Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

Bookkeeping for Aviation Industry

Hire Remote Bookkeeper, Accountant, Tax return Preparer or Admin Person

Monthly Bookkeeping, Payroll, Financial Statements or Tax returns for Business Owners

Aviation Accounting and Bookkeeping: Expert Financial Solutions for the Airline Industry

Aircraft design, build, flight, and upkeep are all parts of the aviation industry, along with airport, airline, and air traffic control work. This is a cost-heavy, rule-bound field where fuel, upkeep, staff, and gear are key costs, and precise aviation accounting ensures these expenses are tracked accurately. Accounting for the airline industry is vital to track costs, control cash, check ticket and cargo income, and meet strict legal rules.

Bookkeeping in the airline industry accounting helps firms keep records clean, make data-backed choices, and stay ready for audits. To stay in profit, raise funds, and make smart plans, firms must keep clear books. Meru Accounting offers expert aviation accounting and bookkeeping services tailored to this field. Our methods are built for the demands of the sector, ensuring clarity and accuracy. Meru helps firms handle funds well using smart tools and deep knowledge, keeping them in line with rules and in strong shape.

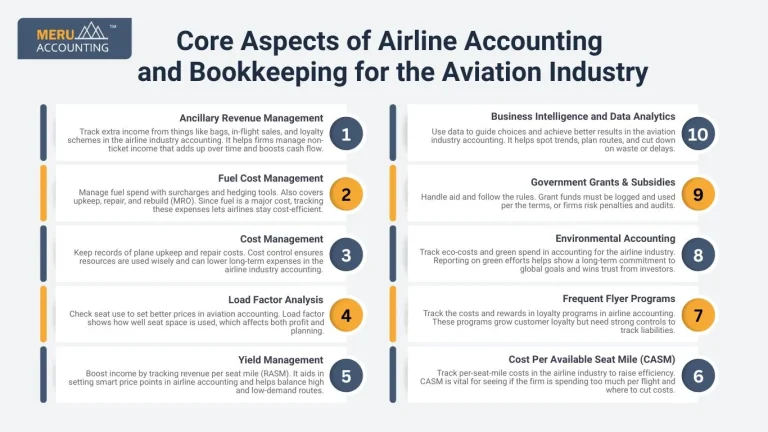

Core Aspects of Airline Accounting and Bookkeeping for the Aviation Industry

Accounting for the aviation industry is key to smooth running. Below are the core parts of sound financial control:

1.Ancillary Revenue Management

- Track extra income from things like bags, in-flight sales, and loyalty schemes in the airline industry accounting. It helps firms manage non-ticket income that adds up over time and boosts cash flow.

2.Fuel Cost Management

- Manage fuel spend with surcharges and hedging tools. Also covers upkeep, repair, and rebuild (MRO). Since fuel is a major cost, tracking these expenses lets airlines stay cost-efficient.

3.Cost management

- Keep records of plane upkeep and repair costs. Cost control ensures resources are used wisely and can lower long-term expenses in the airline industry accounting.

4.Load Factor Analysis

- Check seat use to set better prices in aviation accounting. Load factor shows how well seat space is used, which affects both profit and planning.

5.Yield management

- Boost income by tracking revenue per seat mile (RASM). It aids in setting smart price points in airline accounting and helps balance high and low-demand routes.

6.Cost Per Available Seat Mile (CASM)

- Track per-seat-mile costs in the airline industry to raise efficiency. CASM is vital for seeing if the firm is spending too much per flight and where to cut costs.

7.Frequent Flyer Programs

- Track the costs and rewards in loyalty programs in airline accounting. These programs grow customer loyalty but need strong controls to track liabilities.

8.Environmental Accounting

- Track eco-costs and green spend in accounting for the airline industry. Reporting on green efforts helps show a long-term commitment to global goals and wins trust from investors.

9.Government Grants & Subsidies

- Handle aid and follow the rules. Grant funds must be logged and used per the terms, or firms risk penalties and audits.

10.Business intelligence and data analytics

- Use data to guide choices and achieve better results in the aviation industry accounting. It helps spot trends, plan routes, and cut down on waste or delays.

Why Aviation Requires Specialized Accounting

The aviation industry brings unique financial needs that go beyond general practice. High asset costs, tax across borders, and strict rules require a custom approach. Aviation accounting meets these needs with systems made for the real-world demands of flight operations.

