- ABOUT US

- Who We are

- Testimonial

- Why Meru Accounting?

- Core Values

- OUR SERVICES

- Bookkeeping Service

- Tax Return Services For Business Owners

- Cloud Addons Integration

- Backlog Cleanup Service

- CPA firms

- Payroll management

- CFO-services

- Company Set up Services

- Move To Digital

- Power BI Reporting for Financials

- Receivables Management

- Tax Services

- Bookkeeping for CPA’s

- Dedicated staff

- Odoo Development/Customization and Bookkeeping

- Payables Accounting

- Convert to Xero

- Valuation Services

- Grow your Business

- Power BI and Google looker studio reporting

- SOFTWARE SPECIALIZATION

- Xero

- odoo Development/customization & Bookkeeping

- Sage

- Wave

- Net Suite

- Clear Books

- Zoho Books

- Accountmate

- BillQuick

- Saasu

- FreshBooks

- Sage Intacct

- Yendo

- Oneup

- Deskera

- ZipBooks

- INDUSTRIES EXPERTISE

- Education

- Construction

- Franchise

- Gems & Jewellery Exporters

- Lawyers

- IT Sector

- Mining

- Manufacturing

- Pharma

- Non-Profit

- Physician

- Amazon Sellers

- Aged-Care

- Advertising

- Farming

- Transporatation

- Rental

- Power & Infrastructure

- Travel & Tourism

- Trading Firms

- Wholesale

- Antique Stores Industry

- Grocery stores

- VIRTUAL ASSISTANT

- Virtual Assistant for Real Estate

- Virtual Assistant for Digital Marketing

- Virtual Assistant for E-commerce Business

- Case Study on Web Scrapping

- careers

- Current Openings

- RESOURCES

- Blogs

- EMI Calculator

- Compound Interest Calculator

- Whitepapers

- E-BOOK

- Manuals

- SIP Calculator

- Business Entity Selector

- Generate free management report

- Case Studies

- Video Channel

- ABOUT US

- Who We are

- Testimonial

- Why Meru Accounting?

- Core Values

- OUR SERVICES

- Bookkeeping Service

- Tax Return Services For Business Owners

- Cloud Addons Integration

- Backlog Cleanup Service

- CPA firms

- Payroll management

- CFO-services

- Company Set up Services

- Move To Digital

- Power BI Reporting for Financials

- Receivables Management

- Tax Services

- Bookkeeping for CPA’s

- Dedicated staff

- Odoo Development/Customization and Bookkeeping

- Payables Accounting

- Convert to Xero

- Valuation Services

- Grow your Business

- Power BI and Google looker studio reporting

- SOFTWARE SPECIALIZATION

- Xero

- odoo Development/customization & Bookkeeping

- Sage

- Wave

- Net Suite

- Clear Books

- Zoho Books

- Accountmate

- BillQuick

- Saasu

- FreshBooks

- Sage Intacct

- Yendo

- Oneup

- Deskera

- ZipBooks

- INDUSTRIES EXPERTISE

- Education

- Construction

- Franchise

- Gems & Jewellery Exporters

- Lawyers

- IT Sector

- Mining

- Manufacturing

- Pharma

- Non-Profit

- Physician

- Amazon Sellers

- Aged-Care

- Advertising

- Farming

- Transporatation

- Rental

- Power & Infrastructure

- Travel & Tourism

- Trading Firms

- Wholesale

- Antique Stores Industry

- Grocery stores

- VIRTUAL ASSISTANT

- Virtual Assistant for Real Estate

- Virtual Assistant for Digital Marketing

- Virtual Assistant for E-commerce Business

- Case Study on Web Scrapping

- careers

- Current Openings

- RESOURCES

- Blogs

- EMI Calculator

- Compound Interest Calculator

- Whitepapers

- E-BOOK

- Manuals

- SIP Calculator

- Business Entity Selector

- Generate free management report

- Case Studies

- Video Channel

Home » Business Tips » How does a realistic budget looks like

How does a realistic budget looks like

Table of Contents

ToggleKnowing how a budget looks like is very important for everyone. A realistic budget is a smart plan for your money. It helps you understand how much money you get and how much you spend.

