Maximize the Lifetime Capital Gains Exemption When Selling a Business

Selling a business may feel like the biggest step an owner takes. Many owners want to keep more from the sale and look for tax rules that can help. One rule that can strengthen the value is the Lifetime Capital Gains Exemption. It can reduce tax on the gain when you sell shares of a small firm.

In this blog, we will see how the exemption works, what owners can do to prepare, and how smart planning may raise the chance of using it. Our goal is to give you a clear path with simple words and examples. This will make you feel more ready when you sell your business.

What the Lifetime Capital Gains Exemption Does

A Simple View

The Lifetime Capital Gains Exemption may reduce tax on the gain from the sale of shares in a small business corporation. When your shares qualify, a large part of the gain may not be taxed. This can protect more of the money you receive.

Why It Matters

A business that grows for many years can build strong value. The gain at sale can be large. Without the exemption, the tax bill may take a significant slice of the sale. With the exemption, a part of that gain may stay with you.

Who Can Use It

The exemption may apply when you sell shares of a firm that meets set rules. It must be a small business corporation at the time of sale. You must also meet ownership and holding time rules.

How the Exemption Works in Simple Terms

Understanding the Gain

Your gain is the sale price minus what you paid for the shares. If that gain falls within the exemption limit, you may not pay tax on that part.

The Exemption Limit

There is a lifetime limit. Once you claim it, the amount you used is taken off your remaining limit. Many owners never reach the full limit, so it may cover most of the gain in many cases.

Shares Must Qualify

The firm must meet the rule for a small business corporation. It must use most of its assets in an active business. If too many assets sit idle, the shares may fail the test.

Why Early Planning Can Make a Big Difference

Preparing Years Before the Sale

A common mistake owners make is waiting until the last moment. The conditions that decide if shares qualify can take time to fix. When you begin early, you can adjust the firm in a calm way.

Cleaning the Asset Mix

Some firms hold extra cash, old investments, or unused property. These may hurt the test that decides if the firm is active. With time on your side, you can move or use those assets in a planned way.

Building Strong Records

Buyers like clear records. Tax reviews also need clear records. When you prepare early, you can create a proof trail that shows how long you held shares and how the business used its assets.

What Makes a Firm a Small Business Corporation

Active Business Use

To qualify, most of the value in the firm must be tied to active business work. If the firm holds too many passive assets, it may fail the rule.

Where the Work Happens

The work of the firm must take place inside the country for the rule to apply. Some activity abroad may be fine, yet the main effort should stay here.

Holding Period

You must hold your shares for a required time before the sale. This keeps short term ownership from using the exemption.

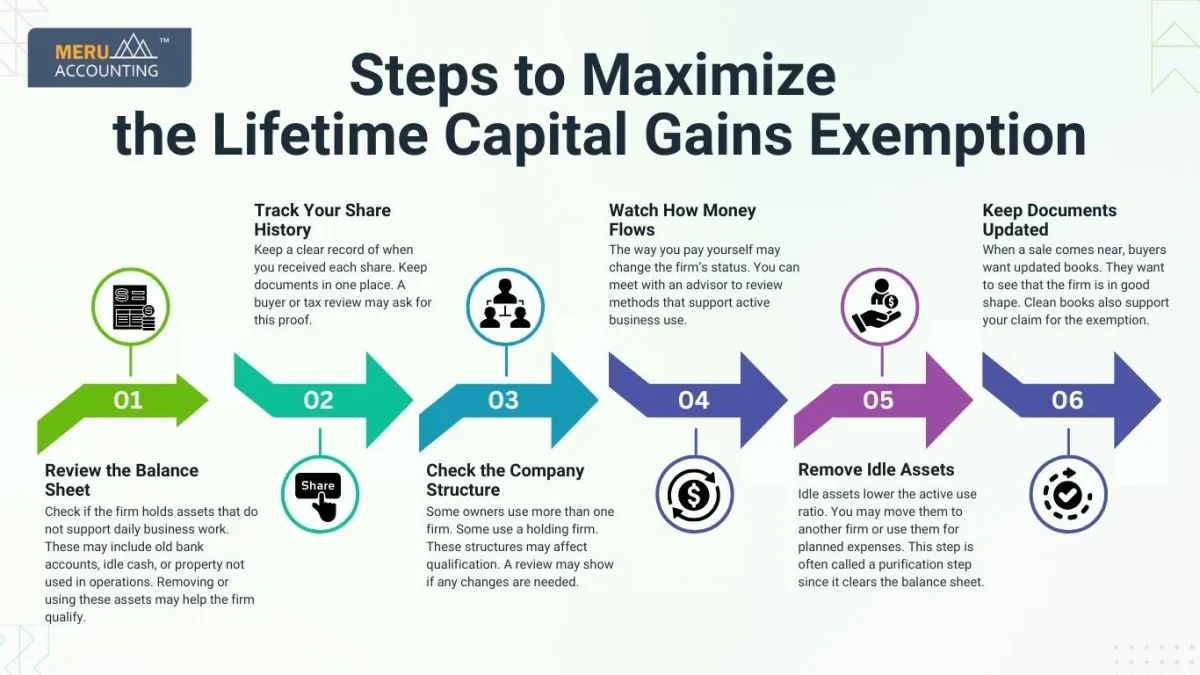

Steps to Maximize the Lifetime Capital Gains Exemption

Here’s how you can maximize the Lifetime Capital Gains Exemption for your business:

1. Review the Balance Sheet

Check if the firm holds assets that do not support daily business work. These may include old bank accounts, idle cash, or property not used in operations. Removing or using these assets may help the firm qualify.

