Where to File Form 720 and How to Submit It Online

Filing IRS Tax Form 720 is a key task for firms that pay excise tax to the U.S. government. This form must be filed each quarter for goods and services like fuel, air travel, and indoor tanning. Many business owners are not sure where and how to file Form 720. Should you send it online or by post? What is the right address? How do you avoid errors when you file it? This blog gives you all you need to know to file Form 720 with ease. We will guide you through the full process, step by step. If you are new or need a quick review, this guide will help.

What is IRS Tax Form 720?

Excise Tax Report

IRS Tax Form 720 is used to report and pay federal excise taxes. These are extra taxes on items and services like fuel, air travel, and indoor tanning. Firms that sell or use these must file the form.

Quarterly Return

Form 720 must be filed each quarter. The IRS asks for a report even if no tax is due.

Used by Businesses

Form 720 is not for individuals. Only businesses that deal in excise-taxed products or services must use it.

Covers Many Taxes

It includes multiple types of excise taxes, such as communication, fuel, environmental, and luxury taxes. You must select the applicable categories for your business.

IRS Requirement

Filing this form is mandatory if you fall under any excise tax rules. Failing to file can lead to legal consequences.

Can Be Filed Online

You can e-file Form 720 using IRS-approved software providers. Online submission is faster and easier.

Different Schedules Attached

Depending on the tax type, you may need to attach Schedules A, T, or C. These schedules provide more detailed information.

Why You Need to File Form 720

Stay Legal

Filing IRS Tax Form 720 ensures you meet federal tax laws and stay compliant. It protects your business from future audits and penalties.

Avoid Fines

Not filing or filing late can result in hefty IRS penalties. These fines can accumulate and affect your finances.

Track Taxes

Form 720 helps you track and record your excise tax liabilities. This makes accounting easier and more accurate.

Required for Audits

Proper filing shows that your business is transparent. It provides documentation needed during tax audits.

Needed for Some Licenses

In some industries, proof of tax compliance is needed to renew licenses. Filing Form 720 meets that requirement.

Protect Business Reputation

Regular compliance shows customers and partners that your business is responsible. This can improve trust and credibility.

Financial Accuracy

Filing this form helps in keeping your financial records accurate. This is helpful in reporting and future planning.

When to File Form 720

Quarterly Filing

Form 720 is filed four times a year, each quarter. Each filing must include the taxes for the 3-month period.

Due Dates

It is due on the last day of the month following each quarter.

Quarter | Period Covered | Form 720 Due Date

|

Quarter |

Period Covered |

Form 720 Due Date |

|

Q1 |

Jan – Mar |

April 30 |

|

Q2 |

Apr – Jun |

July 31 |

|

Q3 |

Jul – Sep |

October 31 |

|

Q4 |

Oct – Dec |

January 31 |

File Even with No Tax Due

You must file even if you have no excise tax liability. The IRS still expects the form as part of compliance.

Know Your Schedule

Plan ahead to meet the deadlines. Mark the due dates to avoid missing them.

Late Filing = Penalty

The IRS imposes penalties for late filing. These can include both fines and interest on unpaid taxes.

No Extensions

There are no automatic extensions for Form 720. You must file by the deadline without exception.

Where to File Form 720 by Mail

If No Payment Included

Mail your Form 720 to: Department of the Treasury and Internal Revenue Service. Use this address when not sending payment.

If Payment Included

Mail to: Internal Revenue Service P.O. Box 932300 Louisville, KY 40293-2300

Use this address when sending a check or money order.

Use the Right Address

Using the wrong address may cause delays. Always double-check before sending.

Mail Early

Send the form at least a week before the deadline. This ensures it arrives on time.

Use Certified Mail

Certified mail provides proof of delivery. It helps if you need to prove you filed on time.

Keep a Copy

Always save a copy of your filed form and receipt. You may need them for your records.

Include All Schedules

Attach any required schedules with your form. Missing schedules can delay processing.

