Introduction to Accounts Payable Management Services

Understanding accounts payable management services is the first step in improving how your business handles outgoing money. These services help track, verify, and pay bills on time. They keep your cash flow strong and help build trust with vendors. If ignored, accounts payable can lead to late fees, payment errors, and even cash shortages. In this blog, we explain what these services include, why they matter, and how your business can benefit from using them the right way. You’ll also learn the importance of accounts payable in building a stable financial base.

What is accounts payable?

Accounts payable refers to the money a company must pay vendors for goods or services bought on credit. A lot of money is used by the company each year for different things like order placement, invoice processing, responding to the dealers, or any other aspect where the amount is payable. All these aspects come under accounts payable in accounting.

An inefficient accounts payable can cause various problems like discount missing, more amounts payable due to late payments, improper financial management, etc. A properly maintained accounts payable helps to streamline accounts, check the progress of the company, observe profit & loss, and check the overall status of the company. The accounts payable process must be performed by proficient people. The accounts payable process must be organized in a well-organized system that can be flexible to give better insight. The company that manages accounts payable properly always has a good condition of the business, which always shows nice profits.

What Do Accounts Payable Management Services Include?

Accounts payable management services cover the full cycle of handling vendor payments. The process starts when a business receives an invoice and ends when the vendor receives payment. Here’s what these services include:

- Invoice Tracking: Every invoice is recorded and tracked from the moment it arrives. This helps avoid missed payments and improves visibility.

- Invoice Matching: Invoices are matched with purchase orders and delivery receipts. This prevents fraud and ensures accuracy.

- Payment Scheduling: Payments are planned based on due dates and available cash. This keeps vendors happy and avoids late fees.

- Vendor Communication: These services manage vendor interactions, answer payment-related queries, and maintain strong relationships.

- Record Keeping: Every step is logged, and reports are generated for audits, tax filing, and financial analysis.

Understanding the Importance of Accounts Payable in Daily Business Tasks

The importance of accounts payable goes beyond just paying bills. This role helps firms handle what they owe and keep good ties with sellers. When managed well, it provides a real-time view of what the company owes and when it must be paid.

Accurate accounts payable systems support business planning by showing clear cash obligations. They also help with audits, budgeting, and meeting financial goals. A weak system, however, may cause vendors to lose trust and delay future deliveries or services. This can lead to a chain reaction of missed deadlines, lost deals, and lost money.

On the other hand, a strong accounts payable process supports vendor loyalty, makes financial reporting smooth, and helps avoid legal risks. That’s why companies of all sizes invest in AP management services.

Common Challenges in Managing Accounts Payable

1. Manual Errors

Mistakes often happen when data is entered by hand. One missed number can delay the whole payment process. Errors also confuse vendors and lead to duplicate payments or unpaid bills. It also confuses when reconciling accounts.

2. Missed Deadlines

Without proper tracking tools, businesses forget due dates. This results in late fees, strained vendor ties, and poor cash planning. Missed deadlines show poor financial management and affect your business image.

3. Lack of Invoice Match

Invoices must match the order forms and proof of delivery. When there is no system to verify this, businesses risk overpaying or paying for items never received. This also opens the door to internal fraud.

4. No Real-Time Data

Real-time data helps track how much money is owed and when it must be paid. Without it, businesses may overspend or miss planning opportunities. Delayed updates can result in unexpected shortfalls.

5. Paper-Based Systems

Using paper invoices or physical ledgers is slow and unsafe. Paper can be lost, damaged, or misfiled. It’s also hard to retrieve old records for audits or disputes. Digital systems fix this problem.

6. Poor Vendor Management

Late payments or poor communication can hurt your relationship with suppliers. Vendors might delay shipments, charge extra, or stop working with your company. Effective vendor communication is key to long-term success.

How Smart Accounts Payable Control Boosts Cash Flow

1. Avoids Late Fees

Good accounts payable management services ensure bills are paid on time. This avoids fines and keeps more money in your hands.

2. Early Payment Discounts

Vendors offer discounts for early payment. A well-run system helps you use these offers and save money.

3. Clear Cash Plan

Knowing what and when to pay helps with planning. It stops overspending and supports plans.

4. Stronger Vendor Trust

Vendors rely on on-time pay. Paying on time may help you get better prices or longer payment terms

5. Faster Process

Automated systems cut time and labor. This means lower costs and less stress on your team.

6. Better Control

A clear system helps spot fraud, errors, or extra charges fast. This helps you take quick steps to fix issues.

