Free Accounting Software for Small Businesses 2025

Running a small firm in 2025 comes with many tasks, and one of the key ones is to keep track of your cash. Not all firms can pay for a full-time bookkeeper or pricey tools. That’s why free accounting software for small businesses is a smart choice. These apps help track costs, send bills, and make reports — all at no charge.

With so many tools out there, it’s key to pick one that’s safe, clear, and can grow with your firm. This guide will show the top free tools in 2025, key features to seek, and how to find the right one for your needs.

Why Choose Free Accounting Software for Small Business?

- No cost to start: Ideal for new ventures.

- Easy to learn: Built for non-accountants.

- Core features included: Track sales, expenses, and reports.

- Cloud access: Work from anywhere.

- Integrations: Link to banks and sales apps.

Key Features to Look For

- Invoicing: Create and send invoices easily.

- Expense tracking: Record bills and costs.

- Bank sync: Automatic import of statements.

- Reports: Profit/loss, balance sheet.

- Multi-user access: Give others secure access.

- Scalability: Easy to upgrade as you grow.

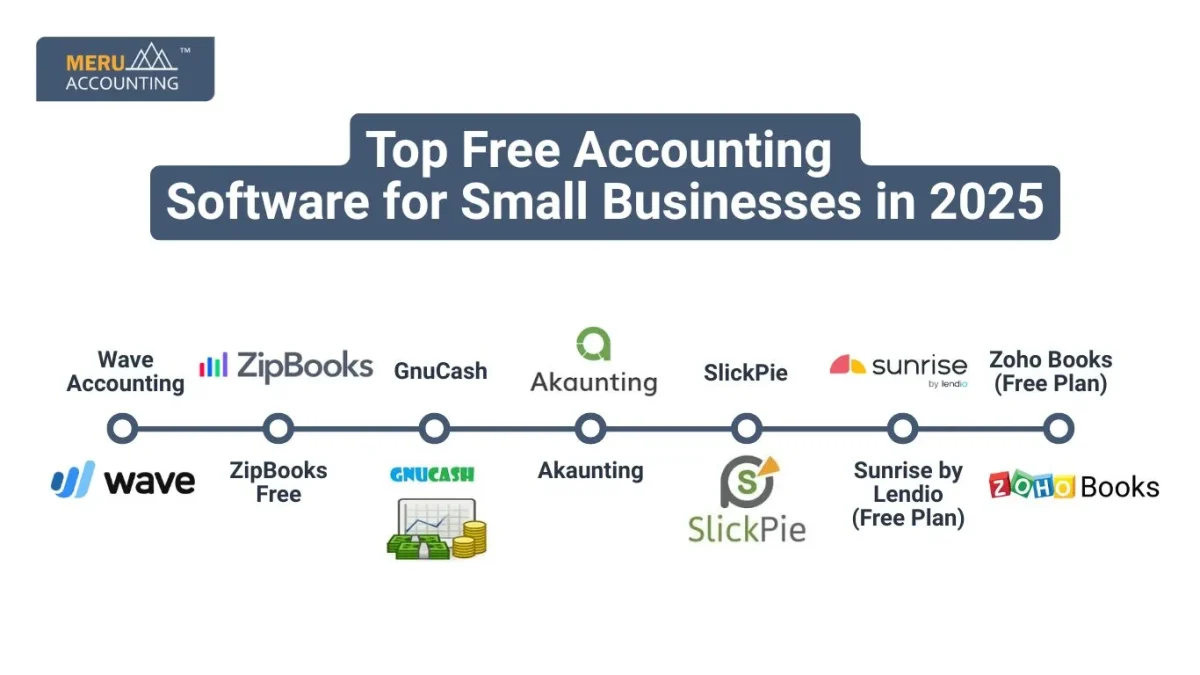

Top Free Accounting Software for Small Businesses in 2025

1. Wave Accounting

- Overview: Cloud-based and truly free.

- Features: Invoices, expenses, receipt scans, reports.

- Why choose it: No monthly fee, unlimited customers, simple interface.

- Limitations: Payroll and payments cost extra.

- Ideal for: Solo owners, freelancers, and simple needs.

2. ZipBooks Free

- Overview: Free plan for basic needs.

- Features: Invoicing, basic reports, vendor entries.

- Why choose it: Clean design, easy onboarding.

- Limitations: No bank sync on free plan.

- Ideal for: Small teams with basic tracking needs.

3. GnuCash

- Overview: Free desktop app (Windows, Mac, Linux).

- Features: Double-entry, reports, budgeting.

- Why choose it: Powerful with full control and offline use.

- Limitations: Old design, no cloud access.

- Ideal for: Users who want full control offline.

4. Akaunting

- Overview: Open-source, cloud-based.

