Everything You Need to Know About U.S. Payroll Tax

In the United States, when a business pays its workers, it must follow rules for US payroll taxes. These are special taxes taken from each paycheck and also paid by the employer. These taxes help fund Social Security, Medicare, and other programs.

Learning about US payroll is very important for all business owners. It helps make sure workers are paid right and the government gets the correct money. If a business does not follow US payroll taxation rules, it can get into trouble. That’s why it’s smart to track taxes, pay them on time, and ask for help if needed.

What are the US Payroll Taxes?

US payroll taxes are the money taken from a worker’s paycheck and also paid by the boss. These taxes help pay for Social Security, Medicare, and other services. Part of the money comes from the worker, and part comes from the employer. This is all part of the US payroll system. Every time a worker gets paid, these taxes are taken out.

The money is then sent to the government. This process is called payroll taxation. It is very important because it helps people when they retire, get sick, or lose their jobs. Every business in the US must follow these tax rules.

Importance of US Payroll Taxes

Here’s why US payroll taxes are important for every business and worker:

1. Pays for Social Security and Medicare

- A big part of US payroll taxes goes to help older people and those with health needs.

2. Supports People Who Lose Jobs

- Part of US payroll taxation helps people who lose their jobs get money while they look for new work.

3. Fund Government Programs

- These taxes also help pay for state and federal programs that serve the public.

4. Keeps Your Business Legal.

- When you follow US payroll tax rules, you stay in good standing with the IRS and local tax offices.

5. Helps You Avoid Big Fines

- If you do not handle US payroll taxation the right way, your business could get big fines or even be shut down.

Following the rules for US payroll taxes is not just smart, it’s the law.

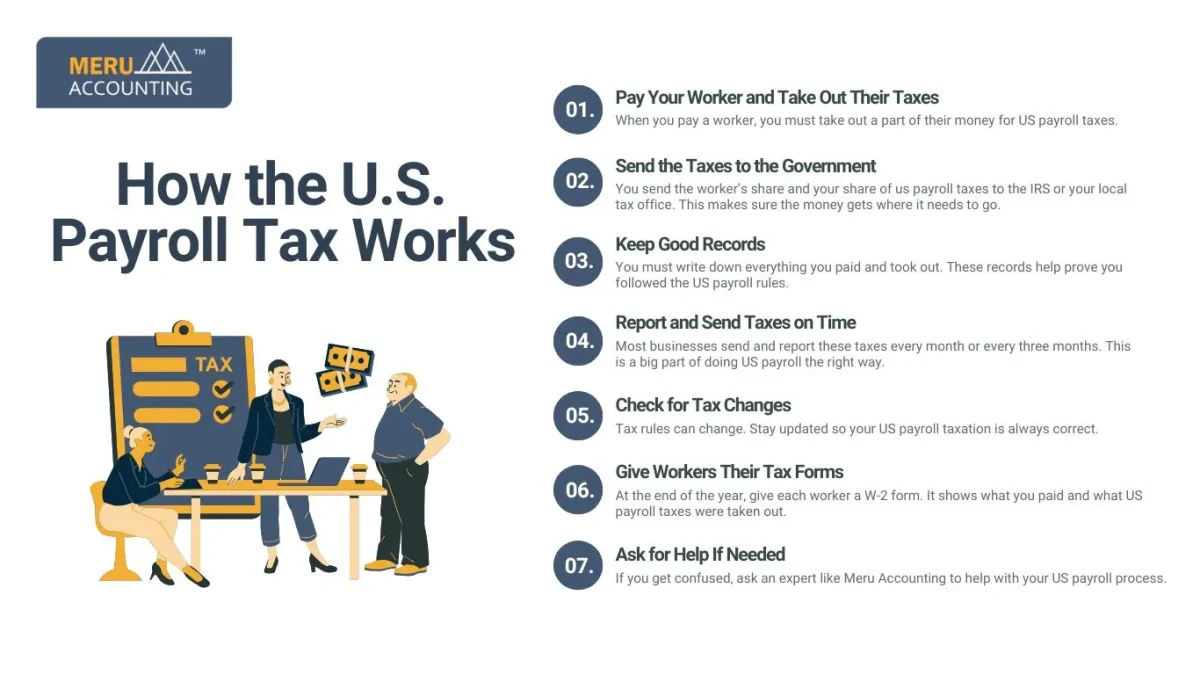

How the US Payroll Tax Works

Understanding how US payroll taxation works helps you follow the rules and avoid problems. Here is how it works step by step:

Step 1: Pay Your Worker and Take Out Their Taxes

- When you pay a worker, you must take out a part of their money for US payroll taxes.