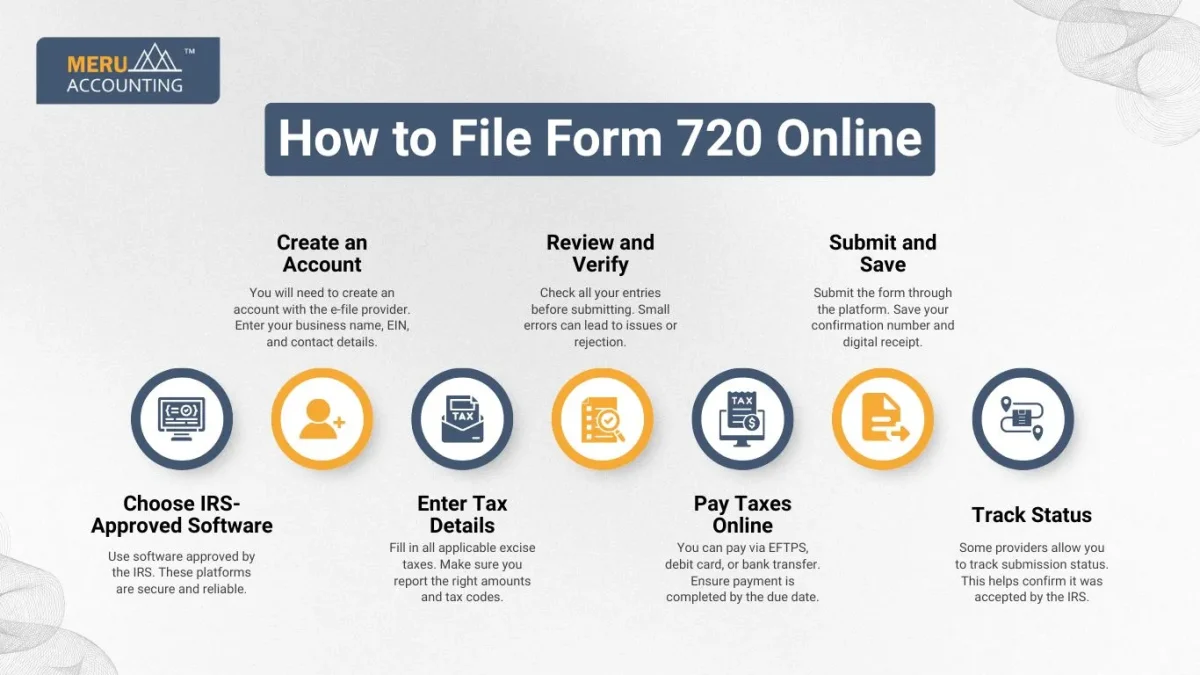

How to File Form 720 Online

Choose IRS-Approved Software

Use software approved by the IRS. These platforms are secure and reliable.

Create an Account

You will need to create an account with the e-file provider. Enter your business name, EIN, and contact details.

Enter Tax Details

Fill in all applicable excise taxes. Make sure you report the right amounts and tax codes.

Review and Verify

Check all your entries before submitting. Small errors can lead to issues or rejection.

Pay Taxes Online

You can pay via EFTPS, debit card, or bank transfer. Ensure payment is completed by the due date.

Submit and Save

Submit the form through the platform. Save your confirmation number and digital receipt.

Track Status

Some providers allow you to track submission status. This helps confirm it was accepted by the IRS.

Benefits of Filing Form 720 Online

Faster Submission

Online filing is fast. The IRS gets your form right away. There is no wait for mail or risk of lost forms. It helps you meet key tax due dates with ease.

Real-Time Error Checks

IRS e-file tools spot mistakes as you file, so you can fix them. The system flags blank fields or wrong codes. This helps avoid rejections or back-and-forth later.

Confirmation Receipt

You get a receipt once you file. It proves your form was sent on time. You can save or print the proof for your records. It’s useful if you ever need to show you filed.

Paperless Process

No need to print or store papers. You save time and space. This also means less risk of lost or damaged forms. It’s better for the planet and for your office.

Easy to Amend

Made a mistake? You can fix the form more easily online. Most platforms let you send updates right away. You don’t need to mail a new form each time.

Details to Include When You File Form 720

Business Info

Enter your full business name and EIN. Make sure these match IRS records.

Quarter Covered

State which quarter you’re filing for. Enter the correct year and time period.

Tax Categories

Choose the correct tax codes for your business. These are listed in the instructions.

Schedules A, T, C

Attach these if they apply to your tax type. They give more detail on tax activity.

Total Tax Due

Add up all excise taxes owed. Ensure accuracy to avoid balance due notices.

