payroll software for your company.

This software does many things, like:

- Calculate salaries

- Deduct taxes

- Add bonuses or overtime pay

- Handle special rules your company follows

It’s like a calculator that understands how your company pays people!

Step 4: Employee Self-Service Portal

A self-service portal is a webpage where employees can:

- Download their payslips

- Check their tax forms

- See how much money they’ve earned

This portal saves time and gives employees more control. It can also match your company’s logo and colors to feel more personal.

Step 5: Payroll Processing

Now comes the important running of the payroll process.

The payroll software will:

- Count the number of days each employee worked

- Add any bonuses or extra hours

- Subtract the taxes

- Calculate the final salary (called net pay)

This step is the heart of the payroll process. Computers do the math quickly and correctly.

Step 6: Tax Compliance

Every business must follow the government’s tax rules.

Payroll software helps with that by:

- Taking out the right amount of tax

- Making sure tax documents are filed on time

- Updating rules automatically when tax laws change

This keeps the business safe from fines or trouble.

Step 7: Payslip Distribution

Once the salary is ready, it’s time to give payslips to the employees.

They can get it through:

- The self-service portal

- Other safe online ways

Step 8: Record Keeping

Businesses must keep records of:

- Who got paid

- How much tax was paid

- Bonuses and deductions

- Employee info

This is helpful for audits, fixing mistakes, or showing the government how money was handled. Online systems keep these records safe and ready anytime.

Step 9: Reporting and Analytics

Online payroll systems also create reports that help businesses:

- See where money is being spent

- Plan for the future

- Find ways to save money

These reports often include charts and graphs that make the data easy to understand.

Challenges in Online Payroll Processing

Using the internet to do payroll can save time and effort. But like anything else, there are some problems that can happen. Let’s look at the common challenges in the payroll process:

1. Wrong Data Entry

The whole payroll process gets into a mess due to any typing error.For example, if you enter the wrong work hours or pay rate, the employee might get paid too little or too much.

2. Internet Problems

Online payroll needs a good internet connection. If the internet stops working or is too slow, you may not be able to log in or finish the payroll on time.

3. Keeping Data Safe

Privacy is very important, even if it includes employee details like salaries, bank account numbers, and tax info. Hackers may try to steal this data, so online payroll systems need strong security.

4. Changing Tax Rules

Tax laws can change often. If the payroll process doesn’t update to match new rules, the company could make mistakes when paying taxes.

5. Learning the Software

People might need training to use the system. Because some people may find it hard to learn how to do payroll online.

Why Choose Online Payroll Processing?

Even though there are a few challenges, online payroll comes with many great benefits! Here’s why many businesses choose to do the payroll process online:

1. Saves Time

The system does a lot of work for you, like calculating pay, tax, and more. This makes payroll online faster and easier than doing it by hand.

2. Fewer Mistakes

Computers are good at math! They help avoid human mistakes when calculating hours, tax, or bonuses.

3. Keeps Data Safe

Online payroll tools use special safety features to protect important employee information. It’s safer than keeping paper records.

4. Easy for Employees

Workers can log in anytime to check their payslips, tax forms, or leave balance right from their phone or computer.

5. Follows Tax Rules

One of the best things about how to do payroll online is that the system gets automatic updates when tax laws change, so your business stays compliant.

6. Quick Reports

With just a few clicks, you can get reports to see how much money is being spent on salaries, taxes, or overtime.

7. Works for All Business Sizes

It doesn’t matter if your company is small or big, how to do payroll online works well for every size of business.

8. Eco-Friendly

Since everything is digital, there’s no need to print papers. This saves trees and helps protect the environment.

In the business world, where every moment is important, using online payroll processing is a smart idea. It helps businesses save time, avoid mistakes, keep employee information safe, follow tax rules, and spend more time growing the company.

If you need any help, Meru Accounting is a great choice. We offer fast, safe, and professional payroll services that work well for businesses of any size..

FAQs

Q1: What is the payroll process?

A: The payroll process is how businesses pay their workers. It includes calculating salaries, deducting taxes, and giving out payslips.

Q2: Why is online payroll better than doing it by hand?

A: Online payroll is faster, more accurate, and saves time. It also helps avoid mistakes that can happen when doing it by hand.

Q3: Can small businesses use online payroll too?

A: Yes! Online payroll services are made for both small and large businesses. Even a small team can benefit from using it.

Q4: Is employee information safe in online payroll?

A: Yes, trusted payroll companies use secure systems to protect all employee data.

Q5: What happens if tax rules change?

A: Good payroll software updates automatically, so businesses always follow the newest tax rules.