Step 2: Send the Taxes to the Government

- You send the worker’s share and your share of us payroll taxes to the IRS or your local tax office. This makes sure the money gets where it needs to go.

Step 3: Keep Good Records

- You must write down everything you paid and took out. These records help prove you followed the US payroll rules.

Step 4: Report and Send Taxes on Time

- Most businesses send and report these taxes every month or every three months. This is a big part of doing US payroll the right way.

Step 5: Check for Tax Changes

- Tax rules can change. Stay updated so your US payroll taxation is always correct.

Step 6: Give Workers Their Tax Forms

- At the end of the year, give each worker a W‑2 form. It shows what you paid and what US payroll taxes were taken out.

Step 7: Ask for Help If Needed

- If you get confused, ask an expert like Meru Accounting to help with your US payroll process.

Common Mistakes in the US Payroll Taxation

Many small businesses make mistakes with US payroll taxation. These are some of the most common errors:

1. Not Taking Out the Right Amount

- If you don’t take out enough tax from a worker’s pay, you could owe money later.

2. Paying Taxes Late

- Missing due dates can lead to fines and problems with the IRS.

3. Not Paying the Employer’s Share

- Businesses must also pay their share of US payroll taxes. Forgetting this is a common mistake.

4. Missing State or Local Forms

- Each state may have its own tax rules. Forgetting to file these forms can cause trouble.

5. Not Fixing Errors

- If you find a mistake but don’t fix it, it could cause bigger problems later.

Being careful and staying organized will help you avoid all of these.

How to Set Up US Payroll Tax

If you are new to US payroll, here is a simple guide to help you start the right way:

1. Get an EIN (Employer Identification Number)

- You need this number from the IRS to track your US payroll taxes and report them.

2. Choose a Tax Service or Software

- Use a payroll service, tax app, or a trusted bookkeeper to help you do the math and file forms.

3. Collect W‑4 Forms from Workers

- Every worker fills out a W-4 form to show how much tax to take from their paycheck.

4. Calculate Payroll Taxes Each Pay Period

- Every time you pay your workers, you calculate their taxes using their W-4 info.

5. Send Tax Money on Time

- Always send tax money to the IRS and state tax offices by the due date.

6. File Payroll Tax Forms

- Use forms like 941 for federal taxes and state forms for local rules. File them on time.

7. Keep Payroll Records for at Least Four Years

- You must keep records of all US payroll taxation information. This helps during audits or tax time.

Understanding US payroll taxes, US payroll, and US payroll taxation is key to running a safe and legal business. You must track what you take from workers’ pay, you must pay your share, and you must file on time. When you do it right, it keeps your business strong and your team happy.

If all these rules seem hard, you don’t have to handle it alone. Meru Accounting can help. We know the rules of US payroll tax and can be your guide through each step. With our help, you can stay clear, correct, and in control. Partner with us, and we will manage US payroll taxes the smart way.

FAQs

- How often do I pay U.S. payroll taxes?

It depends. Most big businesses pay monthly or semi-weekly. Smaller ones often pay every three months. - What happens if I miss a payroll tax payment?

You may have to pay late fees and interest. The IRS could also audit your business. - Can I handle the U.S. payroll by myself?

Yes, if you only have a few workers. However, a payroll service helps avoid mistakes and saves time. - Do I need an expert for state taxes too?

Yes. Each state has its own income tax rules. A pro or service can help you get it right. - What is FORM 941?

Form 941 is the U.S. federal paycheck form sent to the IRS every three months. It shows total take-outs and employer shares.