Accounting Procedure for Different Industries

Industry accounting is different across sectors. Each business has its own way of handling money and records. That is why understanding the accounting procedure for each industry is important. Every industry needs to maintain its books of accounts to know its financial position at the end of the year. Just like industries differ from one another, their accounting needs are also different and unique. So, the accounting standards used for a start-up cannot be adopted for a tech firm or a manufacturing firm. That’s the reason that choosing an accounting firm becomes very important for any industry.

Why is Industry Accounting Important?

- Every industry earns and spends money in different ways.

- Accounting helps track all financial activities.

- Proper accounting helps with taxes, audits, and decision-making.

- It keeps the business in line with rules and laws.

- A standard accounting procedure ensures the smooth running of operations.

What Is an Accounting Procedure?

- It is a step-by-step method to record financial activities.

- Includes steps like data entry, posting, adjustments, and reporting.

- Used to make financial reports and statements.

- Helps to find errors and manage finances.

- Used for audits, taxes, and financial planning.

Key Components of Accounting Procedure

- Journal Entries: Record all transactions.

- Ledger Posting: Move entries from journal to ledger.

- Trial Balance: Ensure that debits equal credits.

- Adjusting Entries: Add entries for accruals and prepayments.

- Financial Statements: Prepare an income statement and balance sheet.

- Closing Entries: Clear temporary accounts at the end of the period.

- Audit Trail: Maintain a clear path from start to end.

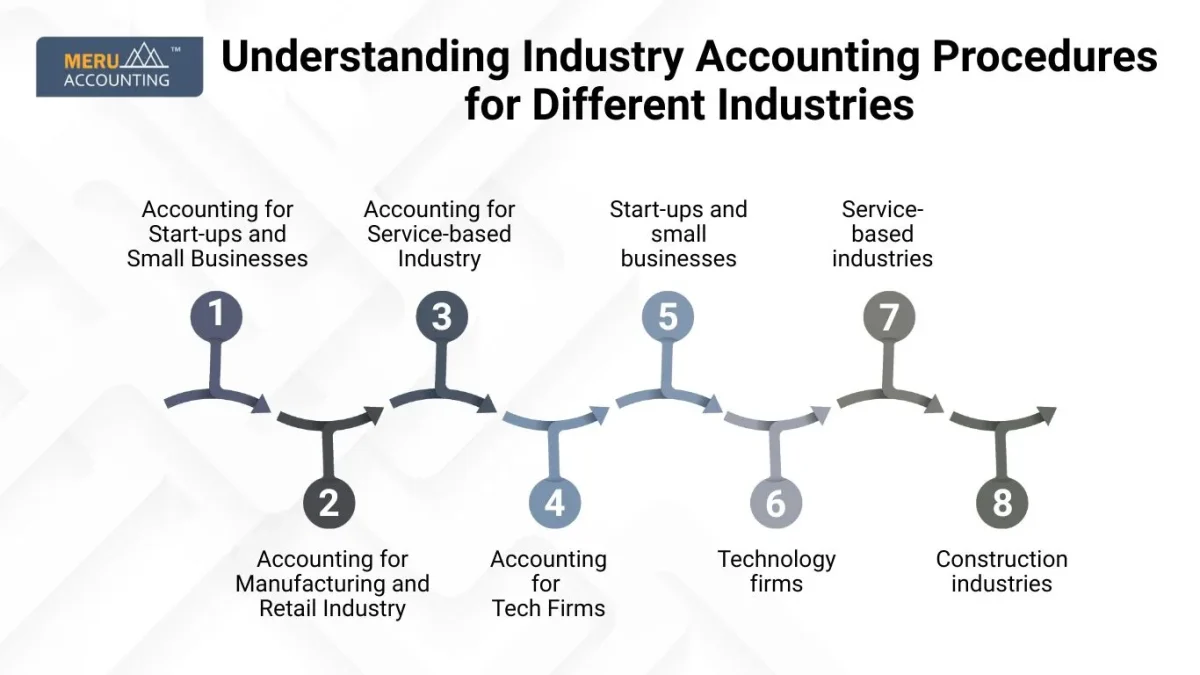

Understanding Industry Accounting Procedures for Different Industries

Accounting for Start-ups and Small Businesses

The major requirement for a start-up or a small business is the capital requirement. As it’s in a prior stage and a new business, sales, revenues, and expenses need to be tracked regularly. In short, maintaining capital flow in the business is a must for them, as that’s the way to their growth.

Accounting for Manufacturing and Retail Industry

For manufacturing and retail businesses, inventory management and control are the core requirements, as the whole business depends on those sources. As an accounting firm, we take care of this special need and deliver the best of our services.

Accounting for Service-based Industry

For a service-based business, accounts receivable and accounts payable, along with asset management, are important requirements. A proper accounting procedure ensures these elements are tracked and managed for smooth business flow.

