Xero Accounting in India: A Simple Guide for Growing Businesses

Xero Accounting is quickly becoming popular in India. Small and mid-size firms now look for smarter ways to handle books. Xero is one of the best tools to meet this need. Many business owners want an easy tool that saves time and money. This is where Xero steps in with full strength. It helps track money flow, bills, bank feeds, and more. This blog will explore how Xero supports Indian firms and why it stands out.

Introduction to Xero Accounting in India

India’s business world is growing fast. Many firms have now shifted from manual to cloud tools. Xero Accounting enhances financial processes with automation and real-time insights, making it a valuable tool for businesses in India. Xero offers a clean, simple interface that suits both beginners and experts. It reduces the need for deep technical skills and helps Indian businesses manage daily accounting with confidence and less stress.

Why Indian Businesses Are Choosing Xero Accounting

Firms want to reduce errors, save time, and stay compliant. Xero supports these needs by offering real-time insights, smooth processes, and cloud-based access from any device with an internet connection.

Easy Use with No Tech Skill

You don’t need advanced training to use Xero. The dashboard is clean, the icons are clear, and the reports are easy to read. This saves time and helps owners make faster business decisions without confusion.

Access from Anywhere

Xero stores data on the cloud, not your device. You can check your books from any place. This helps business owners travel freely while still tracking finances, payments, and compliance in real time.

Saves Time on Manual Tasks

Xero automates routine tasks like bank feeds, invoice reminders, and GST reports. This reduces the time spent on manual data entry and lowers the risk of human error in financial reporting.

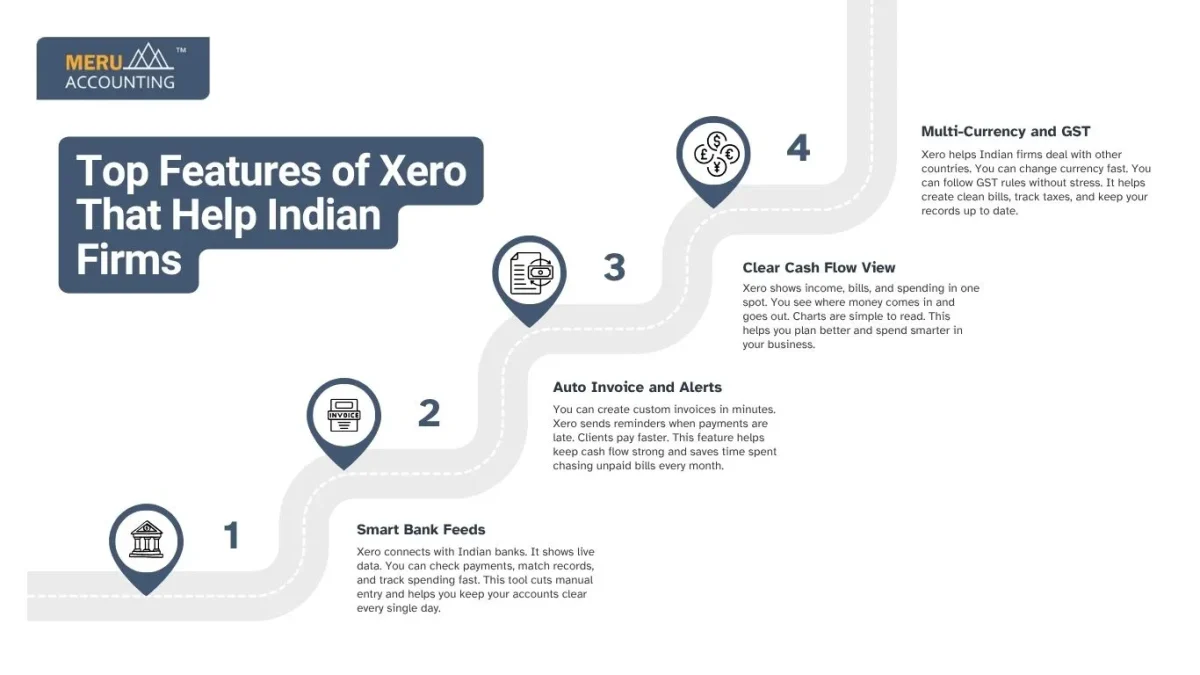

Top Features of Xero That Help Indian Firms

Xero Accounting offers many useful tools, and it’s now widely used in India for daily business tasks. It helps save time, reduce errors, and keep your books clean.

Smart Bank Feeds

Xero connects with Indian banks. It shows live data. You can check payments, match records, and track spending fast. This tool cuts manual entry and helps you keep your accounts clear every single day.