Many people do not know how to make a realistic budget. That is why learning about it step by step is a good idea. In this blog, we will learn what a realistic budget is, why it is important, and how you can make one. You will also learn how Meru Accounting can help you make a strong and easy budget for your needs.

What Is a Budget?

A budget is a simple plan. It shows how much money you get and how much you use. It is like a money map. A realistic budget means that your money plan is true and fits your real life. It does not guess. It shows what really happens with your money. Learning how a budget looks helps you make better choices. You don’t spend too much, and you save more. It keeps you ready for the future and out of trouble.

A realistic budget is a smart plan for your money. It shows how much money you earn and how much you spend. When you learn how a budget looks like, you can make better choices with your money. This kind of budget helps you stay safe, save more, and avoid running out of cash.

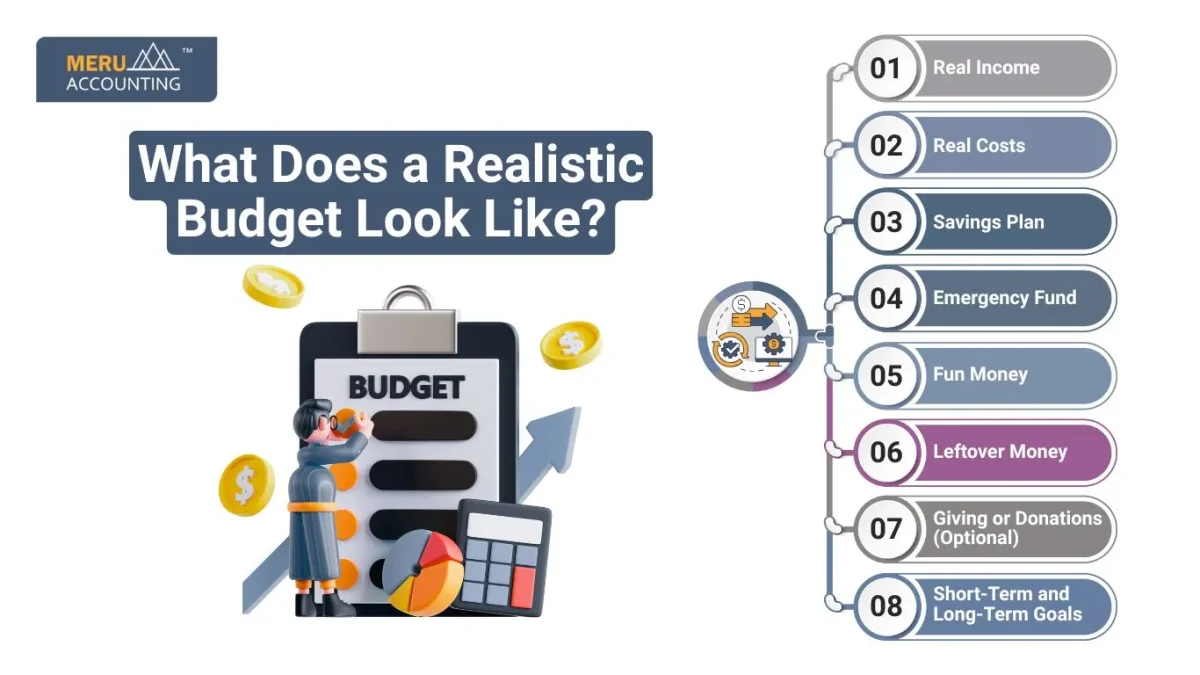

What Does a Realistic Budget Look Like?

1. Real Income

This is the money that comes in. A budget starts with knowing how much money you really get. This is called real income.

You should include:

- Pay from a job (even part-time)

- Business money (like selling crafts or helping neighbors)

- Pocket money from family

- Extra income like gifts or rewards

Tip: Be honest. Only write what you really get, not what you wish you had. A realistic budget works best with real numbers.

