Why Maintaining 7 Years of Tax Records Matters in the UAE

Keeping 7 Years of Tax Records in the UAE may seem hard, but it gives clear help for businesses and people. The UAE grows fast, and tax rules may change at any time. Keeping records for seven years may help firms and freelancers track money well. Businesses may also plan and control costs with less risk of mistakes.

Maintaining 7 Years of Tax Records may also protect firms from audits and fines. Tax officials may ask for old records to check compliance. Organized records may save time and cost during checks. They may also guide planning, investments, and long-term growth.

Understanding 7 Years of Tax Records in the UAE

Types of records

The term 7 Years of Tax Records may cover company, VAT, and personal files. Keeping records may show clear money flow and reduce disputes. Past files may help firms see income and cost trends. Consistent records may also make reporting and planning easier.

Why UAE ask for records

Officials may ask firms to keep records to check tax rules. Proper records may make audits less stressful. 7 Years of Tax Records may act as proof if disputes arise. Clear records may also show a firm is skilled and reliable.

Why UAE Law May Require 7 Years of Tax Records

Audit readiness

Officials may request records anytime to check the money. Firms may face problems if documents are not well kept. Keeping files may reduce fines and simplify audits. Records may also show true business performance clearly.

VAT compliance

Firms may need to show files for VAT checks. Missing records may cause delays and extra cost. 7 Years of Tax Records may make VAT checks faster and easier. Clear files may also help meet tax rules properly.

Legal safety

Keeping seven years of files may protect firms from legal risk. Officials may ask for proof of cost or income anytime. Good records may resolve disputes faster and with less stress. This may give firms more confidence in their work.

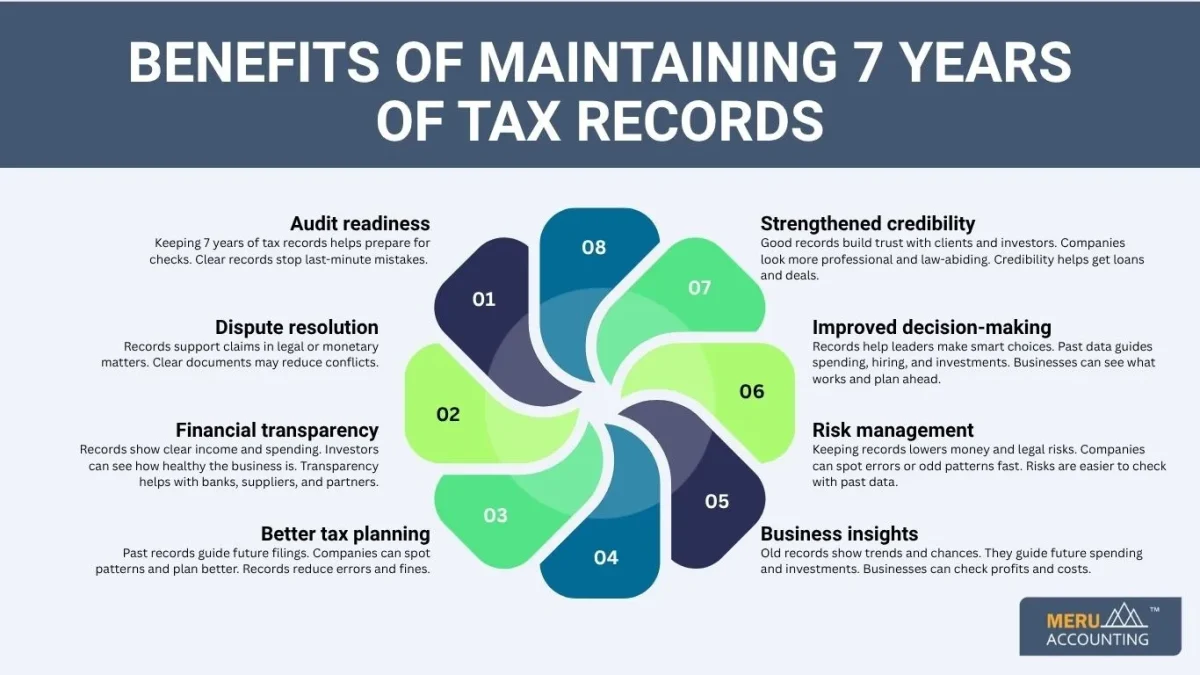

Benefits of Maintaining 7 Years of Tax Records

Audit readiness

Keeping 7 years of tax records helps prepare for checks. Clear records stop last-minute mistakes. Firms can answer questions with ease. Audits may be faster and less stressful.

Dispute resolution

Records support claims in legal or monetary matters. Clear documents may reduce conflicts. Companies can solve issues quickly. This protects both money and reputation.

Financial transparency

Records show clear income and spending. Investors can see how healthy the business is. Transparency helps with banks, suppliers, and partners. It also helps manage the business well.