Auto Invoice and Alerts

You can create custom invoices in minutes. Xero sends reminders when payments are late. Clients pay faster. This feature helps keep cash flow strong and saves time spent chasing unpaid bills every month.

Clear Cash Flow View

Xero shows income, bills, and spending in one spot. You see where money comes in and goes out. Charts are simple to read. This helps you plan better and spend smarter in your business.

Multi-Currency and GST

Xero helps Indian firms deal with other countries. You can change currency fast. You can follow GST rules without stress. It helps create clean bills, track taxes, and keep your records up to date.

How Xero Accounting Boosts Business Efficiency in India

In India, businesses of every type benefit from the flexibility and features of Xero Accounting. It makes daily work faster and cleaner. You spend less time on reports. You avoid mistakes. It brings all your key business tasks in one tool.

One Spot for All Work

You don’t need many tools. Xero keeps sales, bills, and tax in one place. You don’t switch apps. You see all tasks in one clean view. This saves time and keeps your work smooth.

No More Manual Errors

Xero updates numbers on its own. You don’t type the same data twice. GST and payments stay correct. This keeps your books clean and ready for review. You avoid errors that cost time and money.

Simple Reports on Click

Xero gives reports fast. You click once to see profit or tax. These reports help track your work. They also help when you need loans, plan growth, or show numbers to banks or investors.

Industries in India That Benefit Most from Xero

Every industry handles finances differently. However, many sectors across India now prefer Xero because of its automation, real-time access, and clear reports. These features help firms manage money and improve business control with ease.

Startups and IT Firms

Startups and IT companies rely on fast and flexible tools. Xero helps them manage expenses, payroll, and client billing. It also supports investor reporting and makes fundraising easier to track and report.

Retail Shops and E-Stores

Retailers deal with many small transactions each day. Xero supports billing systems, inventory tracking, and payment links. These features allow shops to sync sales and expenses while keeping financial records accurate and up to date.

Small Service Firms

Consultants, freelancers, and small agencies use Xero to stay organized. It helps them send invoices, track hours, and receive payments. They can handle client billing with fewer errors and no need for extra tools.

Import and Export Firms

Importers and exporters need to manage multiple currencies and tax rules. Xero helps track payments, apply GST, and handle currency changes. It makes cross-border transactions easier and more accurate for Indian firms.

Common Challenges in Xero for Indian Users

Though Xero offers great tools, some issues arise. Awareness of these problems can help you plan better and avoid disruptions in your accounting and tax compliance efforts.

Lack of Local Support

Xero is based overseas, so real-time India-specific support is limited. Business owners often struggle with Indian compliance unless guided by certified local experts who understand both Xero and Indian laws.

Setup Takes Time

The initial setup may feel tough. Choosing the wrong accounts or tax settings can affect reports. Many Indian firms benefit from expert help to get clean, correct Xero setups that save future rework.

Tax Match Needs Add-Ons

Xero doesn’t natively support every Indian tax rule. You may need add-ons for TDS, GST returns, and e-way bills. Picking the right plugins requires help from experienced professionals in Indian taxation.

Xero Accounting helps modern businesses in India grow by reducing errors and enabling faster decisions.” Its cloud tools offer flexibility, and its clean layout supports even non-finance users. Meru Accounting helps Indian businesses get the most from Xero. Our team offers expert setup, full training, and tailored support that fits your exact needs. Our Chartered Accountants understand Xero and Indian laws. We set up your accounts, tax rules, and reports to match local compliance and your specific business goals from day one. Every business is unique. We customize the Xero dashboard, reports, and workflows.

FAQs

- Is Xero Accounting a good fit for small businesses in India?

Yes, Xero Accounting works well for small businesses in India. It offers real-time tools, GST support, and easy invoicing. Small firms can manage their books daily without hiring full-time staff or using costly software tools.

- Can Xero handle Indian GST and tax rules?

Yes, Xero handles Indian GST rules well. It supports GST returns, Input Tax Credits, and invoice creation. You can also use add-ons or expert help to manage TDS and other tax rules as needed.

- How does Xero improve cash flow tracking?

Xero gives a full view of your money. It shows income, due bills, and pending payments. You can track each one in real time and plan better. This helps maintain cash flow for steady business growth.

- Can Xero connect with Indian banks?

Yes, many Indian banks work with Xero. You can pull in your transactions daily. This helps avoid manual entry, saves time, and keeps your financial records accurate and up to date without extra work.

- Does Xero work for freelancers and consultants?

Yes, Xero helps freelancers send bills and manage taxes. You can track earnings and file GST returns easily. It gives clear insights, even if you don’t have an accounting or finance background.