2. Real Costs

This part shows where your money goes. These are the real costs or expenses you have each week or month.

Include:

- Rent or house bills

- Groceries or snacks

- Gas or bus fare

- School supplies

- Clothes or shoes

- Phone or internet bills

- Fun things like games or outings

Tip: Even small things like gum or pens count. If you spend money on it, write it down.

3. Savings Plan

A realistic budget should help you save. Saving is important for big goals and for safety in the future.

You might save for:

- A new phone or tablet

- A bike or skateboard

- A school trip

- A gift for a friend

Tip: Try to save a part of your income each time you get paid. Even $5 or $10 adds up over time. Keep it in a safe place like a piggy bank or savings account.

4. Emergency Fund

Sometimes life surprises us. A tire might go flat, your backpack may break, or you may get sick. That’s why it’s smart to set aside money for these surprises.

Use an emergency fund for:

- Fixing broken items

- Paying for medicine

- Helping during slow money months

Tip: Don’t spend this money unless it’s something urgent. It keeps your budget strong and your mind calm.

5. Fun Money

A budget doesn’t have to be boring. A realistic budget also includes money just for fun. This helps you enjoy life while still being smart with money.

Fun money can be used for:

- Snacks with friends

- Going to the movies

- Buying a game

- Getting a new book or toy

Tip: Make sure your fun money is part of your plan, not something that makes you go over your budget.

6. Giving or Donations (Optional)

If you like to help others, you can include a small part of your budget to give away. This can be for:

- A local shelter

- A school fundraiser

- Helping a friend in need

Giving makes you feel happy and helps others too. Just make sure it’s planned in your budget.

7. Short-Term and Long-Term Goals

Sometimes we need to save for now, and sometimes we need to save for later. A good realistic budget lets you do both.

- Short-term goals: Saving for a birthday gift or a class trip next month.

- Long-term goals: Saving for a computer, college, or a family trip.

Tip: Write these goals down to help you focus.

8. Leftover Money

Sometimes, you might have extra money after all your needs, savings, and fun. This is called leftover money. You can:

- Save it for the next month

- Add more to your emergency fund

- Use it for a surprise treat

Tip: Always check where your leftover money can be most helpful.

Example of How a Budget Looks Like

Here is a simple budget example. You can change the numbers to fit your life.

- Total Money In: $500

- Needs (food, rent, phone): $300

- Savings: $50

- Emergency Fund: $30

- Fun Money: $120

That’s how a budget looks like when it is real and easy to follow.

How to Make a Realistic Budget

Here are easy steps to help you make your own realistic budget.

Step 1: Write Down Your Income

Write all the money you get. This can be from a job, your family, or selling old stuff.

Step 2: Track Your Spending

Keep a notebook or use an app. Write down every time you buy something. This helps you see where your money goes.

Step 3: List Needs and Wants

Needs are things like food, rent, or clothes. Wants are fun things like snacks or games. Pay for needs first.

Step 4: Cut Extra Costs

If you spend too much on wants, try to buy less. Use the extra money to save for later.

Step 5: Save Each Month

Try to save a small amount every month. Even $10 is helpful.

Step 6: Check and Update Your Budget

Look at your budget every month. If something changes, update it. This keeps your budget working for you.

A realistic budget is a smart plan to help you use your money well. With it you can track down on all your expenses and spending along with the profits. When you know how a budget looks like, you can make better choices and feel less worry.

Meru Accounting can help you make the right budget for your life. Our team helps you stay neat, plan for later, and feel safe with your money. With a good budget and help from Meru Accounting, you can grow and stay strong.

FAQs

- What is a realistic budget?

A realistic budget is a plan that shows your true income and spending. It helps you make smart money choices. - How do I start a budget?

Write down how much money you get and what you spend. Make a plan for saving and fun. - Why is budgeting important?

It helps you stay out of money problems and reach your goals. - How can Meru Accounting help with budgeting?

Meru Accounting helps you create a clear and useful budget. They also help you update and use it well. - Can a budget help me save money?

Yes! A good budget helps you spend less and save more for the things you really want.