Experience Hassle-Free

Paychex Flex Payroll Solutions

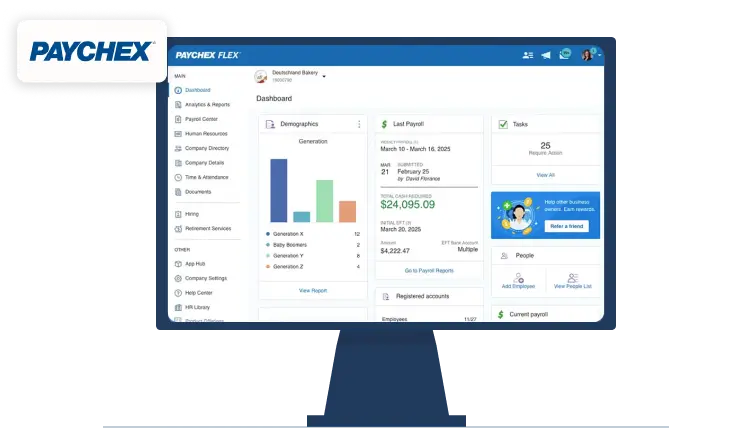

What Is Paychex Flex?

Paychex Flex is a cloud based system designed to manage employee pay, tax filings, and payroll tasks from one place. It helps businesses process payroll accurately while keeping pay schedules, deductions, and compliance aligned. With Paychex, payroll runs stay smooth, timely, and easy to manage even as teams grow.

Paychex Flex also connects payroll data with wider accounting and payroll administration tasks. A Paychex payroll specialist can review pay runs, check tax details, and confirm reports before final processing. By using Paychex Flex daily, business owners gain better control over wages, taxes, and records, while reducing manual work and payroll stress.

Role of a Paychex Flex Payroll Specialist in Daily Operations

A Paychex Flex payroll specialist manages daily payroll activities such as employee data updates, time entry checks, and pay rule validation. They make sure hours, salaries, bonuses, and deductions are applied correctly before each payroll cycle. This daily oversight helps prevent pay errors and keeps employee trust strong. By managing payroll details on a routine basis, the specialist helps ensure pay runs stay accurate and on schedule. They also review alerts and system updates inside the software to catch changes that may affect payroll. This consistent attention reduces last minute fixes and keeps payroll work predictable.

Beyond payroll processing, the dedicated specialist also supports daily accounting and payroll administration tasks. They align payroll data with accounting records, track tax liabilities, and flag issues early. With Paychex Flex reports reviewed regularly, businesses gain clean records, fewer corrections, and better control over payroll costs and compliance needs. This ongoing review helps prevent reporting gaps and supports smoother period close activities. It also gives business owners clearer visibility into labor expenses and payroll trends.

Why Choose Paychex Flex Payroll Solutions?

The right payroll platform shapes how easy it is to manage people and pay. Paychex Flex payroll solutions help businesses handle wages, taxes, and employee data with confidence. It supports accurate pay runs while reducing manual effort. This makes Paychex a dependable choice for growing businesses that need reliable payroll solutions.

Built for accurate payroll processing

Paychex is designed to manage hourly, salaried, and contract payroll with ease. It supports different pay schedules and employee types without confusion. This structure helps reduce missed payments and keeps payroll records consistent.

Clear tax handling and compliance support

The system calculates payroll taxes and supports timely filings. This helps businesses stay aligned with changing tax rules. Clear tax handling lowers risk and reduces last minute compliance stress.

Simple payroll views and insights

Paychex provides easy views of payroll totals, deductions, and trends. These insights help business owners understand labor costs better. Clear data supports smarter planning and cost control.

Timely pay runs and steady cash planning

With organized payroll data, pay runs are processed on time. This helps employees get paid without delay and supports smooth cash flow planning. Reliable payroll timing builds trust across teams.