1. High-Value Assets & Depreciation

Aircraft and parts cost a lot and need the right long-term tracking. Airline accounting should:

- Track asset value with smart depreciation

- Align with rules like ASC 360 and IFRS

- Plan for sale, upgrade, or phase-out of key assets

2. Maintenance Reserve & Lease Accounting

In airline industry accounting, leased aircraft must follow strict terms. Aviation accounting helps:

- Log and track reserve funds and usage

- Record major work and assign costs right away

- Comply with ASC 842 and IFRS 16

3. Multi-Jurisdictional Tax Exposure

Airlines often fly across many states and nations. Effective airline industry accounting includes:

- Handling VAT, sales, and use taxes

- Managing fuel tax and green levies

- Tracking charter and cargo tax across regions

4. Complex & Variable Revenue Streams

Income in the airline industry shifts and comes from many sources. Airline industry accounting covers:

- Fares, add-on fees, and upgrades

- Cargo and charter deals

- Points and loyalty programs

- Deferred or split revenue

5. Regulatory & Audit Readiness

Airlines face tight rules and must pass checks, making accounting for the airline industry critical for compliance.

- Clear and correct reports

- Compliance with FAA, EASA, IATA, and tax offices

- Reports tied to real metrics, like flight-hour cost

Benefits of Accounting for Aviation Industry

Sound books bring many gains to the aviation industry:

- Tax optimization: Lower tax bills and stay in line with complex tax rules. A strong tax plan also avoids audits and improves net gain.

- Investor relations: Share clear data to build trust and raise capital. With full and neat reports, firms look more reliable to lenders and buyers.

- Risk management:Spot and cut risks from fuel costs or slowdowns. Good risk plans help firms stay stable even when markets shift.

- Sustainability Reporting: Track and show social and eco-results. It’s a key factor for ESG-focused investors and long-term planning.

- Digital transformation: Use tech to improve finance tasks. Tech cuts errors and lets staff spend time on high-value jobs.

- Support for Mergers and Acquisitions: Offer strong due diligence and reviews for deals. These checks make mergers smooth and help spot weak spots early.

Needs of Accounting for Aviation Industry

The airline industry accounting must address its unique needs:

Revenue recognition

Track income from flights, freight, and extras. Different services need different rules, which must be logged correctly.

Expense Management

Track key costs like fuel, staff, and fees. It helps in cost-cutting and better budget use across departments.

Inventory management

Track parts, tools, and in-flight goods. Clear records prevent waste and help maintain safety standards.

Asset Management

Log planes and parts' cost, life, and sale. This ensures fair value is recorded and aids in maintenance plans.

Payroll management

Pay staff on time and meet benefit rules. Aviation jobs often include shift work and hazard pay, making payroll complex.

Software Used in Aviation Accounting

In aviation accounting, firms need tools that track assets, taxes, and costs. Below are some top software for aviation accounting.

1. Aviation InterTec (AMS)

Overview:

AMS is made for aviation accounting. It helps airlines, charter firms, and leasing firms.

Key Features:

- Aircraft Costs: Tracks cost and depreciation.

- Maintenance Reserves: Tracks maintenance funds.

- Multi-Currency: Handles taxes and money in many countries.

- Reports: Makes custom reports for finance.

2. Ramco Aviation Software

Overview:

Ramco helps with aviation accounting and operations. It works for airlines and MROs.

Key Features:

- Cost Control: Shows real-time data.

- Asset Tracking: Tracks plane costs over time.

- Forecasting: Helps predict income and costs.

- Compliance: Meets FAA and IATA rules.

3. Oracle NetSuite

Overview:

Oracle NetSuite is a cloud tool for aviation accounting, mixing finance with operations.

Key Features:

- Consolidation: Links all units in one system.

- Depreciation: Tracks a plane’s value over time.

- Multi-Currency: Works for global aviation firms.

- Reports: Provides useful data for choices.

4. AeroDocs by Viasat

Overview:

AeroDocs tracks documents and links to aviation accounting systems. It’s used by airlines and MROs.

Key Features:

- Maintenance Tracking: Ties costs to data.

- Compliance: Keeps records for audits.

- Integration: Works with other systems.

- Document Control: Tracks all aircraft documents.

5. AVIATION (by Honeywell)

Overview:

Honeywell helps with aviation accounting and MRO costs.

Key Features:

- Maintenance Costs: Tracks costs like labor and parts.

- Reserve Funds: Manages funds for maintenance.

- Revenue: Tracks income from leases.

- Tax Compliance: Follows tax rules.

6. SaaS Accounting Solutions (QuickBooks Online, Xero)

Overview:

QuickBooks and Xero are cloud tools. They’re good for smaller aviation firms.

Key Features:

- Expense Tracking: Tracks fuel, payroll, and costs.

- Invoices & Payments: Manages payments and invoices.

- Multi-Currency: Works for global payments.