Signature

Don’t forget to sign your form. The IRS will reject unsigned forms.

Contact Info

Provide your phone and email. This helps if the IRS needs to reach you.

Common Excise Taxes on Form 720

Fuel Tax

Gasoline, diesel, and aviation fuels are taxed. Businesses selling or using fuel must report it.

Communication Tax

This tax applies to phone services and air transport. Providers must include this in their filings.

Environmental Tax

Businesses handling certain chemicals must pay this tax. It supports environmental programs.

Tanning Services

Indoor tanning providers pay a 10% excise tax. This is included under Part II.

Vaccines

Some vaccines are taxed under federal law. The manufacturers report these using Form 720.

Tire Tax

Heavy tires for trucks and equipment are taxed. Tire makers must include this in their return.

Foreign Insurance

U.S. policies underwritten by foreign insurers are taxed. These must also be reported.

Who Must File IRS Tax Form 720?

Businesses with Excise Tax Liabilities

If your firm sells goods like fuel, tires, or vaccines, you may owe excise tax and must file Form 720.

This form tracks taxes on goods that have a federal charge.

Even small firms must file if they deal in taxed items.

Air Transportation Companies

Airlines and charter flights must report the tax on each ticket they sell.

The excise tax also applies to cargo and fees.

All ticket-based services must be tracked and reported.

Indoor Tanning Providers

Firms that give indoor tanning services must pay a 10% excise tax and report it with Form 720.

The tax applies to each service sold.

It does not apply to spray tans or other non-UV options.

Manufacturers and Importers

If you make or bring in taxed goods, use this form to report what you owe.

Taxes may apply to parts, tools, or goods brought from abroad.

The IRS checks these filings during tax reviews.

Environmental and Communication Taxes

Firms that pay green or phone service taxes must also send Form 720 on time.

These taxes help fund health and clean-up work.

Phone service taxes apply to both landlines and mobile.

What Happens If You Don’t File Form 720?

IRS Penalties

Not filing or paying your excise tax on time can lead to fines and interest.

Late forms may also face daily fines that grow over time.

The IRS may send you a letter asking for quick action.

Business Delays

Delays may occur for permits, refunds, or tax credits if forms are missing.

Missing tax forms can also cause issues with banks or partners.

It may harm your firm’s record and cash flow.

Legal Action

In rare cases, not filing may bring IRS steps or court action.

The IRS can take funds or block assets if you fail to pay.

Court costs may add up and hurt your firm more.

Tools That Help You File Form 720 Online

IRS E-File System

Use IRS-approved sites to send Form 720 for your firm. These tools are built to match IRS rules and tax codes. You’ll find guides and steps to help you file right.

Tax Software

Tools like Drake, Lacerte, or ProSeries help you file with ease. They include tips, built-in checks, and auto updates. These tools work well for firms with many tax needs.

Help from Tax Preparers

Tax pros and CPAs offer filing help for a small fee. They know the rules and can help you stay on track. This is great for firms that want less stress and risk.

Secure Upload Portals

Many sites let you upload and send files safely with full data care. These portals use locks and codes to guard your info. You can also track the form after you send it.

Filing IRS Tax Form 720 is key for excise tax rules. Whether you file by mail or online, being on time and correct is a must. E-filing is fast, safe, and helps avoid mistakes. Be sure to meet each due date, send all forms, and pay your tax on time. Filing the right way helps your firm stay safe, dodge fines, and build trust. At Meru Accounting, we help firms file Form 720 the right way. Our team keeps you on track with all IRS tax needs. We make sure you stay safe, meet all rules, and avoid costly errors. Let us take care of your excise tax with skill and care.

FAQs

- What is IRS Tax Form 720 used for?

It reports and pays federal excise taxes for goods and services like fuel, air travel, and tanning. - Who must file Form 720?

Businesses that sell or use items subject to excise tax must file this form quarterly. - How often do I need to file Form 720?

You must file it every quarter, four times a year. - Can I file Form 720 online?

Yes, you can e-file using IRS-approved tax software. - Where do I mail Form 720 if I include a check?

Send it to P.O. Box 932300, Louisville, KY 40293-2300. - What if I make a mistake on the form?

File a corrected Form 720 as soon as possible to fix the issue. - Is there a penalty for filing late?

Yes, late filings can result in penalties and interest from the IRS.