Better tax planning

Past records guide future filings. Companies can spot patterns and plan better. Records reduce errors and fines. They also help with budgets and growth plans.

Business insights

Old records show trends and chances. They guide future spending and investments. Businesses can check profits and costs. This helps with long-term plans.

Risk management

Keeping records lowers money and legal risks. Companies can spot errors or odd patterns fast. Risks are easier to check with past data. This protects firms from fines or disputes.

Improved decision-making

Records help leaders make smart choices. Past data guides spending, hiring, and investments. Businesses can see what works and plan ahead. Clear records support smart strategies.

Strengthened credibility

Good records build trust with clients and investors. Companies look more professional and law-abiding. Credibility helps get loans and deals. Clear documents also boost reputation.

Key Elements to Keep in Your 7 Years of Tax Records

Invoices and receipts

All sales or purchase receipts may help in audits. Organizing receipts may save time during checks. They may act as proof for cost or income in your 7 Years of Tax Records. Clear invoices may prevent fines or delays.

Bank statements

Bank statements may confirm money flow and transactions. Keeping digital and hard copies may lower risk. Statements may help match accounts and tax filings. They may also aid future budgeting and planning.

VAT returns

Past VAT files may support compliance and corrections. Officials may ask for proof of errors or gaps. Organized VAT returns may reduce delays or penalties. They may guide future tax planning too.

Payroll records

Employee pay and benefits may be needed for checks. Proper payroll records in your 7 Years of Tax Records may prevent legal trouble. Payroll may also aid planning and staffing decisions. Records may improve trust with staff and officials.

Contracts

Contracts with clients or suppliers may require money transactions. Properly stored contracts may prevent disputes or gaps. Contracts may also prove revenue or cost claims. They may support transparency and law compliance.

Expense reports

Good records may reduce mistakes and fines in audits. Organized expense files may track company spending trends. They may support budgets and internal reviews. Clear expense files may improve cost control.

Asset records

Assets and depreciation records may support tax claims. Proper files may avoid value errors or disputes. They may also help with insurance or law matters. Updated asset files may strengthen financial control.

How Businesses May Store 7 Years of Tax Records

Physical filing systems

Paper files stored safely may back up audits. Labels and folders may make retrieval fast. Keeping files organized for your 7 Years of Tax Records may prevent loss or damage. Physical filing may provide legal proof if needed.

Digital records

Cloud storage may save space and allow quick access. Strong passwords may stop theft or hacks. Digital tools may reduce mistakes and save time. Files for your 7 Years of Tax Records may be accessed for audits anytime.

Hybrid systems

Combining paper and digital storage may be safe and quick. Hard copies may back up digital files if systems fail. Hybrid storage may increase file security. Firms may simplify audits and reduce risk.

Regular updates

Records must be updated to stay correct and reliable. Timely updates may prevent missing or wrong data. Accurate updates may help firms answer requests fast. This may also improve planning and control.

Challenges of Maintaining 7 Years of Tax Records

Space constraints

Paper files may take up a lot of space over time. Firms may need cabinets or rooms to store files. Bad storage may cause loss or damage. Proper planning may reduce space issues effectively.

Digital security

Online files may risk hacking or data loss. Security tools may protect money and staff information. Backups may prevent loss during failures. Digital safety ensures access when officials check files.

Time consumption

Entering and checking records may take a lot of time. Staff may need training for accurate record-keeping. Regular checks may prevent errors and delays. Time spent may save fines later.

Compliance complexity

Tax rules may change and need record updates. Firms must stay informed about new rules. Compliance may need checks and corrections often. The following rules may reduce legal or money risks.

Cost factors

Storage, software, and staff may raise costs. Firms may weigh the cost against the benefit of proper records. Planning may lower record management costs. Investments may give long-term savings and efficiency.

Best Practices for Maintaining 7 Years of Tax Records

Organized filing

Keep records sorted by year and type for access. Labels may make audits easier. Proper filing may lower mistakes and save time. An organization may also help with internal tracking and control.

Supporting documents

All transactions need supporting files for checks. Missing files may delay audits. Accurate documents may prevent disputes with clients or officials. Supporting files may build trust and compliance.

Accounting software

Use software to manage records fast and well. Tools may automate repeated entries. Software may create reports and audit trails. It may lower mistakes and improve efficiency.

Regular audits

Check files often to confirm accuracy and completeness. Early spotting may prevent penalties. Audits may improve record systems. Regular checks may ensure compliance and reliability.

Staff training

Train staff to keep files properly. Skilled staff may lower mistakes. Training may enforce good habits for handling your 7 Years of Tax Records. Trained staff may support long-term compliance.

Who May Benefit Most from 7 Years of Tax Records in the UAE

Small business owners

May track cash flow, VAT, and costs clearly. Records may prevent fines in inspections. Organized files may support future growth.