- Reports: Simple reports for quick checks.

7. Aviation Financial Systems (AFS)

Overview:

AFS is a big tool for aviation accounting. It works for larger airlines and charter firms.

Key Features:

- Ledger: Tracks all records.

- Revenue: Manages income from services.

- Reports: Makes detailed reports for audits.

- Lease Management: Tracks aircraft leases.

8. AeroFinancials

Overview:

AeroFinancials is a cloud tool for aviation accounting. It helps with taxes and fleet costs.

Key Features:

- Depreciation: Tracks plane value.

- Tax Reports: Handles tax for many regions.

- Fleet Costs: Checks fleet performance.

- Integration: Links to other tools.

Why Choose Meru Accounting?

Meru Accounting is a trusted expert in aviation accounting, offering tailored financial services for airlines, airports, and aviation support firms. Our deep knowledge of accounting for the airline industry allows us to meet the sector’s complex needs with accuracy, speed, and compliance. Below are the key reasons aviation businesses choose Meru:

- Industry Knowledge: Our team knows the field’s rules, costs, and income needs. We’ve helped firms of all sizes solve finance pain points and grow.

- Regulatory Compliance: We meet legal and tax rules (FASB, IASB). These rules shift often, and we make sure you're always updated and audit-ready.

- Risk management: We help deal with fuel cost spikes and delays. Our plans help clients hold steady through tough markets.

- Data Analytics: Use trends to boost profit and cut waste. With clear dashboards, clients can act fast and improve decision-making.

- Global Reach: We handle multi-national tax and finance needs. From exchange rates to local tax codes, we make cross-border work easier.

- Technology Integration: We use smart tools to cut errors and save time. Our software picks are tailored to your firm’s size and scope.

Services Offered by Meru Accounting

Meru Accounting delivers a wide range of bookkeeping and accounting services tailored for the aviation industry. We focus on the core financial functions that aviation firms need to stay compliant, manage costs, and grow in a fast-paced, capital-heavy environment. Each service is designed with industry-specific needs in mind, making us a leader in aviation accounting.

Lease Accounting

Manage lease terms per ASC 842 and IFRS 16. We track all lease types to reflect real costs and avoid under- or over-reporting.

Fuel Hedging

Log hedge contracts to lower price risks. This service gives you control over a large and volatile cost, keeping budgets stable.

Revenue Recognition

Record cargo and flyer program income per IFRS 15. This service helps avoid misstating income and ensures trust from investors.

MRO Accounting

Track repair costs and meet compliance. It helps with budget planning and shows the full cost of keeping planes in service.

Regulatory Compliance

Meet all laws and avoid fines. We stay ahead of global and local rules so you don’t miss critical deadlines or updates.

Data Analytics

Find ways to grow profit and run lean. Our custom tools help firms see trends in real time and act before problems grow.

Financial Statement Preparation

Create clean reports to guide decisions. These reports meet both local and global standards and suit audit needs.

Budgeting and Forecasting

Plan funds and future growth well. With clear forecasts, firms can plan routes, fuel needs, and hiring with ease.

Meru Accounting offers full bookkeeping and accounting for the aviation industry, built to meet the sector’s special needs. We understand the small details, like tracking spare parts or hedge contracts, and the big ones, like meeting global tax rules. With the right tools and skills, we help firms track spend, income, and rules. We guide firms to smart plans, face industry shifts, and reach peak results. Our support helps build trust with investors, stay clear of the law, and grow in a tough field. Our goal is to give aviation firms a clear view of their money, so they can fly higher with full control of their future.

High-value assets, complex income streams, and multi-country taxes make aviation accounting key for compliance and cost control.

It tracks fuel spend, hedging deals, and upkeep costs, helping airlines cut costs and plan budgets well.

Bookkeeping logs ticket, cargo, and extra income, giving correct reports and aiding pricing choices.

We keep all records in line with FAA, EASA, IATA, and tax rules, making airlines audit-ready always.

Tools like Aviation InterTec, Ramco, Oracle NetSuite, and AeroFinancials track costs, taxes, leases, and depreciation well.

It checks costs and debts of frequent flyer schemes, keeping rewards and finances correct.

It cuts taxes, manages risks, aids investor trust, and drives data-based decisions for profit and growth.

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

Help you with switching from your traditional software to Xero and Quickbooks.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

When you choose to outsource your accounting work with us, it benefits you in the following ways:

- 1. Cost-saving

- 2. Access to skilled and experienced professionals

- 3. Better management of books of accounts

- 4. Decreased chances of errors

- 5. Improve business efficiency

- 6. De-burdens in-office employee’s dependency

- 7. Better turnaround time

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.