2. Track Your Share History

Keep a clear record of when you received each share. Keep documents in one place. A buyer or tax review may ask for this proof.

3. Check the Company Structure

Some owners use more than one firm. Some use a holding firm. These structures may affect qualification. A review may show if any changes are needed.

4. Watch How Money Flows

The way you pay yourself may change the firm’s status. You can meet with an advisor to review methods that support active business use.

5. Remove Idle Assets

Idle assets lower the active use ratio. You may move them to another firm or use them for planned expenses. This step is often called a purification step since it clears the balance sheet.

6. Keep Documents Updated

When a sale comes near, buyers want updated books. They want to see that the firm is in good shape. Clean books also support your claim for the exemption.

Real Examples to Show How Lifetime Capital Gains Exemption Work

Example 1

A Tech Firm Owner With Extra Cash

A tech firm records strong years and stores extra cash in the company. The owner plans to sell in three years. An advisor reviews the balance sheet and finds that the extra cash may harm active business status. The owner moves part of the cash to a separate firm and uses part of it for new equipment. When the sale comes, the firm meets the active asset test and the shares qualify for the Lifetime Capital Gains Exemption.

Example 2

A Family Business With Old Investments

A family business kept an old investment account inside the firm for many years. The account has no link to daily operations. The owners want to sell soon. They are advised that the investment account may block the exemption. They sell the investments and move the funds out. The firm returns to active status and the owners use the exemption at the sale.

Example 3

An Owner With Missing Share Records

A seller held shares for a long time but lost some records. Buyers raise concerns. The owner works with advisors to rebuild proof through bank entries and other documents. The delay is short. The sale moves through and the owner uses the exemption.

Example 4

A Firm That Grew Too Passive

A firm once active shifts to rental income. Over time the active part becomes small. The owner wants to sell but the shares may not qualify. The owner invests in new business lines and raises active income. After some time, the firm passes the test again.

Planning for a Future Sale?

Here’s Why You Must Pre-plan

Many owners do not plan to sell right away. But the way you run the firm today may affect your sale years later. Keeping the firm active and keeping records clear can make life easier when a buyer comes.

Good Habits That Support the Lifetime Capital Gains Exemption

- review the balance sheet each year

- remove assets that drift away from business work

- track shares with care

- keep financial records tidy

These may sound simple. Yet many owners skip them.

Working With Advisors

When rules feel complex, advisors can look at your business and give clear steps. They may run the active asset test and explain which assets harm qualification. They may also help prepare for negotiations with buyers.

Advisors may also warn you about traps. For example, some owners shift assets too late. Some take money from the firm in ways that weaken active status. A quick review may avoid these mistakes. Meru Accounting has been helping firms to take the maximum benefits of Lifetime Capital Gains Exemption when they sell their business.

The Lifetime Capital Gains Exemption can be a strong tax tool for owners who plan to sell shares in a small firm. IEarly steps, clean records, and a well prepared balance sheet may raise the chance of maximizing its potential. Outsourcing your business bookkeeping to Meru Accounting can help you prepare for the future of your business. We can help you prepare well for the Lifetime Capital Gains Exemption from today itself. Contact us now to get started!

FAQs

- What is the Lifetime Capital Gains Exemption and how can it help me during a share sale?

It is a rule that may remove tax on part of the gain from the sale of qualifying shares. It may help owners keep more from the sale. - Who can use the Lifetime Capital Gains Exemption when selling a business?

Owners who sell shares in a small business corporation may use it. The firm must meet set rules at the time of sale. - Why does early planning matter for the Lifetime Capital Gains Exemption?

Some conditions take time to fix. Early steps may help you shape the firm to qualify. - Can extra cash in the company cause issues when I try to qualify for the exemption?

Yes when cash grows too large it may harm the active test. Moving or using it may help. - How long must I hold my shares to qualify for the exemption?

You must hold them for a required period. Clear records may help prove this. - Can investment accounts inside the company affect my chance of qualifying?

Yes when they sit inside the firm they may lower active use. Many owners remove them. - Can trusts help me plan for the exemption in a family setting?

Trusts may help spread gains among family members. They must follow strict rules. - Why would buyers care about my tax plan when I am claiming the exemption?

Your tax outcome may shape your price. When you use the exemption, deals may move smoother. - What is the active asset test and why does it matter for this rule?

It checks if most of the firm’s assets support active work. Passing it helps shares qualify. - Can I fix issues close to the sale if my company does not qualify?

You may fix some issues though some take time. Early work is usually better. - Are asset sales covered by the Lifetime Capital Gains Exemption?

No, the exemption applies to share sales. Asset sales do not receive the same benefit. - What records should I keep to support my exemption claim?

Keep shared records and proof of ownership. Buyers and reviews may ask for them. - Can passive income in the company hurt my exemption plan?

Yes it may reduce active use. You may need to shift back to active work. - Does holding property inside the company affect the active test for this rule?

Property that does not support business work may harm active status. You may need to move it out. - Is the Lifetime Capital Gains Exemption something I can use only once?

You can use it until you reach your lifetime limit. Many owners never exceed it. - Should I speak with an advisor before planning for this exemption?

Yes since rules can be detailed. A review may prevent mistakes. - Can family members use the exemption when the business is sold?

Family members may use it when they hold qualifying shares. It may help increase the tax benefit. - Can missing or unclear share records delay the use of the exemption?

Yes, missing records can slow buyer reviews. Rebuilding proof may be needed. - What if my firm has both active and passive parts when I plan to claim the exemption?

You may still qualify if most of the value is active. You may need to adjust this ratio. - Can the exemption improve my long term retirement plan?

Yes, keeping more of the gain may support long term goals. Many owners value this outcome.