Corporates

May comply with audits and legal rules quickly. Big firms may use detailed records. Clear records may boost investor trust and safety.

Freelancers

May track invoices and payments accurately for taxes. Good records may simplify yearly filings. Freelancers may manage money and plan growth.

Investors

May check files before investing. Past records may show trends and risk. Good files may prevent costly mistakes.

Legal professionals

May use old records for audits or disputes. Correct files may help with legal advice. Proper files may boost trust and credibility.

Digital Solutions for 7 Years of Tax Records

Cloud accounting

May allow instant access and secure backup of files. Cloud systems may lower paperwork and mistakes. Firms may get files fast during audits. Cloud may support long-term record keeping.

Automated filing

May save time by entering repeated data automatically. Automation may reduce mistakes. Staff may focus on analysis instead of typing. Efficiency may improve compliance and work.

Data encryption

May protect files from unauthorized access. Encrypted files may give legal proof during audits. Encryption may keep data private and trusted.

Reports and analytics

May give insights from past records quickly. Analytics may guide budgets, planning, and decisions. Firms may check health using reports.

Common Mistakes to Avoid in Maintaining 7 Years of Tax Records

Ignoring small receipts

Missing receipts may make your 7 Years of Tax Records incomplete. Collecting all receipts may ease audits. Correct receipts may reduce mistakes and fines.

Mixing accounts

Combining personal and business records may confuse audits. Separate accounts may keep clarity and compliance. Clear separation may improve tracking and reporting.

Delayed filing

Late updates may cause mistakes and fines. Filing on time may lower risks. Records may remain correct for audits.

No backup

Loss of files without backup may cause problems. Copies may prevent errors or data loss. Both digital and paper backups may ensure safety.

Poor categorization

Bad organization may slow audits and cause errors. Good categorization may save time. Structured files may ease retrieval.

Maintaining 7 Years of Tax Records in the UAE may help businesses and people stay ready and compliant. Proper files may ease audits, VAT checks, and legal reviews. Past data may guide growth and business choices.

Meru Accounting provides comprehensive services to manage 7 years of tax records efficiently. Using advanced digital tools, we ensure organized filing, secure record keeping, and audit-ready documentation. Our certified experts maintain full compliance, allowing businesses to focus on growth while we handle their tax records seamlessly. Partner with us for professional and reliable tax record management.

Good record keeping may act as a shield, aid decisions, and support long-term financial clarity. Simple organization, digital tools, and expert help may make 7 Years of Tax Records easy and valuable.

FAQs

- Why may UAE businesses keep 7 Years of Tax Records?

It may help during audits and tax compliance checks. - Which UAE firms must maintain 7 Years of Tax Records?

Most companies, especially those registered for VAT or in free zones. - Do freelancers need 7 Years of Tax Records in the UAE?

Yes, to track income and expenses for tax purposes. - What types of documents count in 7 Years of Tax Records?

Invoices, receipts, bank statements, payroll, VAT returns, and contracts. - Can digital files be used for 7 Years of Tax Records?

Yes, UAE authorities may accept organized electronic records. - What happens if 7 Years of Tax Records are missing?

Firms may face fines, audits, or legal penalties from officials. - Are VAT records part of the 7 Years of Tax Records?

Yes, VAT files must be maintained for seven years in the UAE. - Can accountants manage 7 Years of Tax Records for businesses?

Yes, certified accountants may handle record filing and organization. - How should UAE businesses store 7 Years of Tax Records?

Use secure physical, digital, or hybrid filing systems for safety. - Is audit readiness a reason to keep 7 Years of Tax Records?

Yes, records may simplify government inspections and financial checks. - Do contracts form part of the 7 Years of Tax Records?

Yes, client and supplier agreements support financial transparency and audits. - How can proper record-keeping reduce fines in the UAE?

Accurate 7 Years of Tax Records may prevent mistakes and penalties. - Are payroll records necessary for 7 Years of Tax Records?

Yes, they may be needed for staff, tax, and audit verification. - Can old invoices be discarded after seven years?

No, UAE authorities may require access during audits or disputes. - Does proper record maintenance improve financial planning?

Yes, historical 7 Years of Tax Records may guide growth decisions. - How often should 7 Years of Tax Records be updated?

Records should be updated after each financial transaction or change. - Can cloud systems store 7 Years of Tax Records safely?

Yes, secure cloud platforms may simplify storage and backup. - Are paper files still relevant for 7 Years of Tax Records?

Yes, they may serve as legal proof when required by authorities. - How do 7 Years of Tax Records help resolve disputes?

They may prove transactions, expenses, and compliance during conflicts. - Can maintaining 7 Years of Tax Records boost investor confidence?

Yes, transparent financial history may increase trust and credibility.