Connects with accounting and HR tools

Paychex links payroll with other systems used for accounting and workforce management. This reduces duplicate work and keeps data aligned. Integrated records make reviews and reporting easier.

Our Paychex Flex Payroll Solutions

Our Paychex Flex payroll solutions support the full payroll cycle, from employee setup to tax reporting and reviews. We help businesses maintain accurate payroll data while keeping records organized. With guidance from experienced Paychex Flex professionals, payroll operations stay simple, stable, and stress free.

We set up employee profiles, pay rates, tax details, and pay schedules based on your business structure. Each setup is reviewed carefully to avoid future errors. A clean setup helps payroll run smoothly from the start.

We handle regular payroll processing using Paychex payroll software. Every pay run is reviewed for accuracy before final submission. This helps prevent incorrect payments and reduces employee queries.

We manage payroll tax calculations and filing tasks within Paychex. This ensures taxes are calculated correctly and submitted on time. Proper tax handling helps avoid penalties and compliance issues.

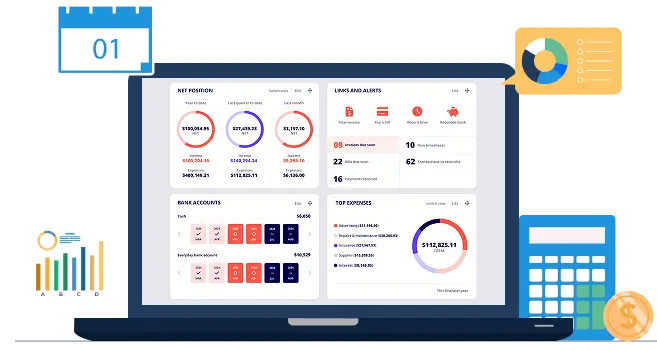

We match payroll records with accounting data at the end of each period. Our team reviews totals, fixes mismatches, and prepares payroll summaries. This keeps books clean and ready for reporting.

We provide clear payroll reports covering wages, taxes, and deductions. These reports help track labor costs and payroll trends. Ongoing support ensures payroll processes adjust smoothly as your business changes.

Trusted by businesses of all sizes, our Paychex payroll solutions simplify pay processing and workforce management. Learn how we help you stay compliant, pay employees on time, and keep payroll records clear. Get your free consultation with our Paychex experts.

Paychex Flex Features & Integrations

Paychex Flex becomes even more effective with add-on features that extend payroll and workforce tools. These features help manage employees, benefits, and reporting with ease. We help configure and support these options so your payroll system stays efficient and reliable. Let’s have a look at the features offered by Paychex software:

Payroll Services

- Small Business Payroll: Tailored payroll solutions for businesses with 1-19 employees.

- Midsize to Enterprise Payroll: Scalable payroll services for organizations with 20-1000+ employees.

- Compare Payroll Packages: Evaluate and choose the payroll package that best suits your company’s needs.

- Switch Payroll Companies: Seamless transition when switching payroll service providers.

- ERTC Service: Expert assistance with the Employee Retention Tax Credit program.

- Payroll Tax Services: Ensuring accurate payroll tax calculations, filings, and compliance.

Employee Benefits

- Group Health Insurance: Offering health insurance options to support employee well-being.

- HSA, FSA & More Benefits: Administering health savings and flexible spending accounts.

- Retirement Services: Helping employees plan for the future with retirement benefit options.

- Benefits Administration Services: Streamlined benefits management for employees.

HR Services

- HR Consulting: Expert guidance on HR matters to ensure compliance and best practices.

- Employee Onboarding: Simplifying the onboarding process for new hires.

- Hiring Services: Assistance with the hiring process, from recruitment to onboarding.

- PEO (Professional Employer Organization): Comprehensive HR services, including HR administration, payroll, and benefits.

- Time & Attendance: Tools and solutions for tracking employee time and attendance.

- Time Clocks: Physical and digital time clock solutions for accurate attendance tracking.

- Product Integrations: Seamless integration with various business software and tools for enhanced efficiency.