Accounting for Tech Firms

Payroll and operational costs play a major role in industry accounting for tech firms. Tech firms mostly deal with intellectual properties, and thus these two aspects contribute the most to shaping the success.

Various industry sectors would have different standards with regard to the processes of accounting and bookkeeping. This is to a great extent due to the character of the specific business. A good cash flow which is good is important across various industries.

Regardless of which industry one is working in, it is imperative to have a solid foundation with regard to the fundamental standards of bookkeeping and accounting. There is a need to look at each accounting procedure in the context of its specific industry accounting demands.

Start-ups and small businesses

Start-ups, for instance, might require keeping a watch over the equity of the business owner. But a small business that began with the savings of a business owner would not at first have any investors. In the case of both cases, capital is critical for growth.

Technology firms

Technology firms may have fewer fixed assets to monitor because they conduct most of their work in the cloud or on computers. This implies that bookkeepers and accountants should concentrate more on overseeing working costs and the salaries of the employees.

Service-based industries

Service-based enterprises, for example, law companies, would spend additional time on making a collection of invoices that are not paid, and this would impact the processes of accounting and bookkeeping.

Construction industries

The construction industry is considered a sector that needs to do accounting for a huge amount of money and various raw materials on the books. This implies bookkeepers and accountants need to spend additional time handling inventory when compared to other industries. Another industry that invests additional time in the inventory could be wholesalers.

Apart from all the requirements stated, one thing that holds true for all industries is the need for steady cash flow. Without good cash flow, no industry can survive in the market. Thus, maintaining cash flow is a significant factor for any business in any industry.

Best Practices in Industry Accounting

Use the Right Software

Pick tools made for your industry. They help track costs and speed up work.

Train Your Team

Staff should know the right steps. Good training helps avoid errors.

Follow Tax Rules

Stay up to date with all laws. This keeps you safe from fines and checks.

Keep Records Clear

Log data right and on time. Clean records help with audits and reports.

Review Often

Look at your books each month. This helps find issues before they grow.

Protect Your Data

Back up your files safely. Use cloud storage or secure drives.

Common Challenges

Rules Are Not the Same

Each field has its own set of rules. What works for one may not for all.

Entry Errors

Small mistakes can lead to audits. Check your books with care and often.

Cash Flow Gaps

Late payments cause big issues. Plan for slow times to stay on track.

Inventory Tracking

Real-time tracking is not easy. Use tools that help you stay updated.

Revenue Rules Vary

Not all sales count the same way. Know how your field tracks income.

Time Pressures

Tight deadlines lead to mistakes. Plan ahead to stay in control.

Tips for Effective Industry Accounting

Use Automation

Automate tasks to save time. This cuts errors and boosts output.

Hire the Right Help

Work with pros who know your field. Their skills help you stay compliant.

Stay Organized

Keep all files neat and in order. This makes work fast and stress-free.

Check Each Month

Go through reports every month. Spot trends and plan with clear facts.

Prep for Tax Early

Start tax work well in advance. This lowers stress and avoids a rush.

Track KPIs

Watch key numbers like profit and cost. They guide better decisions.

Benefits of Following the Right Accounting Procedure

Avoid Legal Trouble

The right records mean no tax issues. You’ll pass audits with no stress.

Know Real Profit

See what you earn and what you spend. This helps you grow with care.

Guide Big Choices

Good data helps you plan well. You’ll know when to spend or save.

Raise Business Value

Clean books make your firm worth more. Buyers and partners trust them.

Gain Trust

Lenders and backers want clear books. It helps you get funds with ease.

Improve Cash Flow

Track what’s due and what is paid. This keeps your business strong.

Each business is unique, and so are its industry accounting needs. A proper accounting procedure helps keep everything in order. It also gives a clear picture of the company’s financial health. Following the right method ensures success, growth, and peace of mind. At Meru Accounting, we know each industry has its own way of handling accounts. We offer custom solutions to fit your business needs. Our work is clear, correct, and meets all rules. Partner with us to build strong books and grow your business with ease.

FAQs

Q1: What is industry accounting?

It refers to accounting that is specific to a certain industry’s needs.

Q2: Why is the accounting procedure important?

It helps record, check, and report financial activities clearly.

Q3: Do all industries use the same accounting procedure?

No, each industry uses its own method based on its nature.

Q4: Can accounting software handle different industries?

Yes, many tools have features made for specific industries.

Q5: Is accounting in retail different from manufacturing?

Yes, retail focuses on sales and stock; manufacturing focuses on costs.

Q6: How often should accounting records be updated?

Daily for some entries; others may be weekly or monthly.

Q7: What happens if the wrong procedure is used?

It may lead to errors, losses, or audit issues.