- Features: Invoices, sales, expenses, reports.

- Why choose it: Free core, optional plugins.

- Limitations: Needs hosting; plugins are paid.

- Ideal for: Users wanting flexible open-source tools.

5. SlickPie

- Overview: Cloud accounting with MagicBot auto data entry.

- Features: Invoicing, banking, reports.

- Why choose it: Supports multiple users, web access.

- Limitations: Small bank limits, few advanced tools.

- Ideal for: Small teams with basic needs.

6. Sunrise by Lendio (Free Plan)

- Overview: Simple web accounting software.

- Features: Invoices, expense tracking, cash flow visuals.

- Why choose it: Fast setup, user-friendly dashboards.

- Limitations: Paid plan needed for bank sync, lacks double entry.

- Ideal for: Service businesses focused on cash flow.

7. Zoho Books (Free Plan)

- Overview: Free for businesses under ₹4 million/year.

- Features: Invoicing, expenses, reconciliation, project tracking.

- Why choose it: Seamless with Zoho apps, professional features.

- Limitations: Invoice/user limits, feature caps.

- Ideal for: Firms using other Zoho tools.

Side-by-Side Feature Comparison

| Feature | Wave | ZipBooks | GnuCash | Akaunting | SlickPie | Sunrise | Zoho Books |

|---|---|---|---|---|---|---|---|

| Cloud-based | ✔ | ✔ | ✘ | ✔ | ✔ | ✔ | ✔ |

| Desktop App | ✘ | ✘ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Double-entry | ✘ | ✘ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Invoice Creation | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Expense Tracking | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Bank Sync | ✔ (paid) | ✘ | ✘ | ✘ | ✔ (limits) | ✘ | ✔ (limits) |

| Reports | Basic | Basic | Advanced | Basic | Basic | Basic | Advanced |

| Multi-user Access | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | Limited |

| Mobile App | ✔ | ✘ | ✘ | ✘ | ✘ | ✘ | ✔ |

| Extra Add-ons | Paid | Paid | Free | Paid | Paid | Paid | Paid |

Tips for Choosing the Best Free Accounting Software

- Match tools to your day-to-day workflow.

- Choose simple over complex — pick what fits now.

- Ensure bank sync is supported (saves time).

- Look for scale — future upgrades should be smooth.

- Check for support: forums, help docs, email/chat.

- Try free demo accounts before fully switching.

Steps to Set Up Free Accounting Software

- Sign up with your business email.

- Enter company name, tax ID, and address.

- Connect your bank or upload CSV manually.

- Set up chart of accounts (categories for money).

- Link payment options like PayPal or cards.

- Customize invoice templates.

- Invite staff with limited access.

- Upload expense receipts regularly.

- Review profit/loss reports every month.

- Plan for when to upgrade as you grow.

Pros and Cons of Free Accounting Software

Advantages

- Free for core tasks: invoicing, expenses, reports.

- No learning curve: built for beginners.

- Cloud access with fast setup.

- Upgrade when needed (pay only if required).

Disadvantages

- Limited features: no payroll or inventory in most.

- Support may be limited to forums.

- Add-ons or integrations may cost extra.

- Data safety depends on provider — choose wisely.

When to Upgrade from Free to Paid

- You need payroll services.

- You want better reporting or analytics.

- You add staff who need login access.

- You sell physical products and need inventory tools.

Paid plans range from ₹5,000–₹20,000/year — upgrade when your revenue supports it.

Conclusion

Choosing the right free accounting software for small business in 2025 can help you manage your finances easily, especially when starting out. Whether you prefer cloud tools like Wave and Zoho Books or offline tools like GnuCash, there’s an option for every firm size and goal. Start with free, scale when needed, and always keep your books in shape.

At Meru Accounting, we know the real-world cash needs small firms deal with. We help you get the best out of your tools with setup, tweaks, and clear help. With our help, even free tools work like pros to keep your books in shape and your firm on track.

FAQs

- Q1: Is free accounting software safe to use?

- Yes, most use bank-grade encryption. Still, always back up your data.

- Q2: Can I switch to paid plans later?

- Yes, upgrades are supported by all tools without losing data.

- Q3: Do I need mobile access?

- If you travel or work remotely, apps like Wave or Zoho Books are essential.

- Q4: Can I file taxes with these tools?

- You can export reports, but most free tools don’t allow direct tax filing.

- Q5: Can these tools connect with my bank?

- Some offer free sync (Wave), others charge (ZipBooks).

- Q6: Will I still need an accountant?

- Yes, especially for tax season or audits. But free tools make sharing easy.

- Q7: What if my business grows fast?

- Choose software that supports upgrades or opt for open-source like Akaunting.