Business Insurance

- Workers’ Compensation: Providing coverage for workplace injuries and illnesses.

- General Liability: Protection against common business liabilities.

- Umbrella: Additional liability coverage to safeguard your business.

- Cyber Liability: Insurance against cyber threats and data breaches.

- Commercial Property: Coverage for your business property and assets.

Business Solutions

- Self-employed: Tailored services for solo entrepreneurs and freelancers.

- 1-19 employees: Services designed to meet the needs of small businesses.

- 20-49 employees: Solutions for growing businesses.

- 50-1000+ employees: Scalable services for larger organizations.

- Solutions by Industry: Industry-specific solutions to address unique challenges and compliance requirement

Common Paychex Flex Integrations

Paychex Flex integrates with several systems to keep payroll and accounting data aligned. These integrations reduce manual entry and improve accuracy across platforms.

These integrations help Paychex payroll solutions stay efficient and dependable as businesses scale.

Banking Platforms

Support direct deposit and payroll funding

Time Tracking Tools

Connect hours worked directly to payroll

Expense Systems

Link reimbursements to payroll

Accounting Software

Sync payroll data with financial records

Tax Platforms

Assist with filings and compliance reporting

HR Systems

Align employee records and job details

Benefits Providers

Manage deductions and employee benefits

Document Systems

Store payroll records securely

Reporting Tools

Export payroll data for review and planning

Industries / Businesses We Serve with Paychex Payroll

Our Paychex payroll solutions support businesses across many industries. We help manage wages, taxes, and payroll records with accuracy and care. Businesses using our services save time, reduce payroll errors, and gain clearer payroll visibility.

Small Businesses

Ideal payroll software for small business teams that need simple and reliable pay runs.

Professional Services

Manage staff payroll, bonuses, and deductions accurately.

Retail Businesses

Handle hourly wages, shifts, and payroll cycles with ease.

Healthcare Providers

Support compliant payroll processing for diverse staff roles.

Growing Companies

Scalable payroll solutions that adapt as teams expand.

Hospitality Businesses

Manage variable hours and seasonal payroll needs smoothly.

Manufacturing Units

Track wages, overtime, and payroll costs clearly.

With our support, Paychex becomes a strong payroll system that fits your business needs and growth plans.

Why Businesses Trust Our Paychex Payroll Solutions

Businesses trust our Paychex payroll solutions because we bring consistency, accuracy, and practical payroll expertise. Our team understands Paychex payroll software and handles payroll tasks with care. Here’s why clients rely on us:

Paychex Flex expertise

Our specialists understand the platform deeply and manage payroll tasks with confidence. They ensure every payroll run follows correct rules and setup.

Accurate payroll and clean records

We focus on precise payroll processing and reporting. This helps businesses avoid errors and keep payroll records dependable.

Tailored payroll setup

We configure Paychex based on your business structure and pay policies. This ensures payroll runs match your real operations.

Smooth system connections

We integrate Paychex with accounting and HR systems. This keeps payroll data aligned and reduces repeat work.

Ongoing payroll support

We provide continued help as payroll needs change. Businesses trust us to keep payroll running smoothly year after year.

With our Paychex payroll solutions, businesses gain reliable pay runs, clear records, and better payroll control.

Payroll mistakes should not slow down your business.

Managing payroll can feel complex as teams grow and rules change. Let our Paychex Flex payroll solutions handle your pay runs, tax tasks, and payroll reports with care and accuracy. Save time, reduce errors, and keep payroll on track—starting today.

FAQ's

Most setups take 3 to 7 business days, depending on employee count and payroll structure.

Yes. It works well as payroll software for small business teams and growing companies.

Yes. The system uses strong security controls and access rules to protect payroll data.

Yes. Paychex offers clear reports for wages, taxes, and payroll summaries.

Yes. It supports accounting and payroll administration by syncing payroll data with accounting systems and reports.