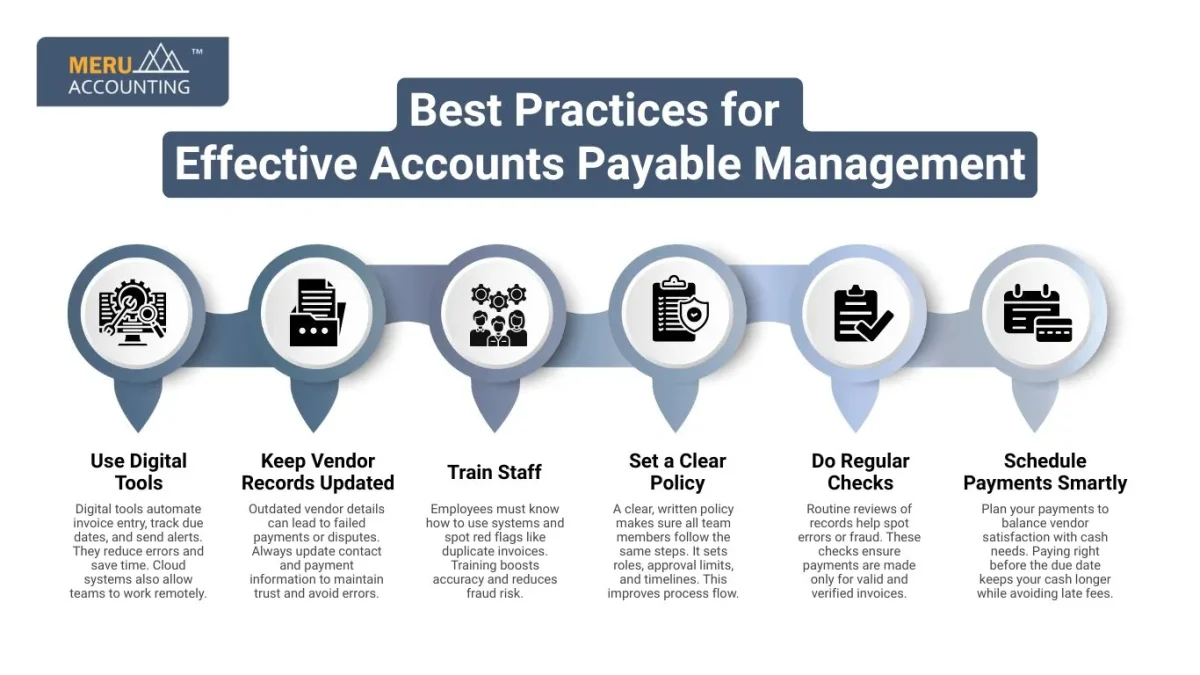

Best Practices for Effective Accounts Payable Management

1. Use Digital Tools

Digital tools automate invoice entry, track due dates, and send alerts. They reduce errors and save time. Cloud systems also allow teams to work remotely.

2. Keep Vendor Records Updated

Outdated vendor details can lead to failed payments or disputes. Always update contact and payment information to maintain trust and avoid errors.

3. Train Staff

Employees must know how to use systems and spot red flags like duplicate invoices. Training boosts accuracy and reduces fraud risk.

4. Set a Clear Policy

A clear, written policy makes sure all team members follow the same steps. It sets roles, approval limits, and timelines. This improves process flow.

5. Do Regular Checks

Routine reviews of records help spot errors or fraud. These checks ensure payments are made only for valid and verified invoices.

6. Schedule Payments Smartly

Plan your payments to balance vendor satisfaction with cash needs. Paying right before the due date keeps your cash longer while avoiding late fees.

Why Outsourcing Accounts Payable Makes Sense for Growing Businesses

1. Saves Time

Outsourcing your accounts payable management services reduces your team’s workload. It gives them more time to focus on growth and customer service instead of chasing invoices.

2. Lower Cost

Hiring, training, and maintaining a full-time payable team can be costly. Outsourcing helps small firms cut expenses while gaining expert help.

3. Reduces Errors

Trained professionals handle the process using reliable tools. This lowers the risk of duplicate payments, fraud, or lost invoices.

4. Gives Real-Time Reports

Service providers offer tools that show the status of invoices and payments. These dashboards give you full control and a better overview.

5. Boosts Vendor Trust

Timely payments made by professionals improve vendor ties. This leads to better service and discounts that help your business save more.

6. Scales with You

As your firm grows, outsourced services grow with you. You don’t need to worry about hiring or retraining as your needs increase.

At Meru Accounting, we understand the importance of accounts payable in keeping your business strong. Our expert team provides full AP management services designed to cut costs, boost cash flow, and reduce stress. From invoice tracking to vendor talks, we handle each step with care. Our tools offer real-time data so you stay in control.

FAQs

- Why should I use accounts payable management services?

These services save time, cut costs, and help you avoid errors. You also keep better ties with vendors.

- How do these services help my cash flow?

They stop late fees, help you get early pay discounts, and keep your spending in check.

- What’s the risk of not managing accounts payable well?

You could face fines, fraud, or poor vendor ties. It also hurts your cash flow and planning.

- Can small firms benefit from outsourcing payables?

Yes. Small firms gain a lot from expert help. It saves time and cuts hiring costs.

- Will I lose control if I outsource this task?

No. You get full reports and real-time views. You stay in control while experts do the work.